- United States

- /

- Hospitality

- /

- NasdaqGS:DNUT

Krispy Kreme (DNUT): Evaluating the Stock After Its Bold Menu Expansion and Nostalgic Marketing Push

Reviewed by Simply Wall St

Krispy Kreme (DNUT) is shaking things up this month with an expanded menu, rolling out nine brand new doughnut flavors and growing its everyday line-up to sixteen options. This refresh comes at the same time as a marketing push that channels a classic 1990s tune, sparking fresh buzz around the brand.

See our latest analysis for Krispy Kreme.

The new menu launch and nostalgia-fueled marketing push come at a time when Krispy Kreme’s momentum is especially volatile. While the company’s 1-month share price return is a striking 20%, the year-to-date share price return has plunged to -59%, and the 1-year total shareholder return stands at -63%. Despite recent product innovation and brand buzz, long-term investors have seen considerable declines, suggesting sentiment is yet to recover in full.

If the blast of new flavors has you hungry for other opportunities, now’s the perfect moment to branch out and discover fast growing stocks with high insider ownership

With the stock down sharply over the past year despite upbeat product news, can investors scoop up Krispy Kreme shares at a bargain, or is the market already factoring in a possible turnaround and future growth?

Most Popular Narrative: 8.9% Overvalued

Krispy Kreme’s last close of $4.03 sits above the most followed narrative’s fair value of $3.70, suggesting recent optimism may already be baked into the stock. This sets the stage for the bullish and bearish forecasts that shape analyst expectations.

The shift toward a more capital-light international franchise model, combined with a strong pipeline of new markets and franchisee expansion (for example, new markets like France, Brazil, UAE/KFC partnership, and first entry into Spain), is expected to accelerate unit growth and drive higher, more predictable returns on capital, supporting both long-term revenue growth and higher margins. Rapid expansion into high-traffic "fresh delivery" (DFD) doors with partners like Costco, Walmart, Target, and Sam's Club, alongside digital sales growth now exceeding 20% of U.S. retail sales, leverages consumer convenience and omni-channel strategies to increase transaction volume and sustained top-line revenue improvement.

What’s under the hood of this valuation? Analysts are betting on a transformation story driven by global expansion and margin gains. There are a few core numbers they’re counting on to shift the outlook. Uncover the financial engine behind this headline value. The key variable may surprise you.

Result: Fair Value of $3.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and uncertainty in U.S. sales after recent store closures remain key risks that could challenge the turnaround narrative.

Find out about the key risks to this Krispy Kreme narrative.

Another View: Multiples Suggest Good Value

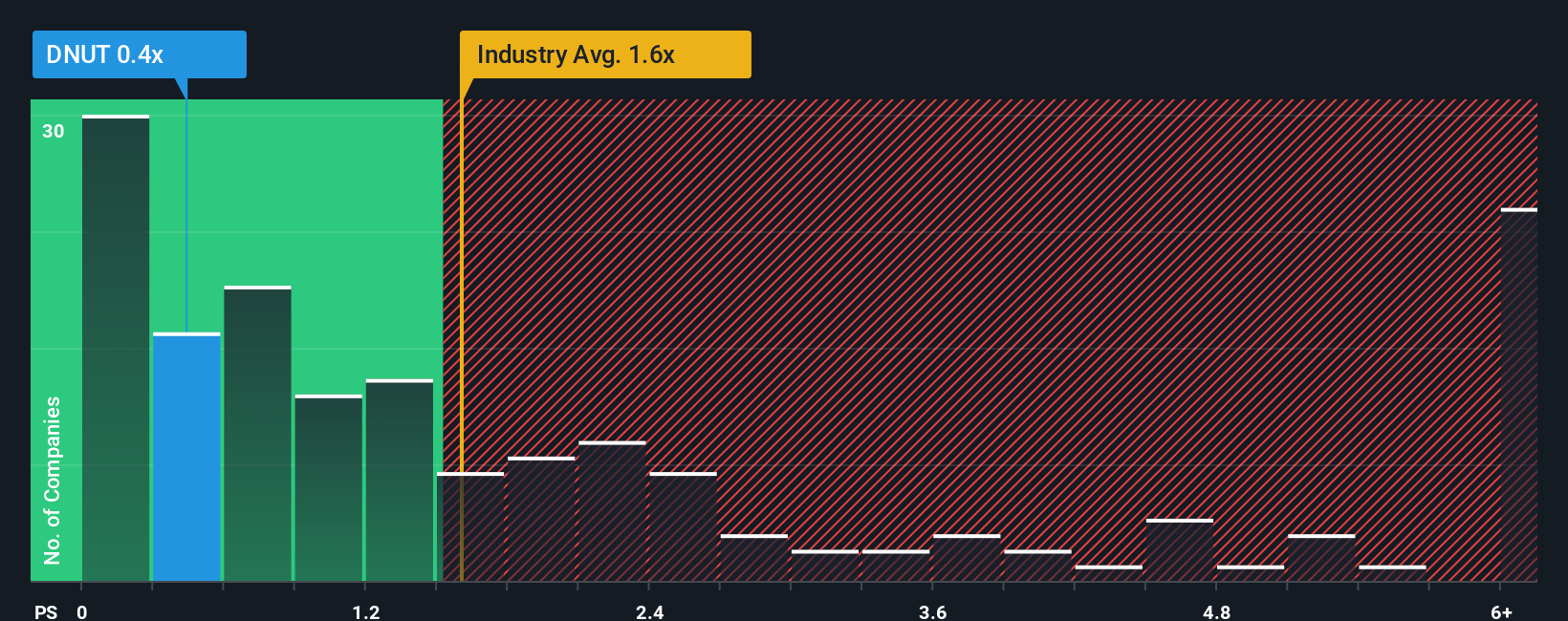

While the fair value narrative calls Krispy Kreme overvalued, another lens shows it trading well below peers. Its price-to-sales ratio is just 0.4x, markedly lower than both the industry average of 1.6x and peer average of 7.7x. The fair ratio stands at 0.7x. The market could move toward this level if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Krispy Kreme Narrative

Prefer to chart your own course or challenge these ideas? Discover how quickly you can craft your own story from the data and insights. Do it your way

A great starting point for your Krispy Kreme research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss your chance to secure your edge in the markets. Simply Wall Street’s powerful screener can help you spot promising stocks before the crowd catches on.

- Capitalize on cash-flow bargains by reviewing these 862 undervalued stocks based on cash flows that may be set for a value-driven rebound.

- Boost your portfolio’s future with these 26 AI penny stocks powering advancements in artificial intelligence and automation.

- Unlock steady income streams with these 14 dividend stocks with yields > 3% offering yields above 3% for strong, regular returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Krispy Kreme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DNUT

Krispy Kreme

Produces doughnuts in the United States, the United Kingdom, Ireland, Australia, New Zealand, Mexico, Canada, Japan, and internationally.

Fair value with very low risk.

Market Insights

Community Narratives