- United States

- /

- Hospitality

- /

- NasdaqGS:WING

Wingstop (WING) Valuation in Focus After Weak Same-Store Sales and Lowered Guidance

Reviewed by Simply Wall St

Wingstop (WING) caught investors’ attention this week after reporting its sharpest drop in same-store sales on record. Management lowered full-year sales guidance as softer consumer demand takes hold in core markets.

See our latest analysis for Wingstop.

After a surge early this year, Wingstop’s share price has come under pressure, falling 24.5% over the past three months and leaving the 1-year total shareholder return at -29.7%. Even with upbeat expansion headlines and tech-driven initiatives, recent momentum is fading as investors weigh sales headwinds. However, Wingstop’s five-year total shareholder return of 101.4% shows longer-term growth potential if management can reignite demand.

If you’re weighing your next move in a market full of surprises, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With analysts cutting price targets and near-term performance under pressure, the key question now is whether Wingstop shares present a genuine bargain at current levels or if the market is already factoring in a recovery down the road.

Most Popular Narrative: 31.1% Undervalued

With the most popular narrative putting fair value at $345.84, there is a large gap compared to Wingstop’s last close of $238.18, raising questions about what is driving this bullish outlook.

The rapid roll-out and full system implementation of the Wingstop Smart Kitchen platform is significantly improving operational efficiency, order throughput, guest satisfaction, speed of service, and consistency. This is expected to drive higher same-store sales, increased delivery frequency, and better net margins as restaurants ramp to the new model.

Curious what financial projections would push a restaurant stock to a nearly one-third premium? A high bar for profit growth, bold digital bets, and margin calls all shape this narrative’s valuation target. See which assumptions fuel this upside case.

Result: Fair Value of $345.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, soft consumer demand and the risk of limited menu innovation could quickly put pressure on Wingstop’s growth story if these trends persist.

Find out about the key risks to this Wingstop narrative.

Another View: What Do the Ratios Reveal?

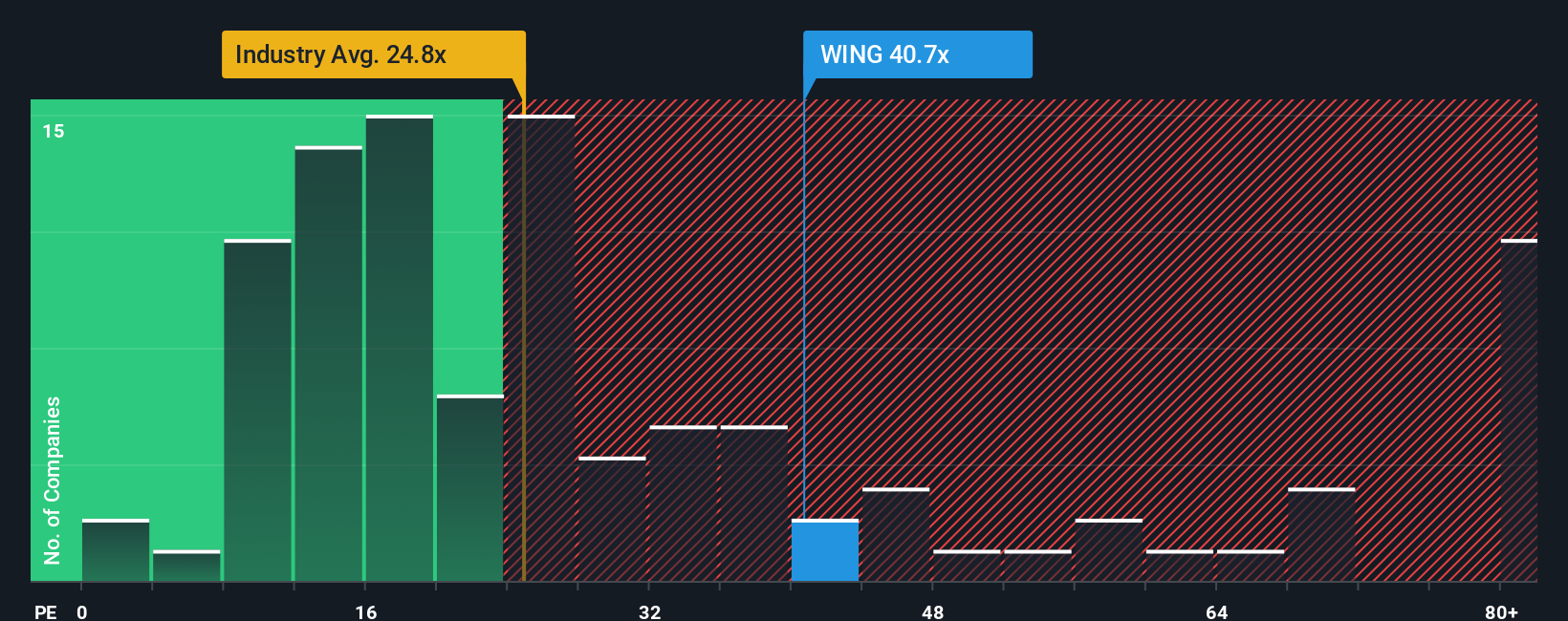

Looking through the lens of the price-to-earnings ratio, Wingstop trades at 38 times earnings, which is much higher than the US Hospitality industry average of 21.4 times and well above the fair ratio of 19.3 times that the market could eventually move toward. This premium signals optimism, but also warns of valuation risk if growth expectations cool. Is the market too bullish, or will future performance match the hype?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wingstop Narrative

If the story here doesn’t match your view or you want hands-on insights from the data, you can shape your perspective in just a few minutes and Do it your way.

A great starting point for your Wingstop research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity when exceptional growth stories might be just a click away. Make your next smart move before the market catches up.

- Capitalize on emerging trends and spot trailblazers in artificial intelligence by exploring these 24 AI penny stocks.

- Boost your income by checking out these 16 dividend stocks with yields > 3%, which features attractive yields and solid financial foundations.

- Get ahead of the competition by seeking out future potential with these 870 undervalued stocks based on cash flows, focused on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wingstop might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WING

Wingstop

Wingstop Inc., together with its subsidiaries, franchises and operates restaurants under the Wingstop brand.

Proven track record with low risk.

Market Insights

Community Narratives