- United States

- /

- Hospitality

- /

- NasdaqGS:MLCO

Melco Resorts & Entertainment (NasdaqGS:MLCO): Evaluating Valuation as Q3 Results Near and Deleveraging Confidence Builds

Reviewed by Simply Wall St

Melco Resorts & Entertainment (NasdaqGS:MLCO) is preparing to announce its third-quarter 2025 financial results on November 6. Investors are watching closely, as sentiment has improved in tandem with expectations for earnings growth and continued debt reduction.

See our latest analysis for Melco Resorts & Entertainment.

After a strong run-up earlier this year, Melco Resorts & Entertainment shares have cooled, posting a 12% decline over the past month. Still, with the stock up more than 48% year-to-date and a 1-year total shareholder return of 22%, momentum remains solid as optimism builds around debt reduction and continued earnings improvements.

If Melco’s rebound has you thinking bigger, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With a strong rally this year followed by a recent pullback, the big question is whether Melco Resorts & Entertainment now offers value for new investors, or if the market has already factored in its future growth prospects.

Price-to-Earnings of 56.5x: Is it justified?

Melco Resorts & Entertainment currently trades at a price-to-earnings (P/E) ratio of 56.5x, placing it well above sector averages and peer valuations, despite a recent pullback in share price.

The price-to-earnings ratio gauges how much investors are willing to pay for each dollar of a company’s earnings. In the hospitality industry, this metric is crucial, especially as companies recover profitability and pursue new growth cycles.

Melco’s P/E ratio is more than double the US Hospitality industry average of 23.5x and also exceeds the average among peers, which stands at 31.7x. Comparatively, this signals a premium valuation. The market may be assigning this valuation due to the company’s rapid earnings growth, but it is not in line with typical industry benchmarks. It is also above the estimated “fair” P/E ratio of 36.6x, which could represent the level the market moves toward if growth assumptions moderate.

Explore the SWS fair ratio for Melco Resorts & Entertainment

Result: Price-to-Earnings of 56.5x (OVERVALUED)

However, slowing annual revenue growth and lingering share price volatility could challenge continued optimism about Melco’s current valuation and growth outlook.

Find out about the key risks to this Melco Resorts & Entertainment narrative.

Another View: Discounted Cash Flow Tells a Different Story

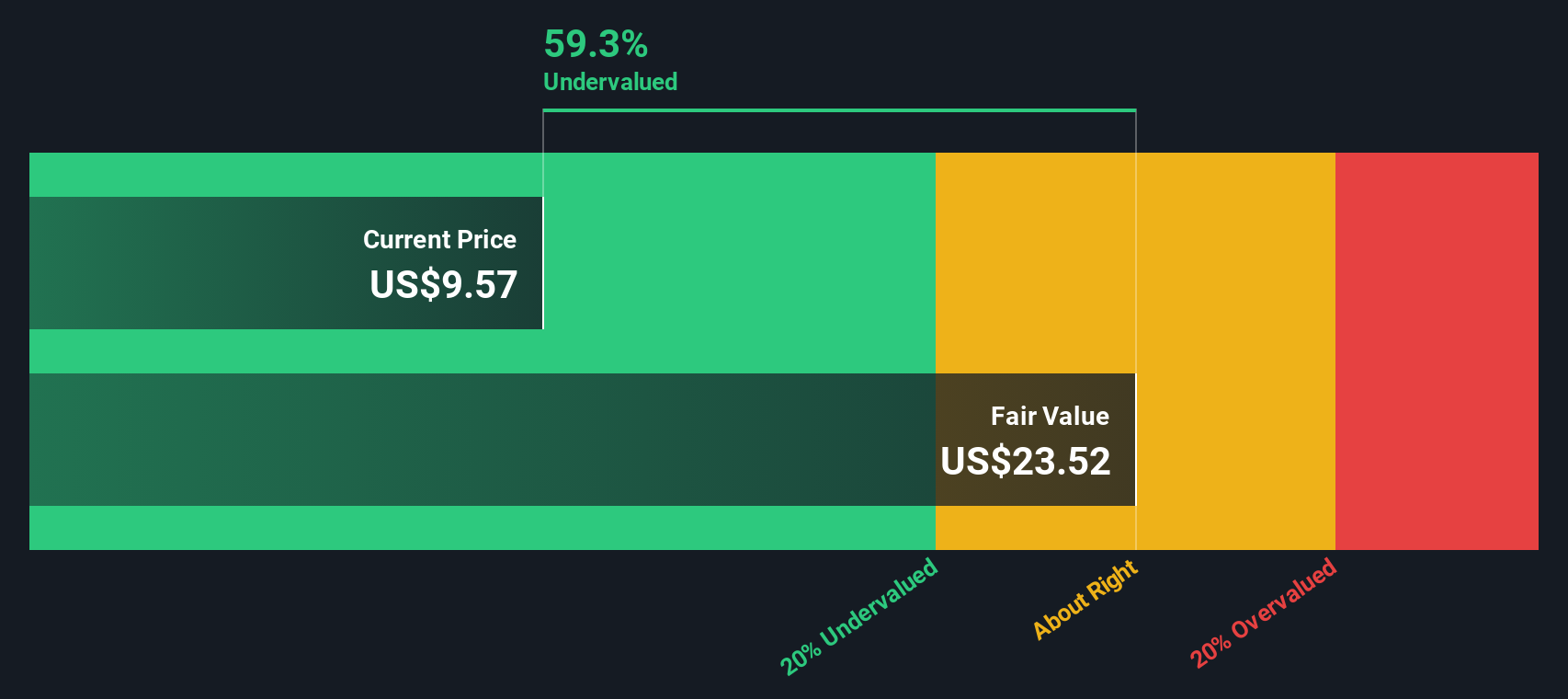

While the price-to-earnings ratio suggests Melco Resorts & Entertainment appears expensive compared to industry benchmarks, our DCF model provides a notably different perspective. The SWS DCF model calculates fair value at $21.95 per share, indicating Melco could be trading at a significant discount relative to its long-term cash flow potential. Should investors trust this optimistic outlook, or are the risks too significant to overlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Melco Resorts & Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Melco Resorts & Entertainment Narrative

If you see the story differently or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Melco Resorts & Entertainment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors never settle for just one idea. Expand your horizons right now to spot stocks with unique strengths and breakthrough potential before others do.

- Boost your portfolio’s income with top picks offering yields over 3% through these 22 dividend stocks with yields > 3% you might otherwise miss.

- Capture the rise of artificial intelligence by acting on these 26 AI penny stocks that are at the forefront of technology-driven growth.

- Enhance your strategy with these 831 undervalued stocks based on cash flows that stand out for strong cash flows and attractive value profiles in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLCO

Melco Resorts & Entertainment

Develops, owns, and operates casino gaming and resort facilities in Asia and Europe.

Good value with reasonable growth potential.

Market Insights

Community Narratives