- United States

- /

- Interactive Media and Services

- /

- NYSE:SSTK

Discover 3 Undervalued Small Caps In United States With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 2.1%, driven by gains in every sector. Over the past 12 months, the market is up 20%, with earnings expected to grow by 15% per annum over the next few years. In this thriving environment, identifying small-cap stocks that are undervalued and have insider buying can present unique opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 9.0x | 2.1x | 44.48% | ★★★★★☆ |

| Thryv Holdings | NA | 0.8x | 31.64% | ★★★★★☆ |

| AtriCure | NA | 2.4x | 46.30% | ★★★★★☆ |

| Titan Machinery | 4.3x | 0.1x | 25.65% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.4x | 22.56% | ★★★★★☆ |

| PCB Bancorp | 11.6x | 2.9x | 39.76% | ★★★★☆☆ |

| Scholastic | 73.1x | 0.6x | 37.04% | ★★★☆☆☆ |

| Papa John's International | 19.6x | 0.7x | 43.78% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.2x | -197.62% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

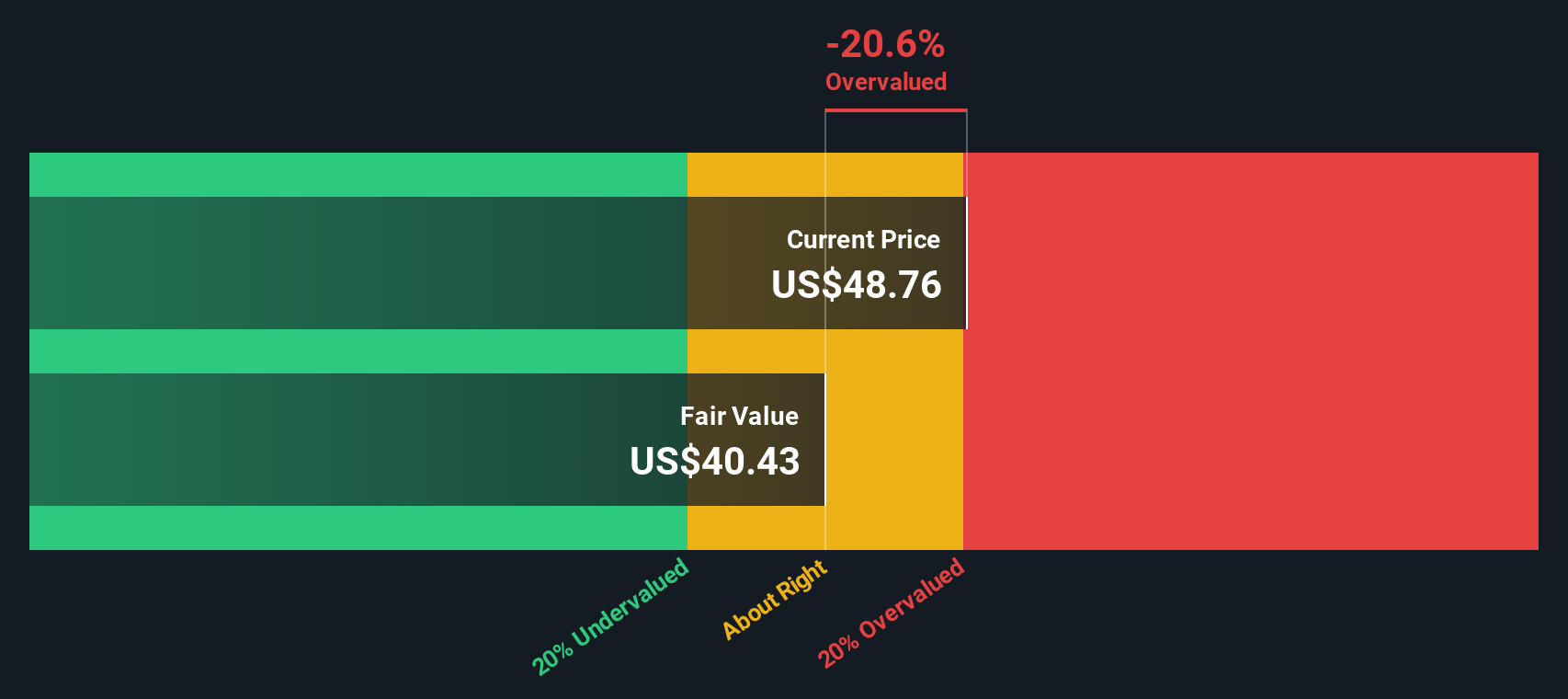

Papa John's International (NasdaqGS:PZZA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Papa John's International operates a global pizza delivery and carryout chain, with a market cap of approximately $2.84 billion.

Operations: Papa John's International generates revenue primarily from its North America commissary, domestic company-owned restaurants, and international operations. The company's gross profit margin has shown variability, reaching up to 31.28% in recent periods. Key expenses include cost of goods sold (COGS) and general & administrative expenses.

PE: 19.6x

Papa John’s International, a small cap stock, recently dropped from the Russell 2000 Dynamic Index on July 1, 2024. Despite this, insider confidence is evident with significant share purchases in recent months. The company reported Q1 earnings with sales at US$40.71 million and net income of US$14.64 million. Additionally, they declared a quarterly dividend of US$0.46 per share payable on August 30, 2024. Future growth prospects include an anticipated annual earnings increase of around 14%.

- Get an in-depth perspective on Papa John's International's performance by reading our valuation report here.

Understand Papa John's International's track record by examining our Past report.

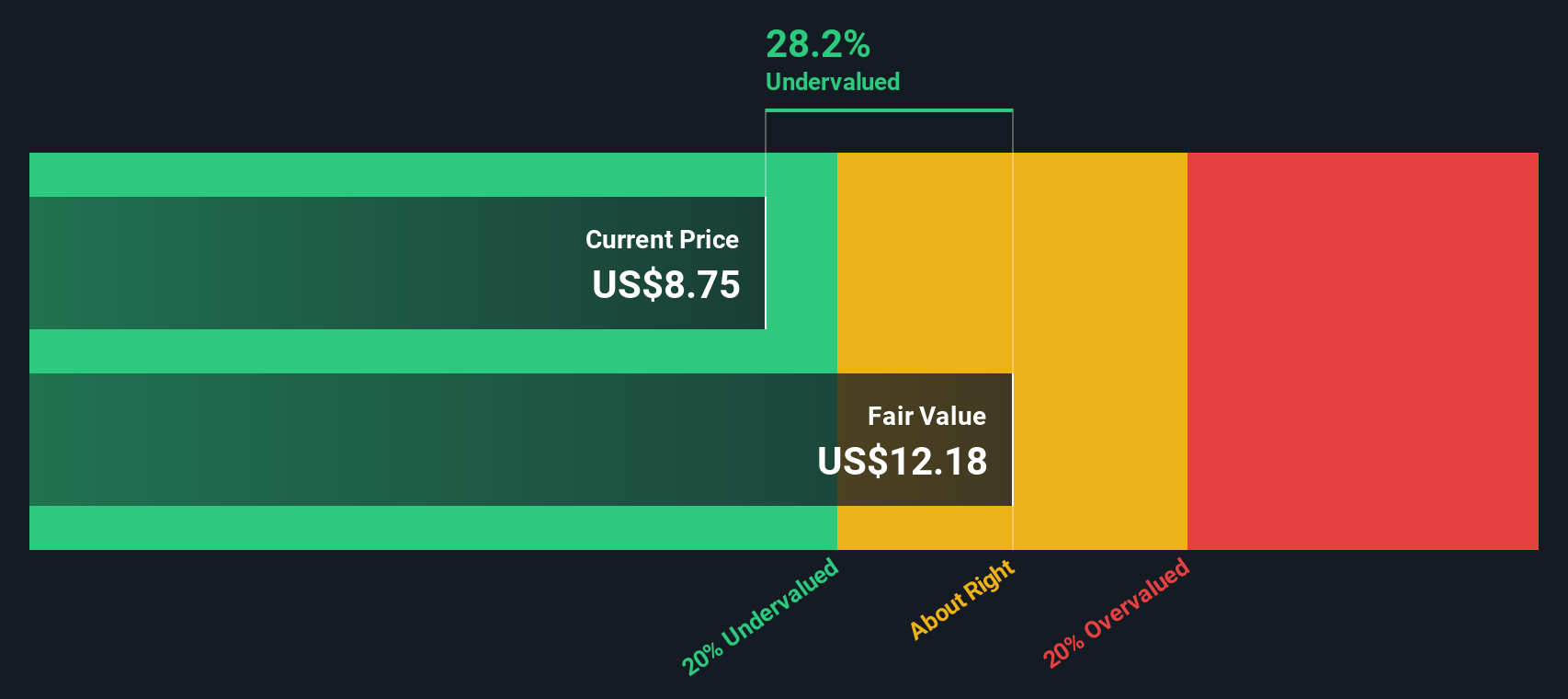

Enviri (NYSE:NVRI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Enviri is a company that specializes in environmental solutions, including waste management and recycling services, with a market cap of $1.50 billion.

Operations: Enviri generates revenue primarily from its Clean Earth and Harsco Environmental segments, with the latter contributing $1.17 billion. The company's cost of goods sold (COGS) for the most recent period was $1.66 billion, resulting in a gross profit margin of 21.29%.

PE: -17.5x

Enviri Corporation, a small-cap stock in the U.S., has seen recent insider confidence with significant share purchases over the past few months. The company reported Q1 2024 revenue of US$600 million, up from US$561 million last year, though net loss increased to US$18 million. Enviri expects Q2 GAAP operating income between US$33 million and US$40 million and forecasts full-year 2027 revenues around US$2.6 billion to US$2.7 billion, indicating steady growth prospects despite current losses.

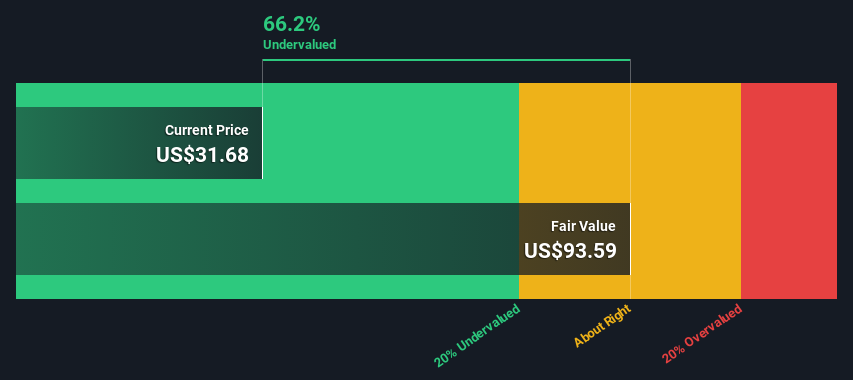

Shutterstock (NYSE:SSTK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shutterstock is a global provider of stock photography, footage, music, and editing tools with a market cap of approximately $2.50 billion.

Operations: The company's primary revenue stream is from Internet Information Providers, generating $873.62 million. Over the observed periods, gross profit margins have fluctuated between 57.02% and 64.38%, while net income margins have varied from as low as 2.61% to as high as 14.08%. Key operating expenses include sales and marketing, research and development, and general administrative costs.

PE: 16.9x

Shutterstock, a U.S. small-cap stock, has shown promising signs of being undervalued. The company recently launched a generative 3D API using NVIDIA's AI architecture to create realistic 3D models, enhancing its tech offerings. Insider confidence is evident with recent share purchases by executives in July 2024. Additionally, Shutterstock secured new credit agreements totaling $375 million and announced a $0.30 dividend per share for September 2024. Earnings are projected to grow by 18% annually, signaling potential future growth.

- Click to explore a detailed breakdown of our findings in Shutterstock's valuation report.

Assess Shutterstock's past performance with our detailed historical performance reports.

Where To Now?

- Delve into our full catalog of 61 Undervalued US Small Caps With Insider Buying here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SSTK

Shutterstock

Provides platform to connect brands and businesses to high quality content in North America, Europe, and internationally.

Adequate balance sheet with moderate growth potential.