- United States

- /

- Consumer Services

- /

- NasdaqGS:MCW

A Look at Mister Car Wash (MCW) Valuation as Wall Street Revisits Sales and Cash Flow Worries

Reviewed by Kshitija Bhandaru

A recent article has put Mister Car Wash (MCW) in the spotlight, emphasizing the company’s weak sales trends and longstanding struggles with cash burn. This renewed focus appears to be affecting how investors view the stock.

See our latest analysis for Mister Car Wash.

Despite a brief bump in the share price, Mister Car Wash has struggled to regain investor confidence after last year's negative headlines. The stock's year-to-date share price return stands at -30.26%. Its 1-year total shareholder return of -21.64% and 3-year total shareholder return of -42.52% suggest fading momentum, as persistent operational challenges continue to weigh on sentiment and valuation.

If these trends have you thinking about where else to look for opportunity, now is a perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares now trading at a substantial discount to analyst price targets, the key question is whether Mister Car Wash is truly undervalued at current levels or if the market has already priced in all anticipated challenges and potential upside.

Most Popular Narrative: 38% Undervalued

With Mister Car Wash closing at $5.07, the most widely followed narrative assigns a fair value of $8.17, indicating clear upside from current prices. The tension between these figures highlights diverging expectations about future growth and operational improvements, providing context for the debate.

“Mister Car Wash's resilient and growing membership subscription base (UWC) provides predictable, recurring revenue and demonstrates strong customer retention, particularly as consumers increasingly value convenience and subscription services. Continued price optimization and tier upgrades (such as growth in the Titanium tier) are expected to further lift revenue per member and expand margins over time.”

Wondering how these everyday car washes could justify a premium price target? The secret lies in recurring subscriptions, margin expansion, and a bold bet on future upgrades. What hidden assumptions are driving such high expectations? Find out what really powers this valuation.

Result: Fair Value of $8.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in retail sales and rising operating costs could challenge Mister Car Wash’s ability to deliver on these optimistic expectations.

Find out about the key risks to this Mister Car Wash narrative.

Another View: What Do the Multiples Say?

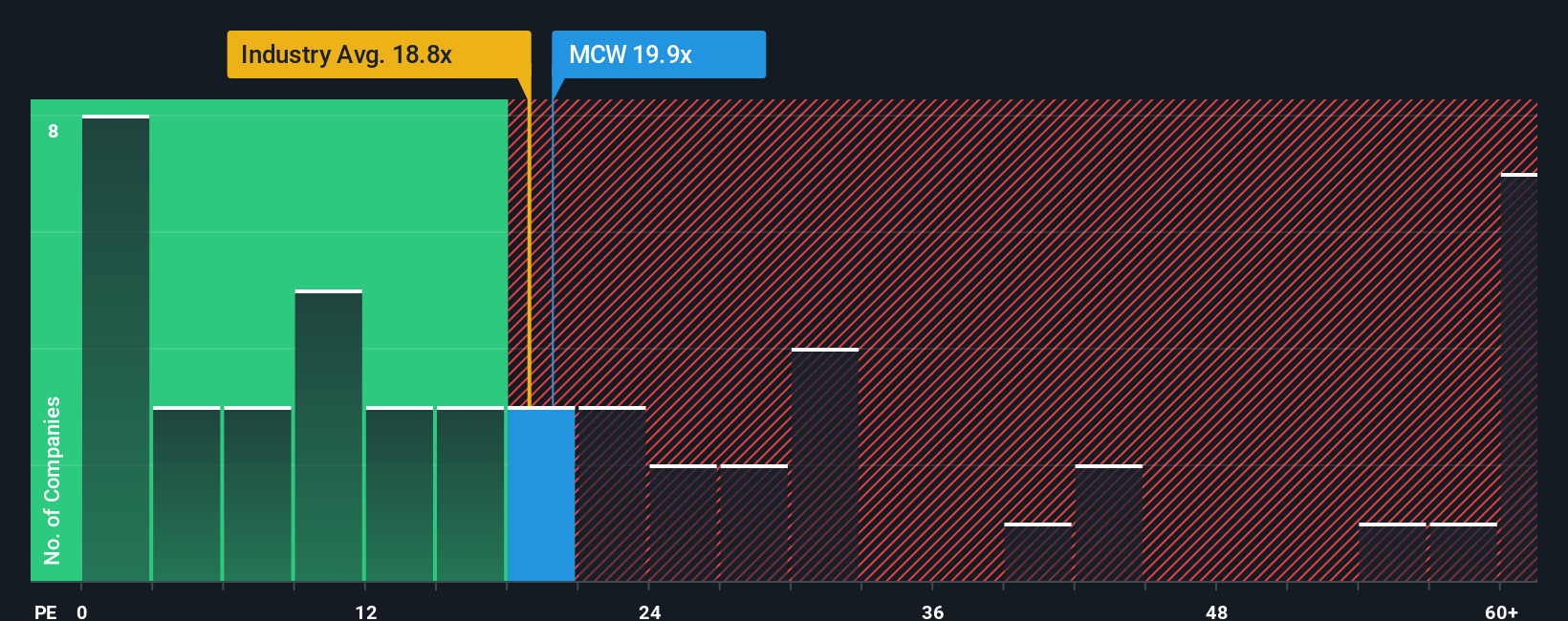

Looking beyond analyst price targets, the company trades at a price-to-earnings ratio of 19x. This is slightly higher than both its industry average of 17.1x and its peer group at 18.4x, yet below the fair ratio of 23.9x. That suggests Mister Car Wash's stock is reasonably valued but offers less clear-cut upside than some may hope. Are the market’s expectations already fully reflected in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mister Car Wash Narrative

If you'd rather chart your own path or want to see the numbers from a fresh perspective, you can assemble your own narrative in just minutes. Do it your way.

A great starting point for your Mister Car Wash research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t stop at just one opportunity. If you want to stay ahead, check out other standout stocks and trends on Simply Wall Street’s powerful screeners today.

- Uncover lucrative income streams by spotting these 19 dividend stocks with yields > 3% with resilient yields above 3% and proven financial strength.

- Tap into the growth potential of artificial intelligence by exploring these 25 AI penny stocks that could influence entire industries in the years ahead.

- Find potential bargains by searching for these 889 undervalued stocks based on cash flows using real-time cash flow analysis to identify stocks trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCW

Mister Car Wash

Provides conveyorized car wash services in the United States.

Proven track record and fair value.

Market Insights

Community Narratives