- United States

- /

- Consumer Services

- /

- NasdaqGS:DUOL

Has Duolingo’s 43% Drop in 2025 Opened a Value Opportunity for Investors?

Reviewed by Bailey Pemberton

- Curious if Duolingo stock is a bargain or overpriced? You are not alone, as many investors are asking whether now is the right time to jump in or hold off.

- The price has swung dramatically this year, dropping 43.1% year-to-date, with a 5.5% uptick in the last week that adds a dash of renewed optimism.

- Recent headlines have focused on Duolingo's ongoing expansion of its product offerings and partnerships, sparking fresh debates about its long-term business model. These developments have certainly played a role in shaping investor sentiment and driving recent volatility in the stock price.

- Currently, Duolingo scores just 3 out of 6 on our valuation checklist, meaning it appears undervalued in only half the key measures we track. There is plenty to explore across different valuation models. In addition, there is an even sharper way to assess true value coming up at the end of the article.

Find out why Duolingo's -48.6% return over the last year is lagging behind its peers.

Approach 1: Duolingo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach helps investors determine what a business is truly worth today, based on its ability to generate cash in the future.

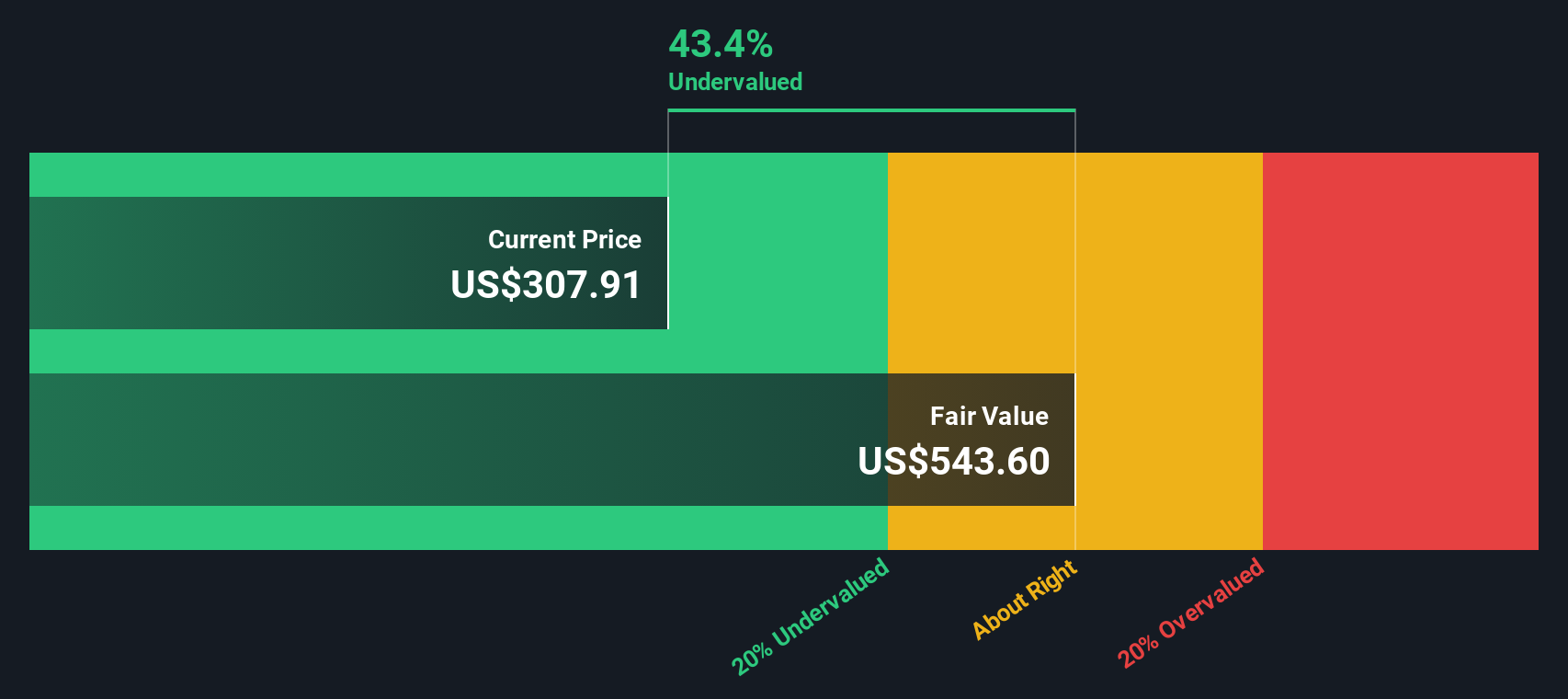

For Duolingo, the most recent reported Free Cash Flow (FCF) stands at $341.6 Million. Analysts have provided explicit forecasts for the next few years, projecting FCF to reach $629.9 Million by the end of 2027. Beyond this, Simply Wall St extrapolates further with ten-year projections estimating FCF could hit $1.2 Billion by 2035 if growth trends hold steady. These projections are based on a mix of analyst estimates and calculated growth rates using the 2 Stage Free Cash Flow to Equity model.

According to this DCF analysis, Duolingo’s fair value per share is $481.54. At current trading levels, this implies a discount of 61.5%, suggesting that the stock is significantly undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Duolingo is undervalued by 61.5%. Track this in your watchlist or portfolio, or discover 930 more undervalued stocks based on cash flows.

Approach 2: Duolingo Price vs Earnings (PE Ratio)

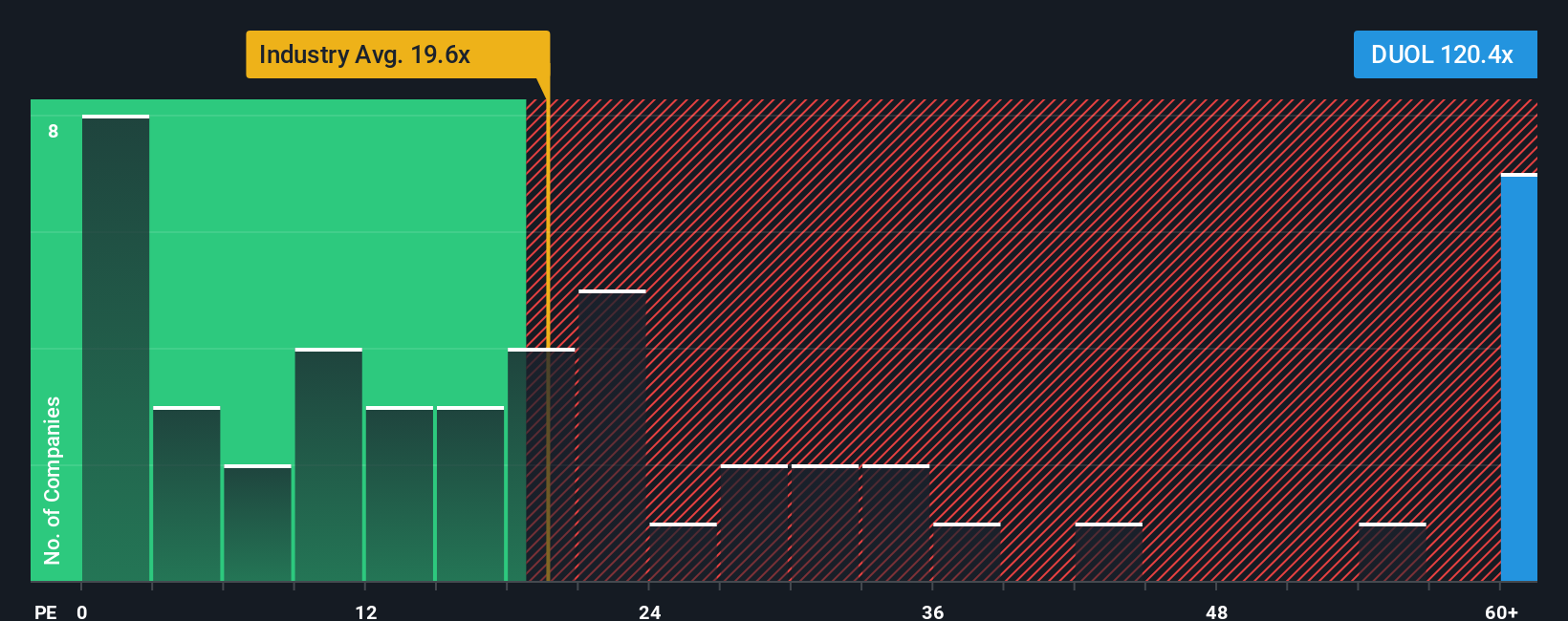

For companies like Duolingo that are now profitable, the Price-to-Earnings (PE) ratio serves as a practical tool for valuing the stock. The PE ratio is investor shorthand for how much the market is willing to pay today for a dollar of the company's current or future earnings. This makes it especially relevant for established, earnings-generating businesses.

Interpreting what a "normal" or "fair" PE ratio should be depends on factors such as earnings growth potential, company-specific risks, and how those compare relative to peers. Faster-growing or more stable businesses typically command higher PE multiples, while slower growth or higher risk can warrant lower ones.

Currently, Duolingo trades at a PE ratio of 22.21x. This is above the Consumer Services industry average of 15.95x but below the peer group average of 24.57x. However, industry or peer comparisons can only tell part of the story.

Simply Wall St’s "Fair Ratio" incorporates not just profit growth but also margins, industry norms, company size, and risk levels to provide a more tailored benchmark. For Duolingo, this Fair Ratio is calculated at 10.98x, reflecting all these nuanced inputs and offering fuller context than broad comparisons.

Comparing Duolingo’s current PE of 22.21x to the Fair Ratio of 10.98x suggests the stock is trading at a substantial premium relative to what Simply Wall St metrics indicate is justified for its profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Duolingo Narrative

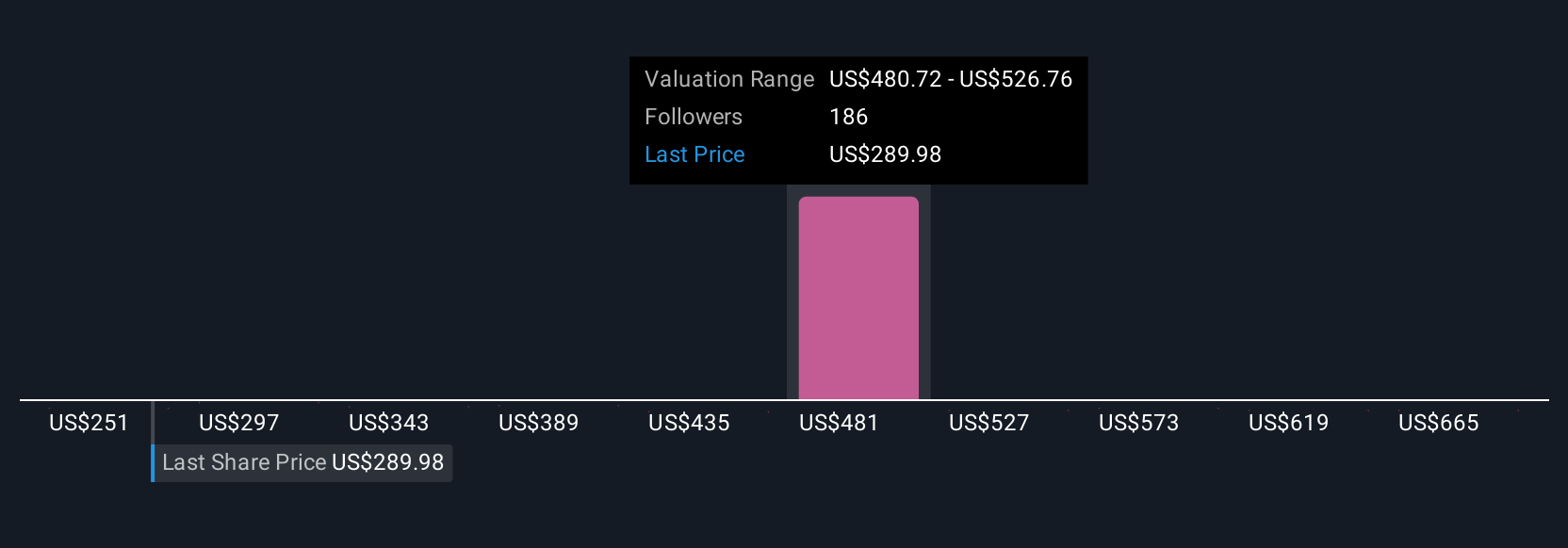

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your personalized perspective on a company’s future, where you support your story about the business with assumptions for revenue growth, profit margins, and risk, tying a financial forecast to a fair value calculation. Narratives make connections between news, company strategy, and financials easy to see. This approach allows you to move beyond the numbers by considering the underlying story that drives your investment outlook.

Simply Wall St’s Community page lets millions of investors access user-driven Narratives. You can compare your reasoning against the crowd, share your own forecasts, and see how new information and earnings instantly update your fair value. Narratives provide a dynamic tool to decide when to buy or sell by continuously comparing Fair Value to the current Price as the situation evolves.

For example, one investor might believe Duolingo’s expansion into new educational categories and markets will drive long-term user growth, leading them to set a high fair value near $600.00. Another may focus on slowing user growth or emerging competition, placing their fair value closer to $239.00 instead. With Narratives, you can see both sides, sense-check your assumptions, and always stay informed as fresh data arrives.

Do you think there's more to the story for Duolingo? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DUOL

Duolingo

Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026