- United States

- /

- Hospitality

- /

- NYSE:ARMK

Will Aramark's (ARMK) Robotic Kitchen Bet Redefine Its Digital Transformation Story?

Reviewed by Sasha Jovanovic

- In early October 2025, Aramark announced a partnership and investment in RoboEatz' Autonomous Robotic Kitchen (ARK) technology, collaborating with ABB Robotics and WellSpan Health to enable 24/7, customizable meal services in healthcare settings.

- This move integrates advanced robotics and software into Aramark’s digital Hospitality IQ™ suite, reducing the need for manual staffing while supporting consistent, tailored meal delivery for healthcare workers around the clock.

- Next, we’ll explore how adopting autonomous kitchen technology could accelerate Aramark’s digital transformation and influence the company’s long-term growth thesis.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Aramark Investment Narrative Recap

Shareholders in Aramark need to believe in the company's ability to secure long-term, multi-year contracts and effectively implement technology that improves operational efficiency and margin resilience. The recent investment in autonomous kitchen technology addresses a key short-term catalyst, labor optimization in healthcare foodservice, but does not materially change the biggest risk, which remains persistent labor cost pressures and the potential for wage-driven margin compression.

Among the latest announcements, the August 18, 2025 repricing of Aramark's 2028 Term Loan B is most relevant, as it aims to reduce interest burden and free up cash, potentially enabling more investment in technological advancements like the RoboEatz partnership. These steps help support margin improvement initiatives that are crucial given the ongoing pressures from labor and rising medical costs.

By contrast, while automation can help reduce staffing needs, it also raises fresh questions for investors about Aramark's exposure to labor disruptions as technology adoption grows...

Read the full narrative on Aramark (it's free!)

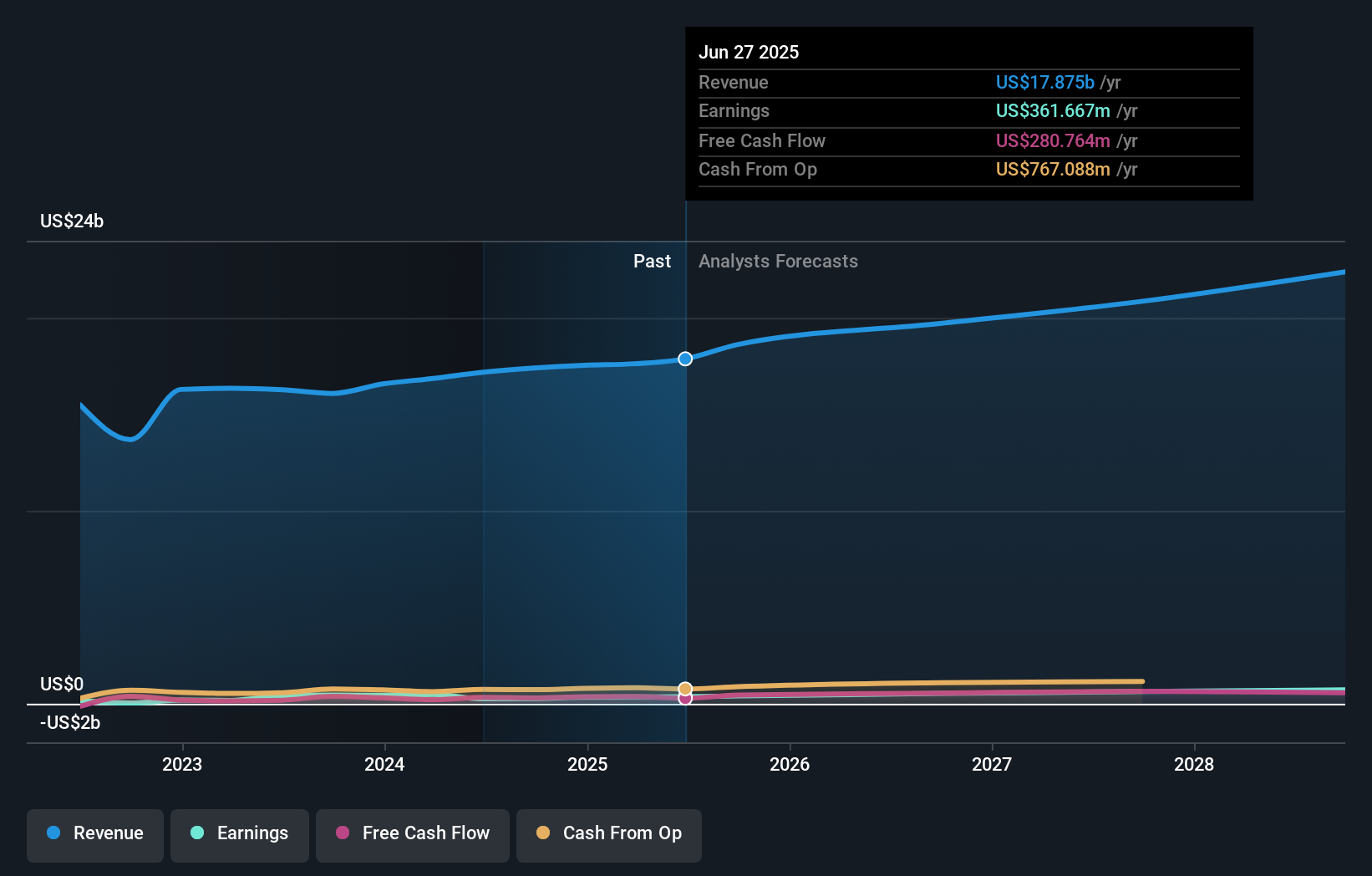

Aramark's narrative projects $21.9 billion in revenue and $695.7 million in earnings by 2028. This requires 7.1% yearly revenue growth and a $334 million earnings increase from the current earnings of $361.7 million.

Uncover how Aramark's forecasts yield a $45.10 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates for Aramark between US$15 and US$45.10 per share. With contract wins driving the growth thesis, you can compare these viewpoints to assess how much weight to give operational catalysts in your own analysis.

Explore 2 other fair value estimates on Aramark - why the stock might be worth as much as 18% more than the current price!

Build Your Own Aramark Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aramark research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aramark research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aramark's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARMK

Aramark

Provides food and facilities services to education, healthcare, business and industry, sports, leisure, and corrections clients in the United States and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives