- United States

- /

- Hospitality

- /

- NasdaqGS:RRR

Red Rock Resorts (RRR): Exploring Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Red Rock Resorts (RRR) has continued attracting investor interest as its stock posted a 7% gain over the past week. This builds on steady year-to-date momentum. The company’s long-term returns also tell an intriguing story for shareholders.

See our latest analysis for Red Rock Resorts.

This week’s jump adds to an impressive year-to-date climb for Red Rock Resorts, with share price momentum reflecting renewed optimism among investors. Looking at the bigger picture, the company has posted a robust 18% one-year total shareholder return, and its strong multi-year performance signals that confidence in its long-term prospects is only growing.

If you’re interested in finding more companies capturing investor attention, now is a perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

With Red Rock Resorts’ shares climbing and long-term returns outpacing many peers, the real question now is whether the current price still leaves room for upside or if the market has already factored in its future growth.

Most Popular Narrative: 11.6% Undervalued

Red Rock Resorts last closed at $58.23, while the most widely followed narrative estimates fair value at $65.85. That narrative’s fair value assumes a notably more bullish outlook than the current market price, reflecting expectations for the company’s ongoing developments and future profitability.

"The successful rollout and ramp-up of new properties like Durango, combined with major upgrades to existing properties in rapidly growing neighborhoods, are enabling Red Rock Resorts to attract younger demographics and higher-value guests. This is expanding market share and supporting both revenue and margin expansion."

Curious what’s fueling that much higher valuation? From bold earnings projections to ambitious revenue growth assumptions, this narrative hides a surprising calculation behind the price tag. If you want to see the full playbook driving that fair value target, you’ll want to look beneath the surface.

Result: Fair Value of $65.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including ongoing construction disruptions and Red Rock Resorts’ high exposure to the Las Vegas local market. These factors could challenge near-term gains.

Find out about the key risks to this Red Rock Resorts narrative.

Another View: Multiples Point to a Premium

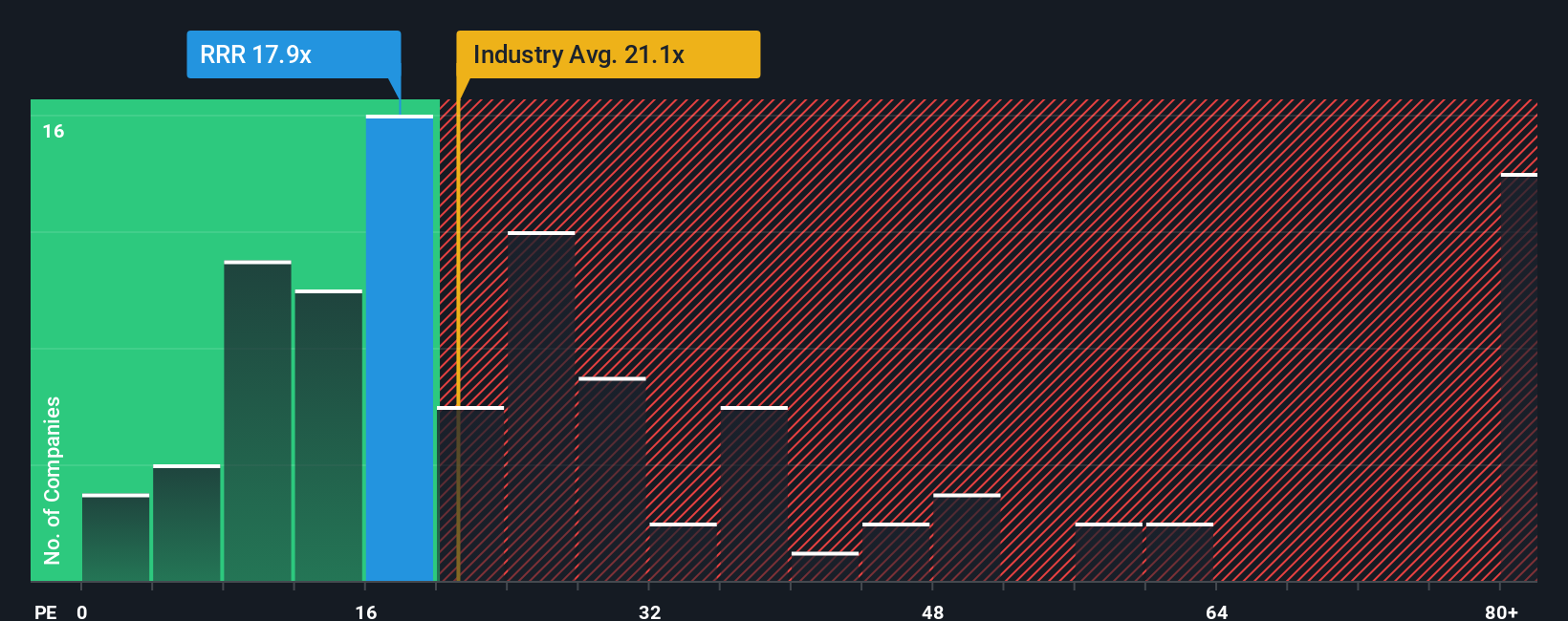

While the narrative and fair value suggest Red Rock Resorts is undervalued, the price-to-earnings comparison offers a different perspective. RRR trades at 18.1x earnings, which is a premium over peers at 16.5x, though it is less expensive than the US Hospitality industry average of 22.1x. The fair ratio model suggests a value of 21.3x, so RRR’s current valuation falls between its peers and the broader sector. Does paying more than the average peer offer genuine upside or extra risk if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Red Rock Resorts Narrative

If you see things differently or want to analyze the numbers for yourself, you can build your own take on Red Rock Resorts in just a few minutes with Do it your way.

A great starting point for your Red Rock Resorts research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities pass you by. Expand your horizons and tap into the smartest trends reshaping the market with our handpicked stock screens.

- Get ahead with these 82 cryptocurrency and blockchain stocks that are making waves in digital payments, blockchain innovations, and the future of finance.

- Secure your income stream and aim for consistent returns by checking out these 14 dividend stocks with yields > 3% yielding above 3%.

- Ride the momentum of machine learning breakthroughs by checking the potential of these 25 AI penny stocks and their role in transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RRR

Red Rock Resorts

Through its interest in Station Casinos LLC, develops and manages casino and entertainment properties in the United States.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives