- United States

- /

- Hospitality

- /

- NasdaqGS:WYNN

Wynn Resorts (WYNN): Assessing Valuation After Special Update on Wynn Al Marjan Island Growth Prospects

Reviewed by Simply Wall St

Wynn Resorts (WYNN) has called a special investor update to walk through plans for Wynn Al Marjan Island in the UAE, putting fresh attention on how this new integrated resort could shape the company’s next growth phase.

See our latest analysis for Wynn Resorts.

At around $127 per share, Wynn’s recent 1 day share price return of 1.33 percent and strong year to date share price return of 51.77 percent suggest momentum is building again. A 1 year total shareholder return of 33.85 percent points to investors steadily re rating its recovery and future growth pipeline, including the UAE project.

If this kind of resort led growth story interests you, it could be worth scanning beyond casinos and checking out auto manufacturers as another way to spot cyclical recovery ideas and potential re ratings.

Yet with the stock up sharply this year, trading near but still below analyst targets, the key question now is whether Wynn remains undervalued ahead of Al Marjan’s opening or if the market has already priced in that growth.

Most Popular Narrative: 9.9% Undervalued

With the narrative fair value sitting meaningfully above Wynn Resorts’ last close, the story frames Al Marjan and premium demand as central valuation drivers.

The imminent launch of Wynn Al Marjan Island, with first mover advantage and limited near term competition in a potentially multi billion dollar new market, is a major forward catalyst that is currently underappreciated by investors and could drive a meaningful step change in both consolidated revenue and EBITDAR.

Curious how steady revenue growth, rising margins, and a richer earnings multiple all converge into that upside target? The full narrative reveals the exact playbook.

Result: Fair Value of $141.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering Macau regulatory and travel risks, along with rising labor and operating costs, could quickly challenge the upbeat valuation narrative around Wynn.

Find out about the key risks to this Wynn Resorts narrative.

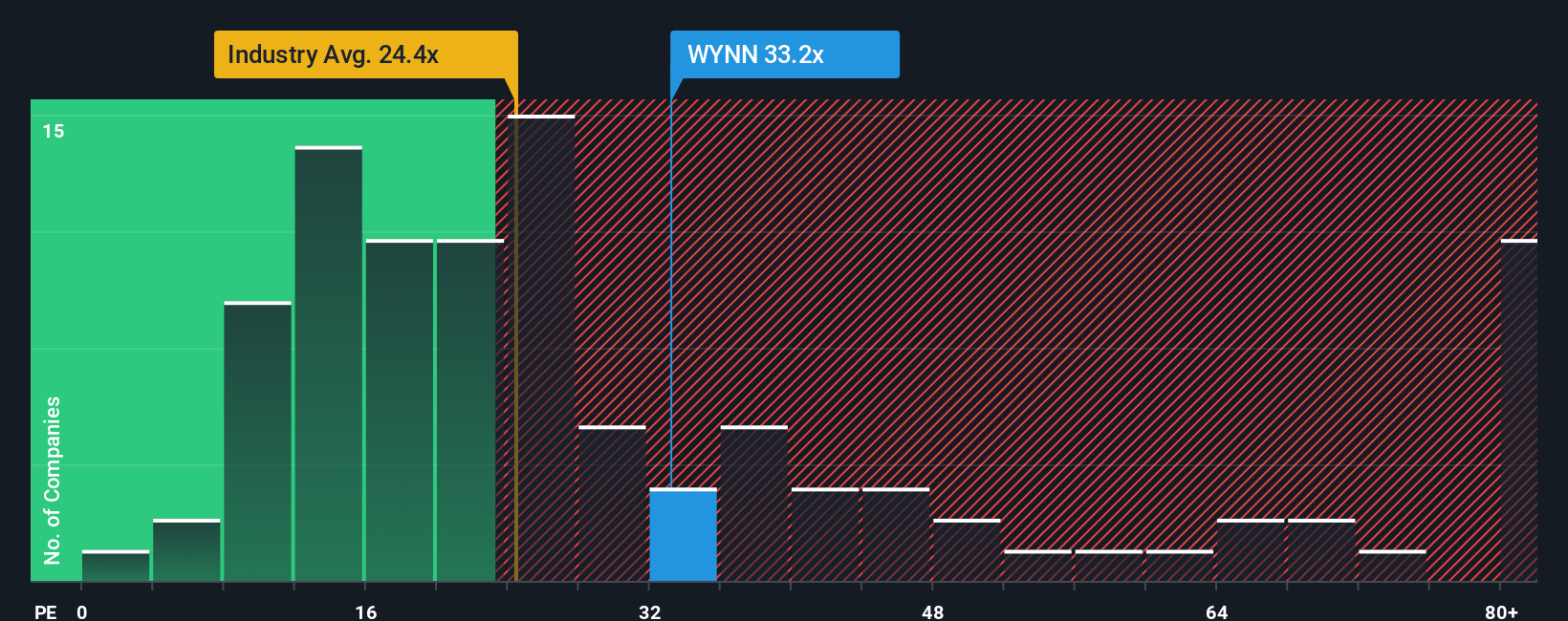

Another Lens on Valuation

Looked at through its price to earnings ratio of 26 times against a fair ratio closer to 23 times and an industry average near 23.3 times, Wynn screens as expensive on this measure despite looking undervalued on narrative fair value. This raises the question of whether sentiment is already running ahead of fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wynn Resorts Narrative

If you are skeptical of this view or simply want to test your own assumptions against the numbers, try building a custom thesis yourself in just a few minutes: Do it your way.

A great starting point for your Wynn Resorts research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single opportunity when the market is full of potential. Use the Simply Wall Street Screener to explore additional investments that may fit your strategy.

- Capture income potential by targeting dependable payouts with these 15 dividend stocks with yields > 3% to support a long term, yield focused portfolio.

- Capitalize on innovation by scanning these 30 healthcare AI stocks that may reshape diagnostics, treatment pathways, and medical efficiency.

- Follow powerful digital trends by tracking these 81 cryptocurrency and blockchain stocks at the forefront of blockchain infrastructure and payment changes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wynn Resorts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WYNN

Low risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026