- United States

- /

- Hospitality

- /

- NYSE:BROS

Dutch Bros (BROS) Valuation in Focus After Raised Guidance and Bold Growth Plans

Reviewed by Simply Wall St

Dutch Bros (BROS) just reported quarterly earnings and revenue ahead of expectations, while also boosting its full-year guidance. The company’s outlook now includes plans for a record number of new store openings and a larger menu rollout in 2025 and 2026.

See our latest analysis for Dutch Bros.

Shares of Dutch Bros jumped 6.1% following the strong earnings report, capping off a robust 1-month share price return of nearly 16% and pushing the stock’s 1-year total shareholder return to 17%. With improving operational metrics, bold expansion targets, and brisk momentum among younger customers, investor sentiment appears to be shifting firmly back towards growth. However, the recent volatility serves as a reminder that ambitions are high as competition heats up.

If Dutch Bros' rollout and momentum have you curious about other companies on the move, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock up sharply on strong results and ambitious growth plans, the real question now is whether Dutch Bros is truly undervalued, or if the market has already accounted for much of its future potential. This leaves investors wondering if there is still a buying opportunity or if further upside is already priced in.

Most Popular Narrative: 27.4% Undervalued

According to the most widely followed narrative, Dutch Bros' fair value target stands notably above recent trading levels, suggesting room for upside. The stage is set for a bold growth case, with expectations hinging on continued momentum and a willingness to embrace ambitious forecasts.

Investments in digital innovation, including increasing adoption of mobile ordering, personalization in the Dutch Rewards loyalty program, and targeted paid advertising, are enhancing customer retention, frequency, and segmentation. These efforts are likely to expand customer lifetime value and drive higher same-store sales growth and margin expansion.

Want to know the secret behind that double-digit margin of undervaluation? This narrative's logic hinges on future sales and profit leaps that would place Dutch Bros well ahead of today’s industry leaders. Find out which numbers, if achieved, could set a new valuation bar and fuel bulls’ excitement.

Result: Fair Value of $78.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost inflation and aggressive store expansion could pressure Dutch Bros’ profit margins and slow planned revenue growth if these trends worsen.

Find out about the key risks to this Dutch Bros narrative.

Another View: Is the Market Already Ahead of Itself?

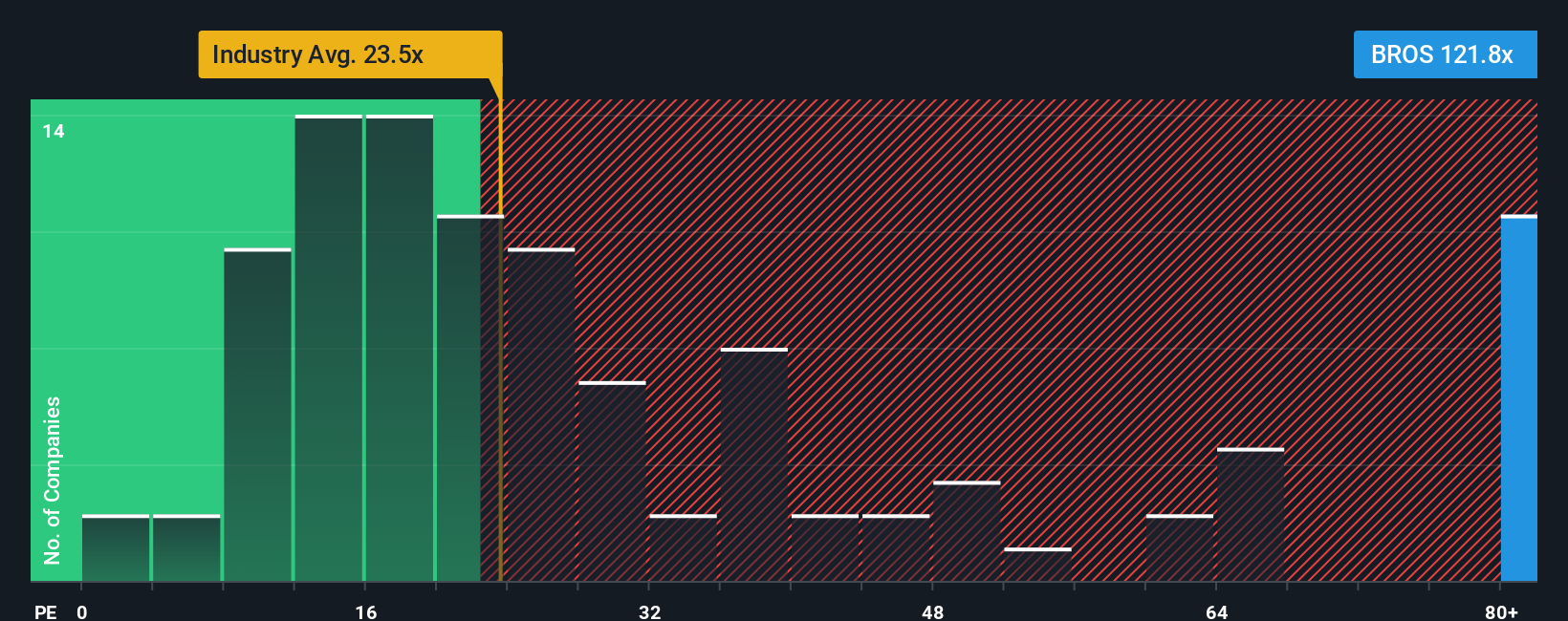

Despite the optimism around Dutch Bros, shares currently trade at a price-to-earnings ratio of 116x. This is significantly higher than both industry peers (28x) and the fair ratio level (35.3x) our data suggests the market could eventually expect. This large premium raises the risk that any stumbles or slower-than-hoped growth could lead to sharp valuation resets.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dutch Bros Narrative

If you feel compelled to question the popular stories or want to reach your own verdict, dive into the numbers and craft your perspective in just minutes, then Do it your way

A great starting point for your Dutch Bros research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their options open. Expand your strategy and tap into fresh opportunities across the market with these standout themes you won't want to overlook:

- Capture the rise of disruptive healthcare innovators shaping tomorrow’s treatment landscape by starting with these 32 healthcare AI stocks.

- Unlock steady income while building your portfolio by reviewing these 16 dividend stocks with yields > 3%, which boasts reliable yields above 3%.

- Position yourself early for the next wave of technological breakthroughs by targeting these 25 AI penny stocks, as these are driving artificial intelligence’s expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BROS

Dutch Bros

Operates and franchises drive-thru shops in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives