- United States

- /

- Hospitality

- /

- NasdaqCM:SBET

Evaluating SharpLink Gaming After Strategic Partnerships and Recent 43% Price Surge in 2025

Reviewed by Bailey Pemberton

- Curious if SharpLink Gaming's latest run means it is a hidden gem or just hype? You are not alone; plenty of investors are eager to see if the numbers add up to real value.

- The stock has surged 43.2% year-to-date and an impressive 60.2% in the past twelve months, but it has pulled back by 28.3% over the last month. This creates plenty of action for risk-watchers and growth seekers alike.

- Recent news of SharpLink Gaming's strategic partnerships and new product launches has caught the market's attention, sparking renewed debate over its future direction. Industry chatter suggests these moves could shift the company's growth trajectory and help justify recent share price swings.

- The current valuation score is 1 out of 6, signaling there is plenty of room for improvement if value is your top priority. We will break down how that score is calculated using different methods. Stick around, because at the end of the article, we'll reveal a smarter way to cut through the noise and assess real value.

SharpLink Gaming scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SharpLink Gaming Discounted Cash Flow (DCF) Analysis

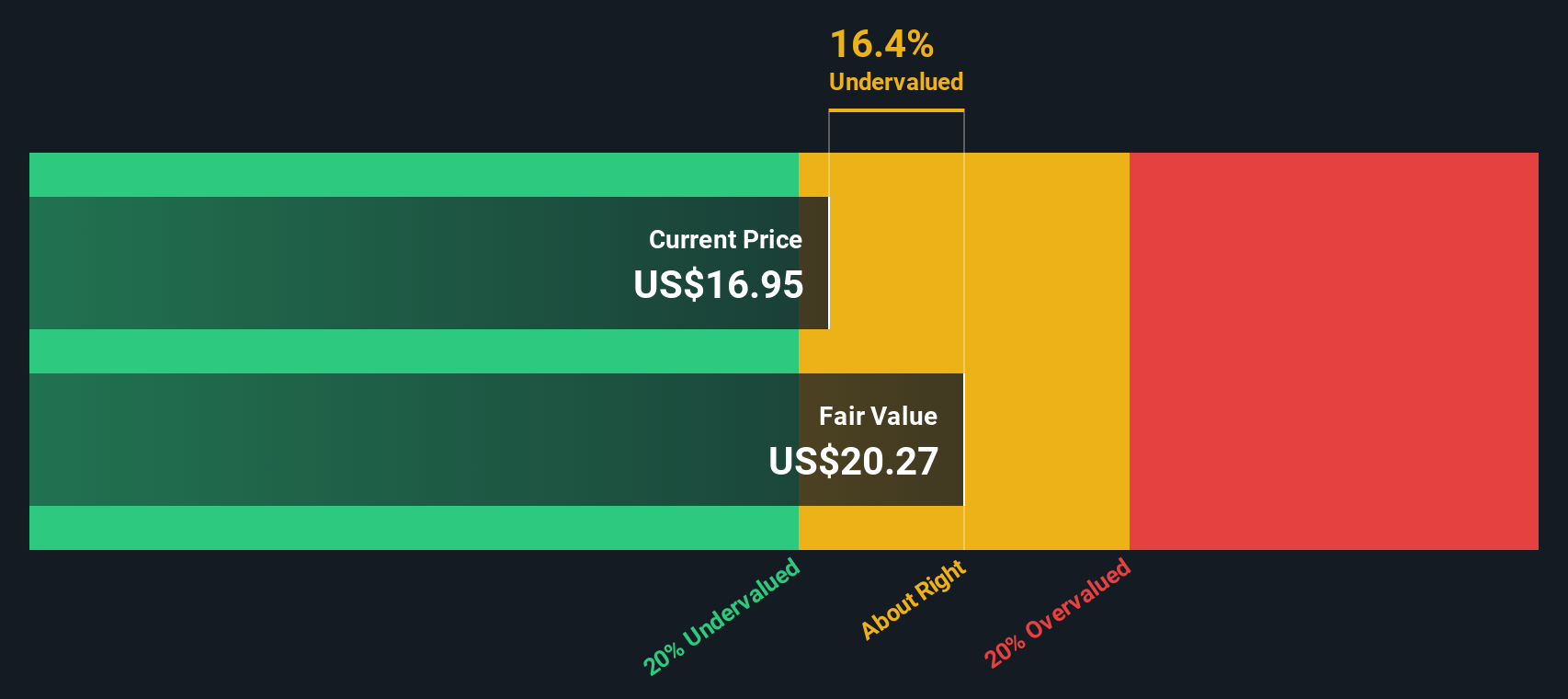

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's value. For SharpLink Gaming, this approach uses expected cash generation to gauge what the business could be worth to an investor at present.

SharpLink Gaming's latest twelve months of Free Cash Flow stand at -$4.00 million. Looking ahead, analysts project Free Cash Flow to grow rapidly, reaching $22.64 million by the end of 2026. Over the following years, estimates continue to climb, reaching as high as $209.10 million by 2035, according to extrapolated figures. These cash flow projections, expressed in US dollars, are subjected to discounting, which adjusts for the time value of money and provides a realistic present-day value for future earnings potential.

Based on the DCF model, SharpLink Gaming's estimated fair intrinsic value is $13.64 per share. This suggests the stock is currently trading at a 15.2% discount compared to its calculated value. This may indicate potential upside for investors who believe in the company's growth story.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SharpLink Gaming is undervalued by 15.2%. Track this in your watchlist or portfolio, or discover 882 more undervalued stocks based on cash flows.

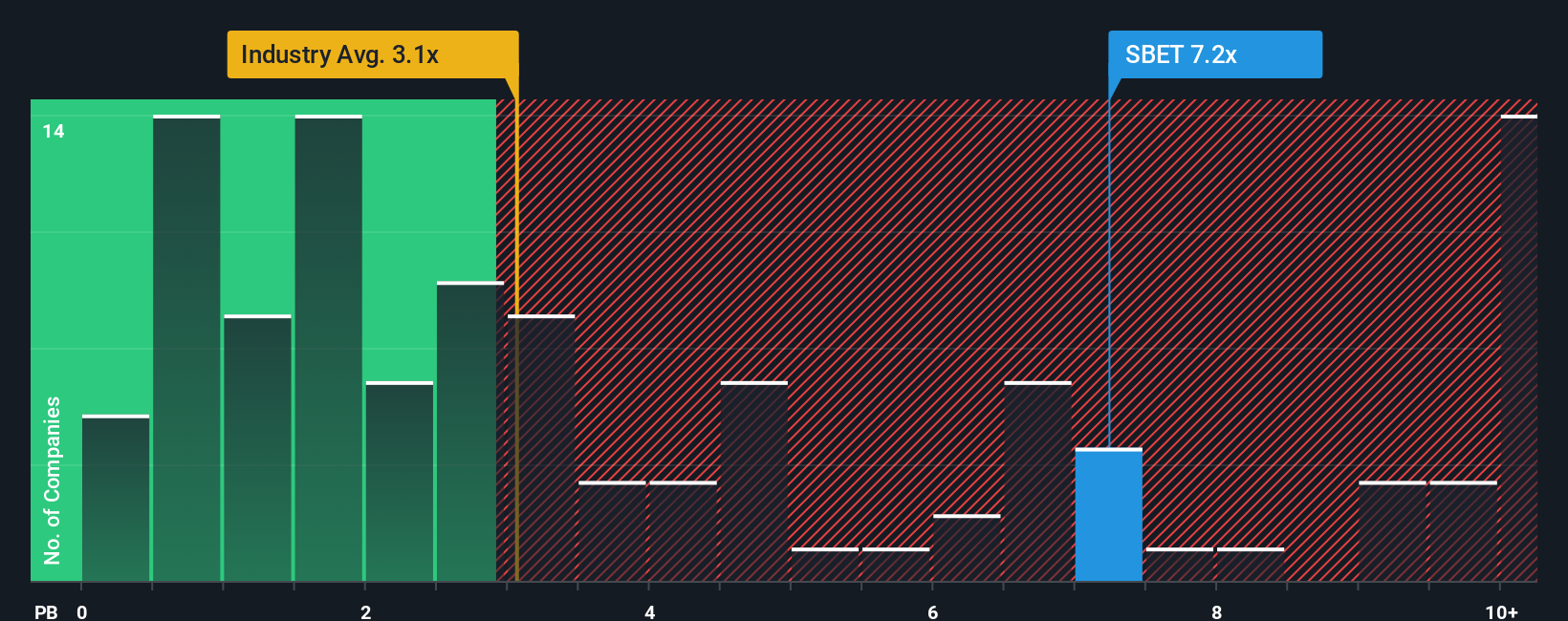

Approach 2: SharpLink Gaming Price vs Book (P/B) Multiple

The Price-to-Book (P/B) multiple is often a go-to valuation method for companies that may not yet be profitable or whose tangible assets provide key value, such as those in technology and gaming. By measuring a company's stock price against its book value, investors can gauge how the market values the underlying assets relative to those of peers in the same space.

