- United States

- /

- Consumer Services

- /

- NasdaqGS:PRDO

Why Perdoceo Education (PRDO) Is Down 13.9% After Sector-Wide Sell-Off Despite Solid Earnings Outlook

Reviewed by Sasha Jovanovic

- In the past week, Perdoceo Education saw a significant decline in its share price amid a broader sell-off across the education and training services sector, largely triggered by a substantial drop in a peer company's shares and reinforced by wider economic concerns about inflation and the labor market.

- This sector-wide downturn occurred despite expectations for Perdoceo Education to report strong quarterly revenue growth and earnings that align with previous guidance, reflecting the importance of external market forces over company-specific performance during periods of industry stress.

- We'll explore how the recent sector-wide market pressure, rather than company fundamentals, may impact Perdoceo Education's investment narrative going forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Perdoceo Education Investment Narrative Recap

To be a shareholder in Perdoceo Education, you typically need to believe in the ongoing demand for career-focused education, the company’s ability to grow both organically and through acquisitions, and its talent for navigating regulatory environments. The recent share price decline, largely sector-driven rather than company-specific, does not materially impact the anticipated strong short-term catalyst, Perdoceo’s expected quarterly revenue growth and earnings in line with guidance. The biggest risk remains the company’s dependence on continued enrollment expansion and successful integration of acquisitions, particularly St. Augustine.

One of the most relevant recent announcements is Perdoceo’s guidance for Q3 2025, which forecasts operating income of US$46.8 million to US$48.8 million and EPS of US$0.55 to US$0.57. This maintains confidence in the catalyst of robust operations and earnings growth, despite the latest market volatility, and demonstrates management’s focus on financial performance as broader sector concerns play out.

By contrast, upcoming regulatory changes are always a risk that investors should be aware of, especially if...

Read the full narrative on Perdoceo Education (it's free!)

Perdoceo Education's outlook anticipates $987.8 million in revenue and $179.9 million in earnings by 2028. This scenario is based on projected annual revenue growth of 8.7% and an increase in earnings of $25.5 million from current earnings of $154.4 million.

Uncover how Perdoceo Education's forecasts yield a $42.00 fair value, a 32% upside to its current price.

Exploring Other Perspectives

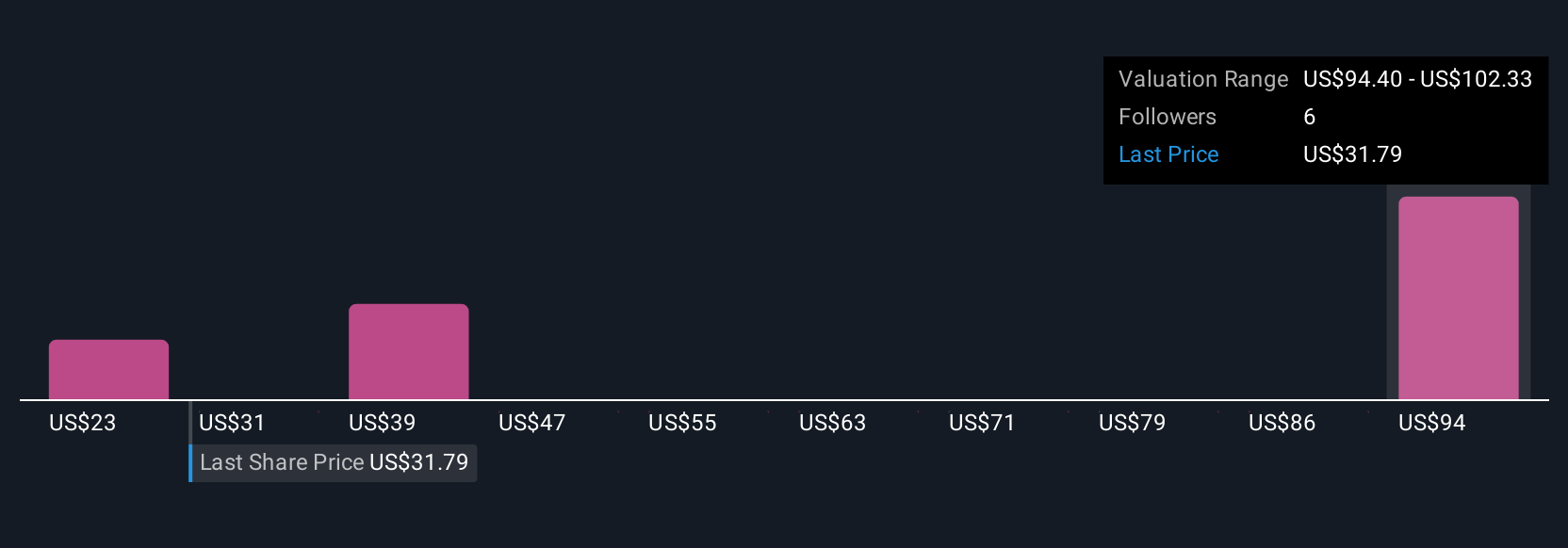

Four fair value estimates from the Simply Wall St Community span US$24 to US$105, pointing to a wide range of investor outlooks. With such variability, and as ongoing sector pressure highlights uncertainty around organic enrollment growth, you should explore several viewpoints before deciding.

Explore 4 other fair value estimates on Perdoceo Education - why the stock might be worth over 3x more than the current price!

Build Your Own Perdoceo Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perdoceo Education research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Perdoceo Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perdoceo Education's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRDO

Perdoceo Education

Provides postsecondary education through online, campus-based, and blended learning programs in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026