- United States

- /

- Entertainment

- /

- NasdaqGS:ROKU

3 US Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As of December 2024, the United States stock market is experiencing a robust period, with the S&P 500 and Nasdaq Composite reaching record highs following positive jobs data. This optimistic economic environment highlights the importance of identifying growth companies where high insider ownership can signal strong confidence in their future potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.7% | 34.7% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Coastal Financial (NasdaqGS:CCB) | 17.8% | 46.1% |

| Clene (NasdaqCM:CLNN) | 21.6% | 60.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.6% | 65.9% |

| BBB Foods (NYSE:TBBB) | 22.9% | 41.5% |

| Credit Acceptance (NasdaqGS:CACC) | 14.0% | 49% |

Below we spotlight a couple of our favorites from our exclusive screener.

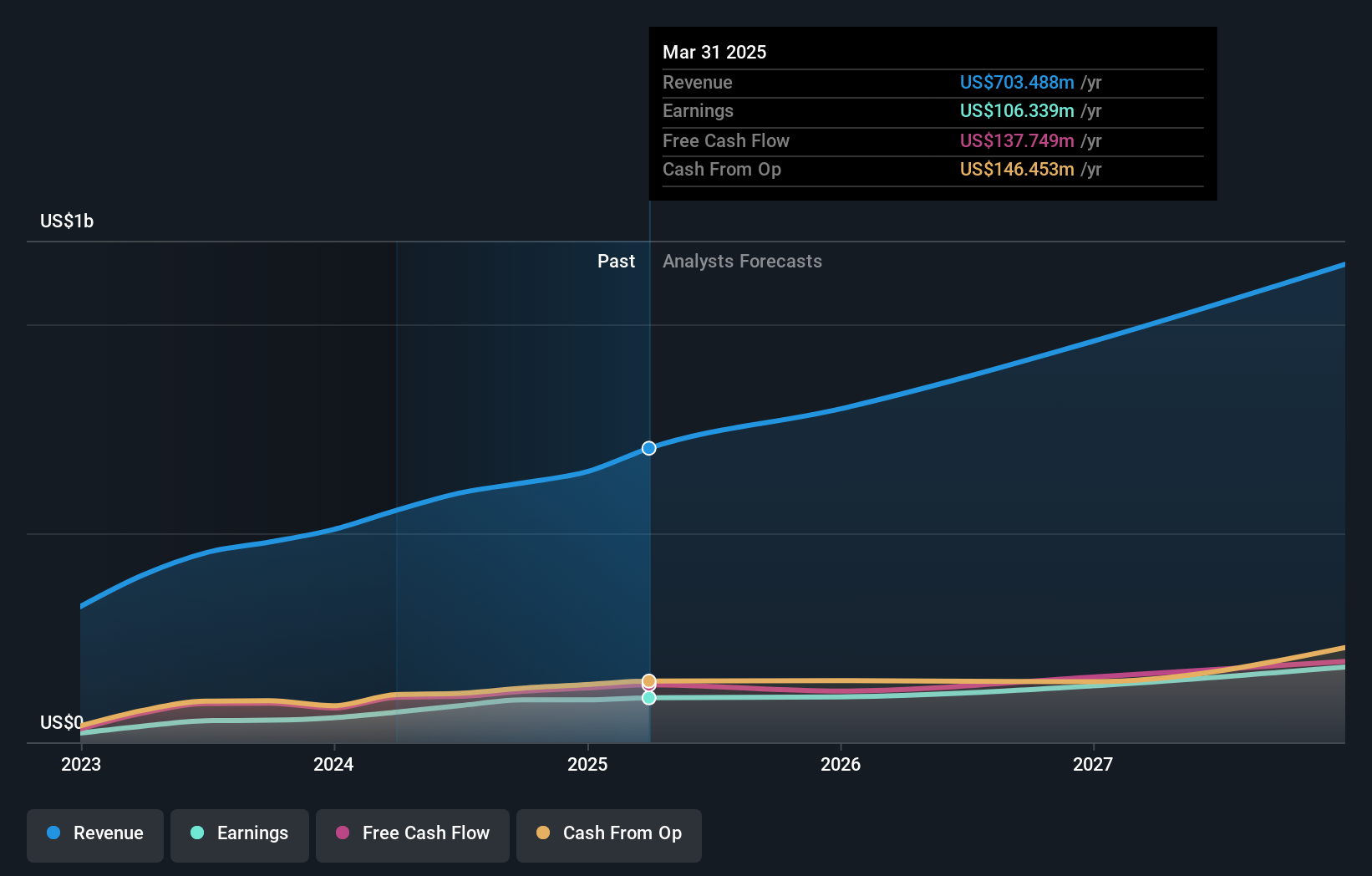

Oddity Tech (NasdaqGM:ODD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Oddity Tech Ltd. is a consumer tech company that creates digital-first brands for the beauty and wellness sectors globally, with a market cap of approximately $2.74 billion.

Operations: The company's revenue is primarily derived from its personal products segment, totaling $620.65 million.

Insider Ownership: 32.5%

Revenue Growth Forecast: 17.5% p.a.

Oddity Tech demonstrates robust growth potential, with earnings forecasted to grow at 18.5% annually, outpacing the US market. The company recently raised its earnings guidance and reported significant profit increases, with Q3 net income reaching US$17.72 million from US$3.83 million a year ago. Additionally, Oddity's share buyback program of up to $100 million reflects confidence in its valuation, currently trading 42.5% below estimated fair value.

- Click here and access our complete growth analysis report to understand the dynamics of Oddity Tech.

- Insights from our recent valuation report point to the potential undervaluation of Oddity Tech shares in the market.

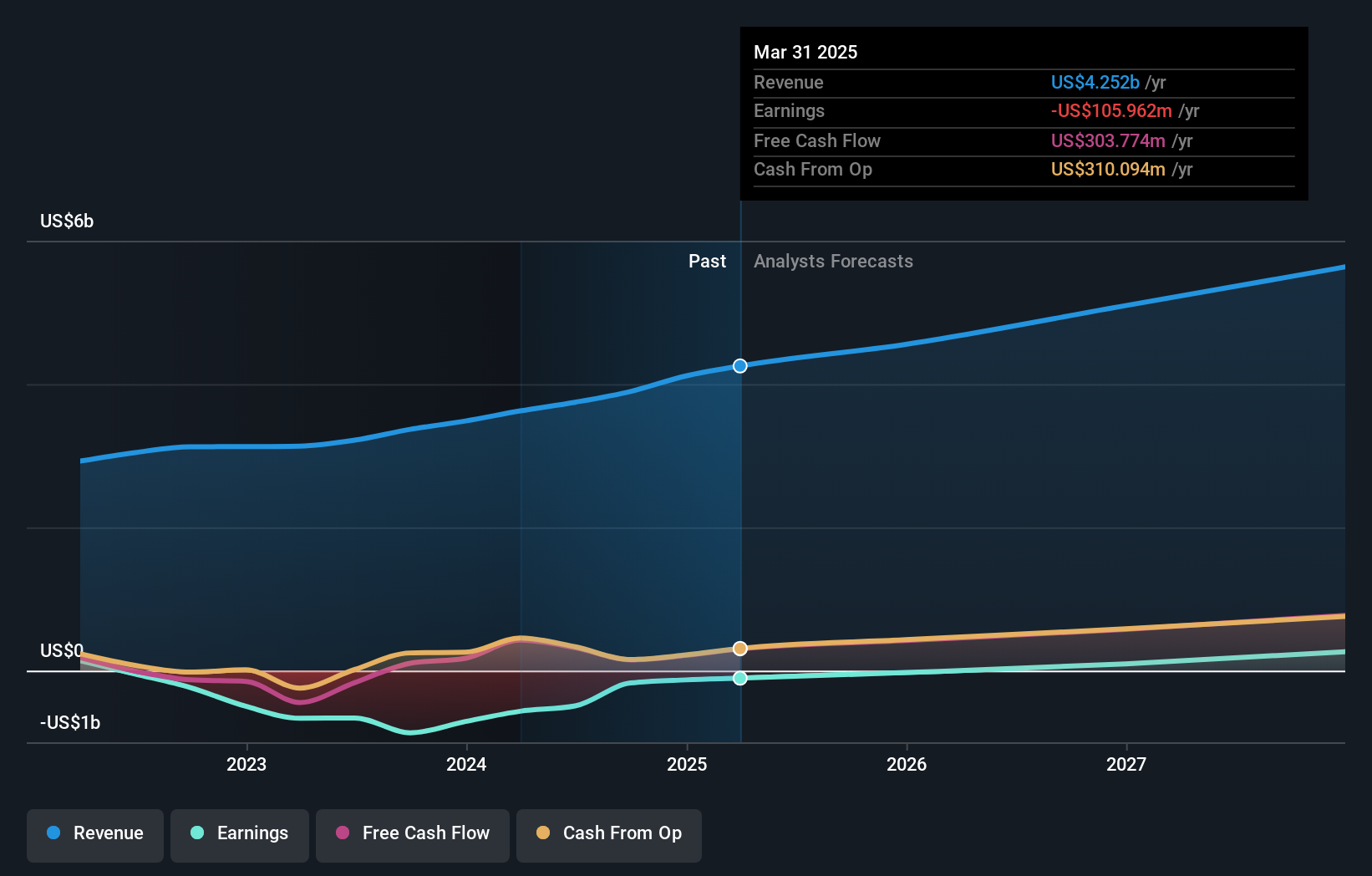

Roku (NasdaqGS:ROKU)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Roku, Inc. operates a TV streaming platform both in the United States and internationally, with a market cap of approximately $12.21 billion.

Operations: Roku generates revenue through its Devices segment, which accounts for $579.97 million, and its Platform segment, contributing $3.32 billion.

Insider Ownership: 12.3%

Revenue Growth Forecast: 11.5% p.a.

Roku's growth trajectory is underscored by expected revenue growth of 11.5% annually, surpassing the broader US market rate. The company anticipates profitability within three years, reflecting above-average market trends. Recent partnerships, such as with FreeCast and Instacart, enhance Roku's platform capabilities and advertising reach. Despite trading at a discount to its estimated fair value, challenges include low forecasted return on equity at 2.5%. Recent financial results show narrowing losses and rising revenues, indicating operational improvements.

- Click to explore a detailed breakdown of our findings in Roku's earnings growth report.

- Upon reviewing our latest valuation report, Roku's share price might be too pessimistic.

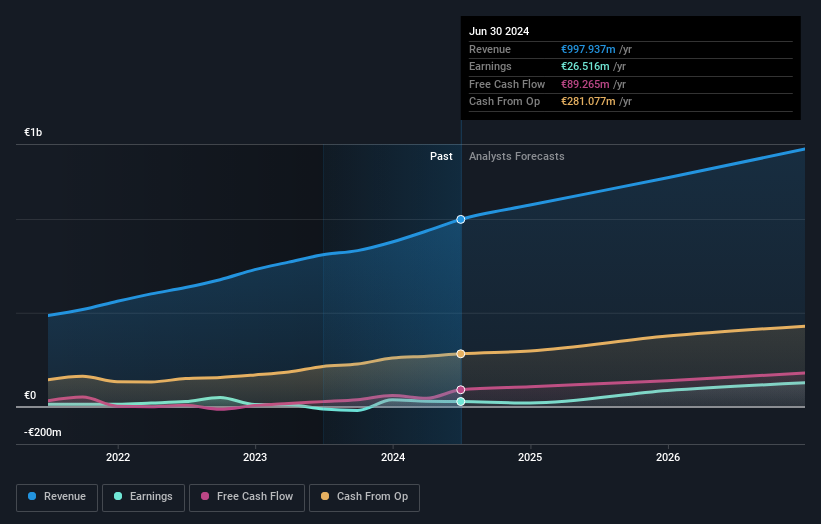

Sportradar Group (NasdaqGS:SRAD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sportradar Group AG, along with its subsidiaries, offers sports data services to the sports betting and media industries across the UK, US, Malta, Switzerland, and globally, with a market cap of approximately $5.27 billion.

Operations: Sportradar Group AG's revenue is derived from providing sports data services primarily to the sports betting and media sectors across multiple regions including the UK, US, Malta, Switzerland, and other international markets.

Insider Ownership: 31.9%

Revenue Growth Forecast: 11.4% p.a.

Sportradar Group is experiencing strong growth, with recent earnings showing a significant rise in net income and sales. The company forecasts revenue growth of 11.4% annually, outpacing the US market's average. Sportradar is actively seeking M&A opportunities to enhance its technology and product offerings while leveraging advanced AI for innovative NBA partnerships. Despite trading below estimated fair value, challenges include a forecasted low return on equity of 10.3%.

- Get an in-depth perspective on Sportradar Group's performance by reading our analyst estimates report here.

- Our valuation report here indicates Sportradar Group may be overvalued.

Key Takeaways

- Reveal the 203 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROKU

Roku

Operates a TV streaming platform in the United states and internationally.

Flawless balance sheet with reasonable growth potential.