- United States

- /

- Consumer Services

- /

- NasdaqCM:OSW

Did AI Initiatives and Raised Guidance Just Shift OneSpaWorld Holdings' (OSW) Investment Narrative?

Reviewed by Sasha Jovanovic

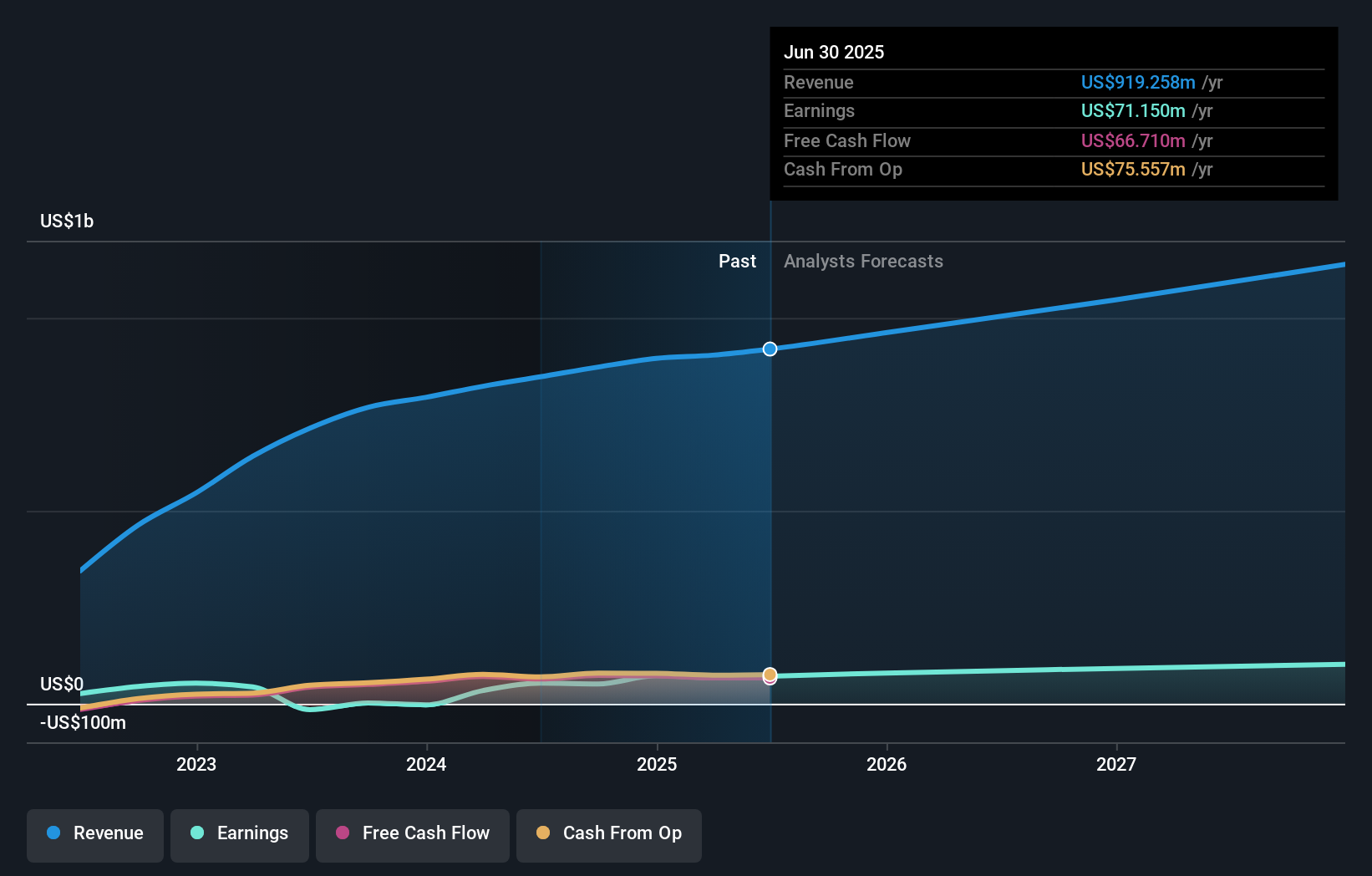

- In recent days, OneSpaWorld Holdings Limited reported quarterly results that surpassed both revenue and earnings expectations, while also raising its full-year guidance and unveiling new AI-driven initiatives to enhance operational efficiency.

- A key insight is that the company continues to generate healthy earnings growth and return capital to shareholders, despite industry concerns about weakening discretionary spending.

- We’ll now examine how OneSpaWorld’s AI initiatives and improved guidance could shape the company’s broader investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

OneSpaWorld Holdings Investment Narrative Recap

Being a shareholder in OneSpaWorld Holdings means believing in the resilience and growth potential of the wellness economy within the cruise industry, even amid macro pressures on discretionary spending. The recent earnings beat and raised full-year guidance reinforce the catalyst of strong onboard demand but do not materially reduce the biggest risk: the company’s reliance on cruise sector recovery and passenger growth, which remains sensitive to external shocks.

The most relevant recent announcement is OneSpaWorld’s introduction of AI-driven initiatives targeting margin expansion and enhanced efficiency. As these efforts are still in the early stages, the extent and timing of their benefits remain uncertain, making operational execution a key point of interest for those watching the short-term impact on profitability and risk management.

However, despite recent progress, investors should remain aware that cruise industry dependence continues to expose OneSpaWorld to potential revenue swings if...

Read the full narrative on OneSpaWorld Holdings (it's free!)

OneSpaWorld Holdings' narrative projects $1.2 billion revenue and $110.6 million earnings by 2028. This requires 8.9% yearly revenue growth and a $39.5 million earnings increase from $71.1 million.

Uncover how OneSpaWorld Holdings' forecasts yield a $26.50 fair value, a 30% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided two fair value estimates for OneSpaWorld, ranging from US$17.46 to US$26.50 per share. While opinions differ widely, the company’s ongoing reliance on cruise passenger volumes invites a closer look at how external travel disruptions could affect future outcomes.

Explore 2 other fair value estimates on OneSpaWorld Holdings - why the stock might be worth as much as 30% more than the current price!

Build Your Own OneSpaWorld Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OneSpaWorld Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OneSpaWorld Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OneSpaWorld Holdings' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OSW

OneSpaWorld Holdings

Operates health and wellness centers onboard cruise ships and at destination resorts in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026