Generally, a "fair" P/B multiple depends on expectations for future growth, the quality of a company's assets, and the level of risk compared to competitors. Fast-growing or low-risk companies often justify above-average multiples, while riskier or slower-growing businesses might warrant a lower P/B.

SharpLink Gaming currently trades at a P/B multiple of 5.03x. For context, the hospitality industry average is substantially lower at 2.60x, while close peers average 2.16x. This indicates that investors are paying a premium for each dollar of book value compared to both the sector and its competitors.

Simply Wall St’s proprietary "Fair Ratio" incorporates growth outlook, risk profile, profit margins, industry trends, and market capitalization to determine what P/B multiple is truly suitable for a company like SharpLink Gaming. Unlike simple peer or industry comparisons, the Fair Ratio helps cut through market noise to find a more tailored valuation benchmark.

Comparing the Fair Ratio with SharpLink Gaming’s current P/B of 5.03x, the gap is significant. This suggests the stock appears to be trading well above its justified value based on fundamentals and risks.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SharpLink Gaming Narrative

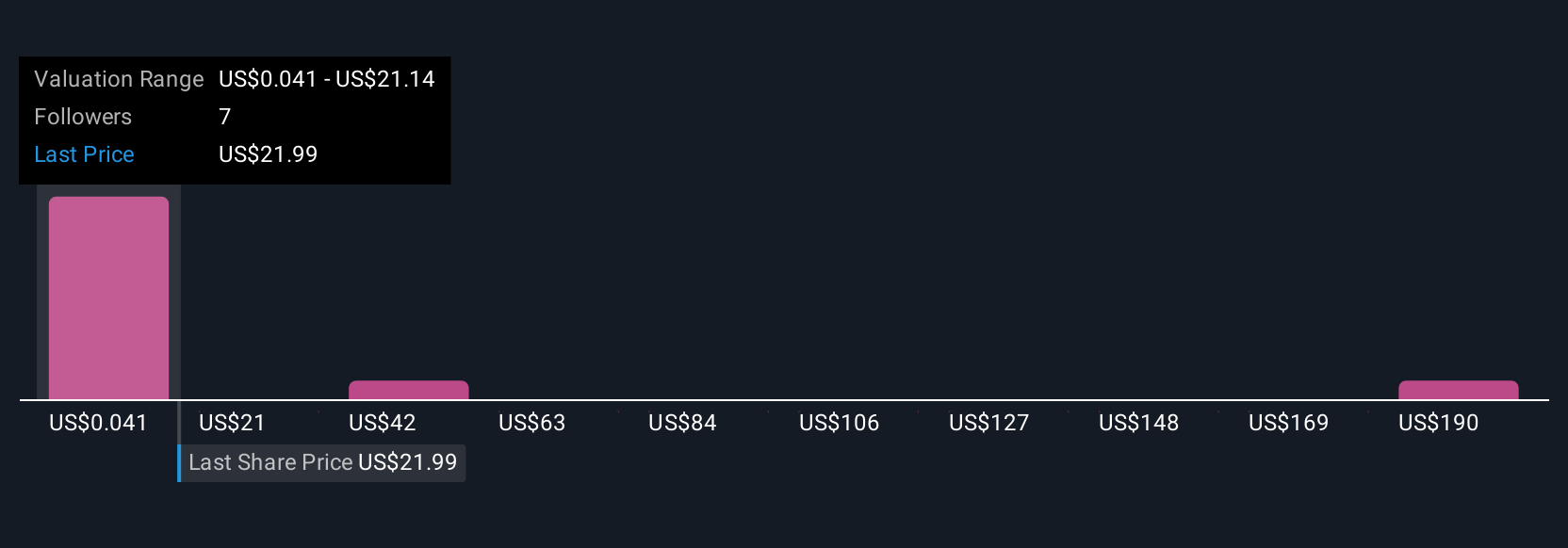

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. Narratives are personal investment stories that go beyond just the numbers; each one combines your perspective on a company with your own assumptions about future revenue, earnings, margins, and fair value. By linking a company’s story to its financial forecast and resulting fair value, Narratives let you clearly see the connection between what you believe and what the numbers say.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy, interactive tool to explore, share, and compare different views on a stock. Narratives empower you to make smarter buy or sell decisions by continually comparing Fair Value to the current Price, with automatic updates as new news or earnings come in. For example, some investors might see SharpLink Gaming’s fair value as high as $19, while others estimate it as low as $8, all depending on their personal stories and forecasts.

Narratives give you the power to invest with confidence, using a more dynamic and tailored approach that grows alongside your knowledge and the company’s progress.

Do you think there's more to the story for SharpLink Gaming? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SBET

SharpLink Gaming

Engages in developing a treasury strategy centered on Ether.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives