- United States

- /

- Hospitality

- /

- NYSE:BROS

What Dutch Bros (BROS)'s Upbeat Guidance and Self-Funded Expansion Means for Shareholders

Reviewed by Sasha Jovanovic

- In the past week, Dutch Bros Inc. announced strong third-quarter results, raising full-year guidance and targeting 38 new shop openings across 17 states, with total revenue expected between US$1.61 billion and US$1.615 billion for 2025. Alongside rapid store expansion, the company advanced its breakfast program and solidified plans to launch in new markets, signaling confidence in its competitive positioning.

- An interesting insight is that Dutch Bros has shifted to funding most new shop openings itself after reaching free-cash-flow positivity, marking a significant transition to a self-sustaining high-return growth model.

- We'll examine how higher full-year earnings guidance and accelerated expansion targets may influence Dutch Bros' investment outlook and growth assumptions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Dutch Bros Investment Narrative Recap

To be a shareholder in Dutch Bros, you need to believe in its ability to scale rapidly while retaining its strong culture and customer loyalty, as well as maintaining shop-level profitability amid aggressive national expansion. The recent earnings beat and raised guidance reinforce the positive momentum behind its fastest-growing catalysts, continued shop openings and elevated same-store sales, but do not materially alter the most important short-term risk, which remains the threat of market saturation and cannibalization as US store counts swell.

Among the latest developments, Dutch Bros’ expansion of its breakfast program to 160 locations stands out. This ties directly to efforts that could boost average ticket size and help the company capture a greater share of the morning daypart, a key driver for further improving transaction growth and supporting ongoing store-level performance.

Yet, despite this progress, investors should also be aware that store growth at this pace brings concerns around margin pressures and whether demand will keep up with ...

Read the full narrative on Dutch Bros (it's free!)

Dutch Bros' outlook anticipates $2.6 billion in revenue and $197.4 million in earnings by 2028. This requires 21.8% annual revenue growth and a $140.2 million increase in earnings from the current $57.2 million.

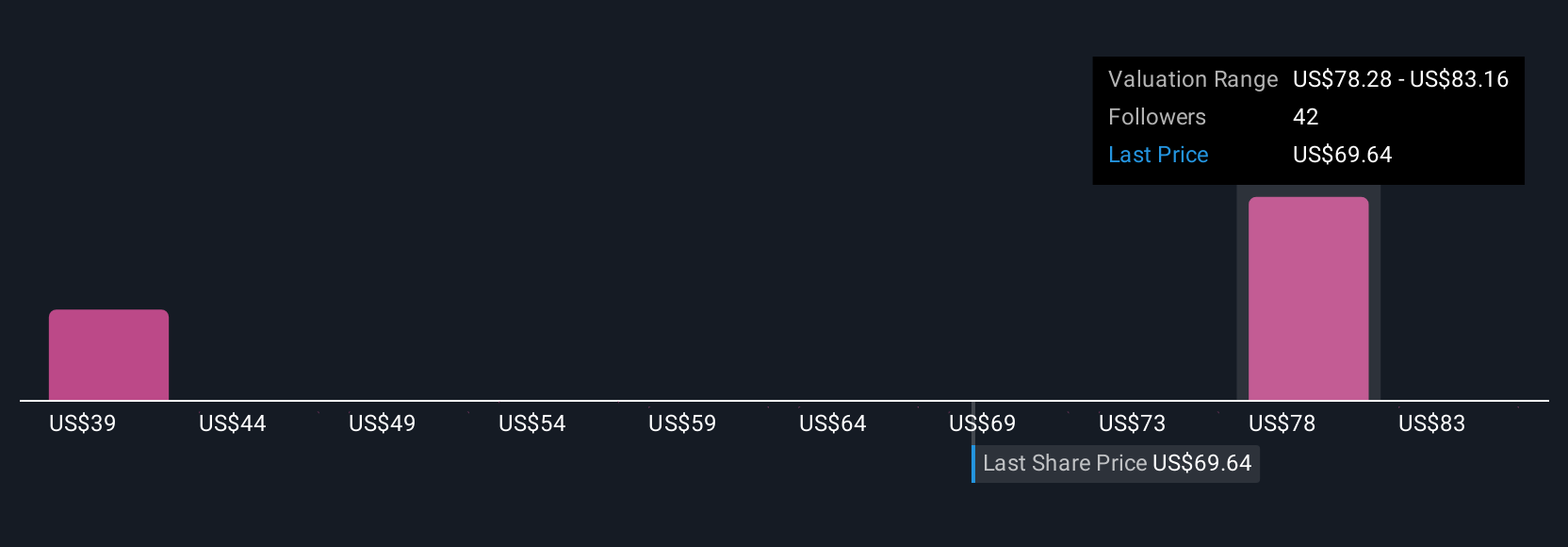

Uncover how Dutch Bros' forecasts yield a $78.06 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Dutch Bros range from US$57.03 to US$85 based on eight unique analyses. While many see expansion as a long-term catalyst, others question if rapid unit growth could pressure same-store sales and future earnings, highlighting the many ways participants assess Dutch Bros’ outlook.

Explore 8 other fair value estimates on Dutch Bros - why the stock might be worth just $57.03!

Build Your Own Dutch Bros Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dutch Bros research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dutch Bros research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dutch Bros' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BROS

Dutch Bros

Operates and franchises drive-thru shops in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives