- United States

- /

- Consumer Services

- /

- NasdaqGS:STRA

Should Surging EdTech Sales and Dividend Hike Spur Action From Strategic Education (STRA) Investors?

Reviewed by Sasha Jovanovic

- Strategic Education, Inc. recently reported third-quarter 2025 earnings, with sales of US$319.95 million and net income of US$26.63 million, both exceeding analyst forecasts, while also declaring a regular quarterly dividend of US$0.60 per share payable in December 2025.

- Performance was highlighted by strong growth in the Education Technology Services segment, particularly via increased Sophia Learning subscriptions and expanded Workforce Edge employer partnerships.

- We'll examine how the surge in Education Technology Services growth shapes Strategic Education's investment narrative going forward.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Strategic Education Investment Narrative Recap

For shareholders of Strategic Education, the core belief centers on the company’s ability to drive revenue and earnings through growth in education technology and corporate partnerships. The latest earnings report, with higher-than-expected sales and continued expansion in the Education Technology Services segment, highlights the importance of Sophia Learning and Workforce Edge. However, higher operating expenses in this fast-growing segment remain a key risk and could pressure margins if not carefully managed.

Among recent initiatives, the launch of Strategic Education, Inc.Signal Labs with LearnLaunch is particularly relevant. By bringing new education startups directly into Strategic Education’s ecosystem, the company aims to further strengthen its technology and employer partnership capabilities, both essential drivers of near-term performance. This activity underscores how the company's growth narrative relies on continuous innovation and strong collaboration with employers.

But while the focus is on technology-led growth, investors should not overlook the potential impact of margin pressure from higher operating expenses...

Read the full narrative on Strategic Education (it's free!)

Strategic Education's narrative projects $1.4 billion revenue and $164.9 million earnings by 2028. This requires 4.7% yearly revenue growth and a $52.2 million earnings increase from $112.7 million today.

Uncover how Strategic Education's forecasts yield a $103.33 fair value, a 36% upside to its current price.

Exploring Other Perspectives

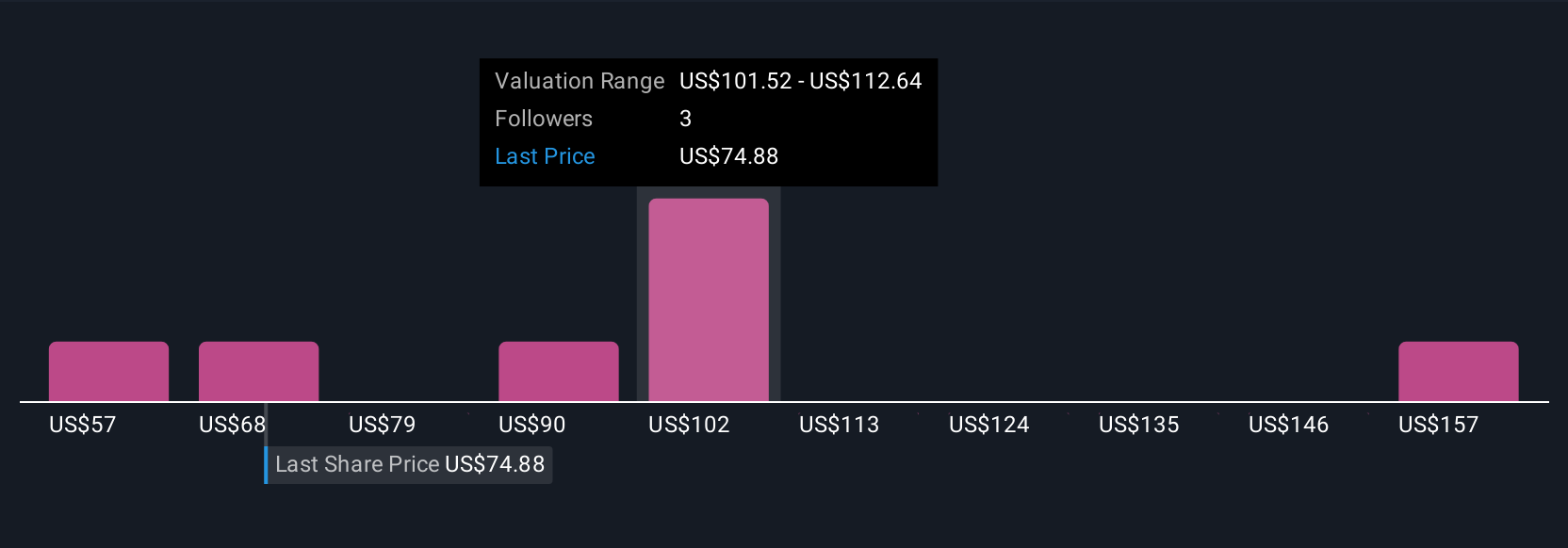

Simply Wall St Community valuations for Strategic Education range from US$57.04 to US$146.00 across 5 contributors. Your opinion matters just as much, especially considering margin pressures remain an area to watch for future performance.

Explore 5 other fair value estimates on Strategic Education - why the stock might be worth 25% less than the current price!

Build Your Own Strategic Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strategic Education research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Strategic Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strategic Education's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STRA

Strategic Education

Provides education services through campus-based and online post-secondary education, and programs to develop job-ready skills.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives