- United States

- /

- Hospitality

- /

- NasdaqCM:SBET

SharpLink Gaming (SBET): Evaluating Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for SharpLink Gaming.

SharpLink Gaming has seen its share price rally sharply in 2024, posting a year-to-date share price return of nearly 35%. More recently, though, momentum has cooled with a 1-month share price return of -28% and a 3-month slump of -45%, hinting at shifting sentiment following prior gains and recent volatility. Despite these swings, the one-year total shareholder return sits just above 34%, showing that early investors this year are still ahead in aggregate. However, the longer-term picture remains challenging, with a 3-year total shareholder return of -86%.

If volatility in emerging sectors like gaming has you thinking bigger, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

With such sharp swings in share price and rapid growth in the gaming sector, the key question now is whether SharpLink Gaming is trading at a bargain or if investors have already factored the company’s future prospects into the current price.

Price-to-Book of 0.7x: Is it justified?

SharpLink Gaming is trading at a price-to-book (PB) ratio of just 0.7x, making it appear meaningfully undervalued compared to both the industry average and peers. With a last close price of $10.89, the market is pricing SBET at a discount to the book value of its assets, signaling potential upside if fundamentals improve.

The price-to-book ratio compares a company's market valuation to its net assets and is especially relevant for sectors where tangible assets have lasting value. For SharpLink, operating in the hospitality and gaming space, this ratio can serve as a sanity check on how much the market trusts its asset base against future prospects.

With the US Hospitality industry averaging a PB ratio of 2.4x and SharpLink's peers at 2.1x, the company's 0.7x multiple stands out as a deep discount. Such a low valuation could reflect skepticism about profitability or recent volatility, but also sets the stage for re-rating if growth targets are hit. If the fair value PB ratio becomes available, it could give a sense of where the market might shift next.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 0.7x (UNDERVALUED)

However, persistently negative net income and recent price volatility could signal challenges ahead if SharpLink does not deliver sustainable growth soon.

Find out about the key risks to this SharpLink Gaming narrative.

Another View: Discounted Cash Flow Perspective

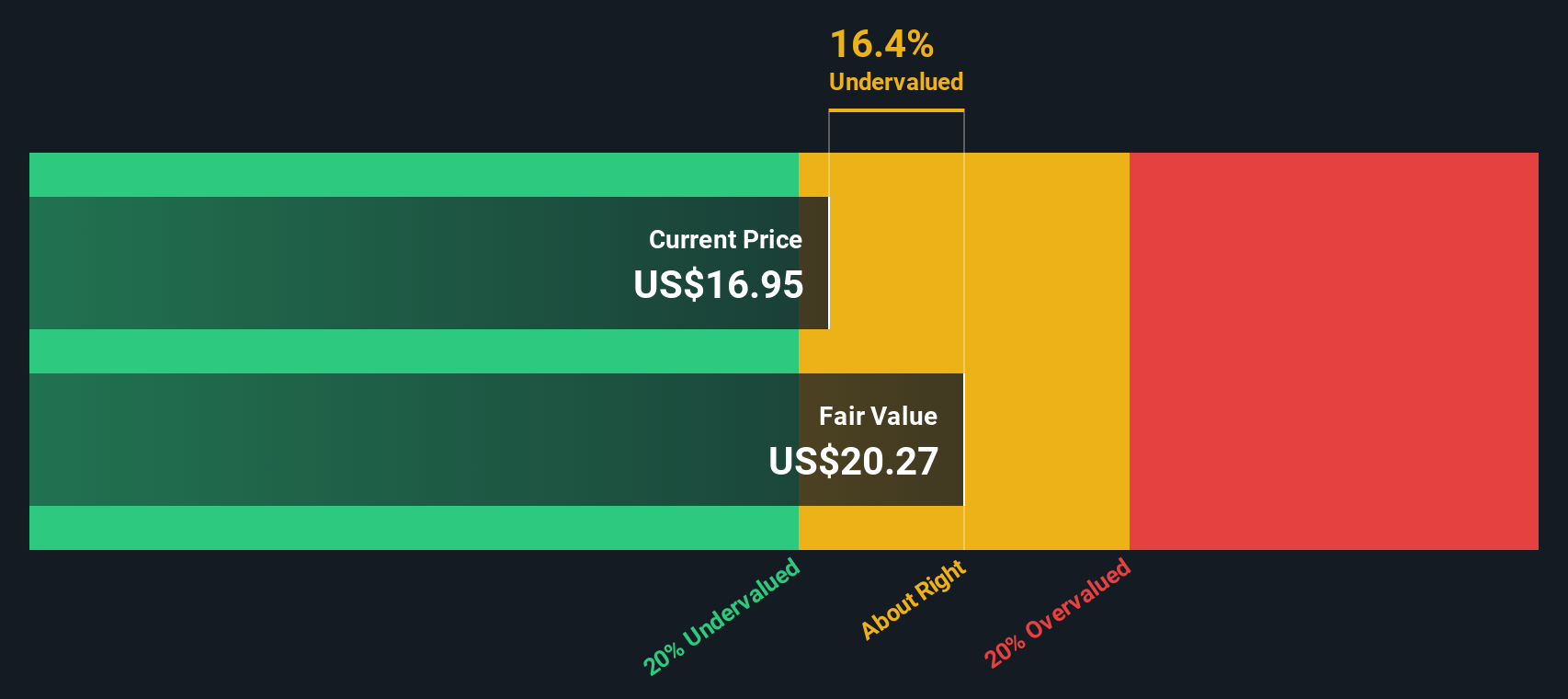

Looking at SharpLink Gaming through the lens of our SWS DCF model, the numbers tell a similarly upbeat story. The current share price of $10.89 is trading 22.3% below our estimated fair value of $14.02. This suggests shares may still be undervalued despite recent swings. Is the market too pessimistic, or is there more to uncover beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SharpLink Gaming for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SharpLink Gaming Narrative

If you see things differently or want to dig into the data on your own terms, you can quickly build your own perspective from scratch in under three minutes, and Do it your way.

A great starting point for your SharpLink Gaming research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let smart opportunities pass you by. The Simply Wall Street Screener makes it easy to chase down new winning stocks and stay ahead of the crowd.

- Grab a head start on potential multi-baggers by exploring these 3588 penny stocks with strong financials, which show surprising resilience and financial health.

- Tap into the unstoppable trend of artificial intelligence by seeking out these 24 AI penny stocks that are powering tomorrow's innovations.

- Lock in better value by targeting these 878 undervalued stocks based on cash flows and discover which names stand out for their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SBET

SharpLink Gaming

Engages in developing a treasury strategy centered on Ether.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives