- United States

- /

- Hospitality

- /

- NasdaqGS:DKNG

What the ESPN Bet Expansion Means for DraftKings Stock in 2025

Reviewed by Simply Wall St

If you are keeping tabs on DraftKings and wondering whether it is the right moment to click “buy,” you are certainly not alone. With sports betting on the rise nationwide and DraftKings’ name popping up in countless headlines, investors are paying close attention to every price swing and market whisper. Over the past year, the stock has rallied by 16.3%, showing that the company’s expansion efforts and changing regulatory landscape may be starting to pay off. While the most recent month saw a modest dip of 2.1%, DraftKings is still up an impressive 21.2% year to date, mirroring broader optimism in growth stocks. Of course, volatility is nothing new for DraftKings. Just look at the three-year return of 136.5%. However, it is important to also consider the rollercoaster ride that has included a 5.5% drop last week and a five-year return still in the red at -20.6%.

Amid this movement, the question lingers: is DraftKings actually undervalued, or are these swings just part of the game? By ticking the boxes for three out of six valuation checks (for a value score of 3), DraftKings is not a clear slam dunk, but it does show some intriguing potential for those who dig deeper than surface-level momentum. Up next, I will break down how these different valuation methods stack up, and tease out a smarter framework for understanding what those numbers really mean for investors like us.

Why DraftKings is lagging behind its peersApproach 1: DraftKings Discounted Cash Flow (DCF) Analysis

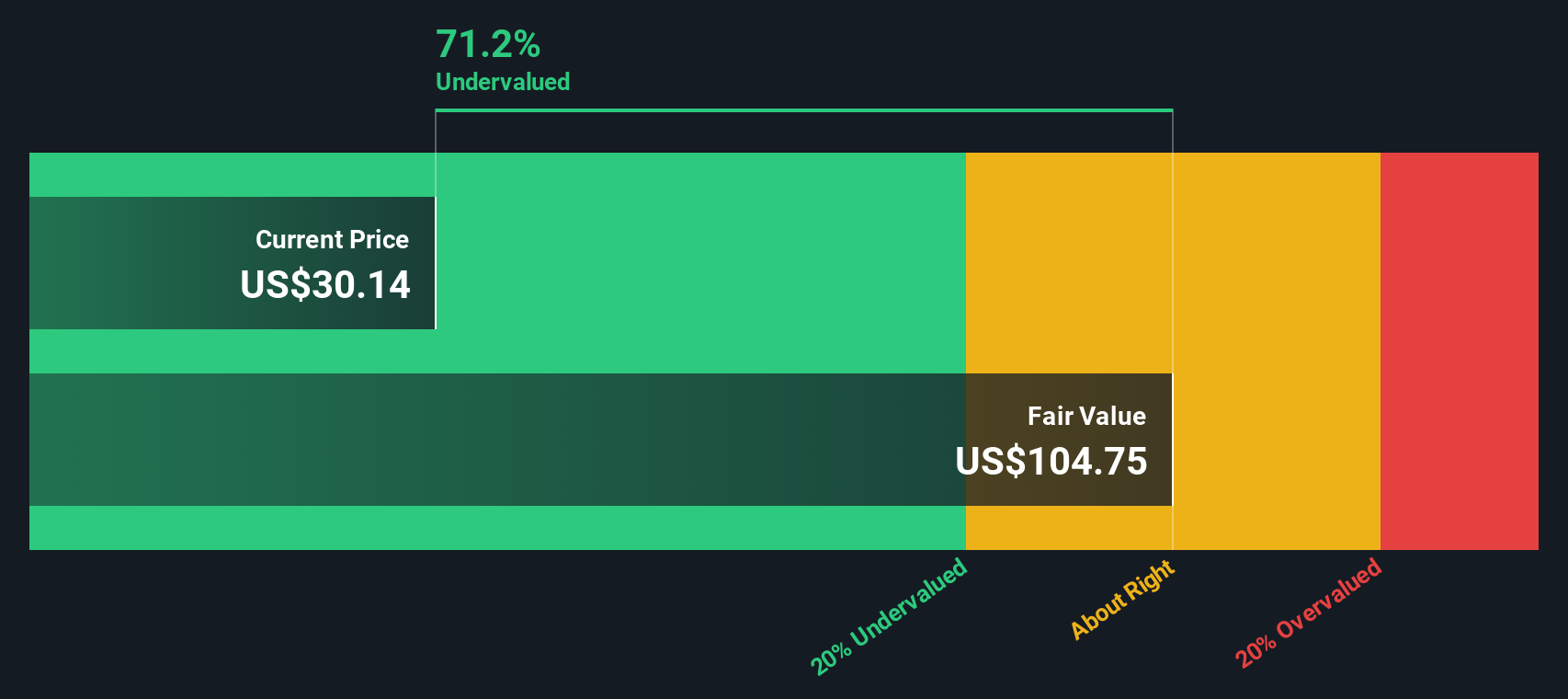

The Discounted Cash Flow (DCF) model estimates what a company is worth based on its future cash flow projections, discounting them back to today's value to reflect the time value of money. For DraftKings, this model starts with the most recent Free Cash Flow, which stands at $360.37 Million. Analysts provide specific cash flow estimates for the next five years, with projections extending further into the future based on trend extrapolation.

Based on these inputs, DraftKings' Free Cash Flow is expected to surpass $2.6 Billion by 2029, according to analyst forecasts and Simply Wall St’s growth extrapolations. All calculations are done in US dollars to ensure consistency when comparing the company’s financial outlook to its share price.

Plugging these numbers into the DCF framework yields an estimated intrinsic value of $110.38 per share. Compared to the current market price, this figure suggests DraftKings is trading at a 60.2% discount, indicating the potential for significant upside if these projections are realized.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for DraftKings.

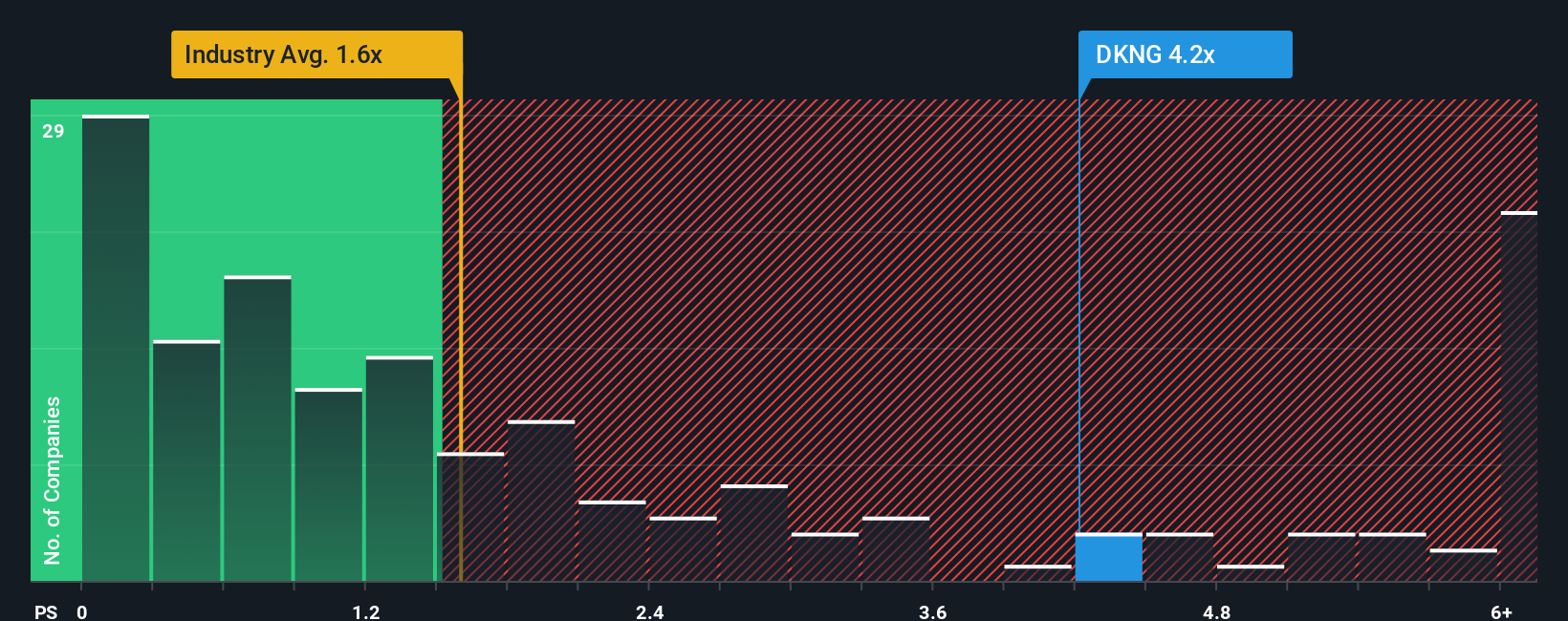

Approach 2: DraftKings Price vs Sales

The Price-to-Sales (P/S) ratio is often used as a preferred valuation metric, especially for fast-growing companies like DraftKings that are not yet sustainably profitable. Since traditional earnings-based ratios may not capture the potential of a business still scaling up, the P/S ratio allows investors to compare how much they are paying for each dollar of revenue. This can be a fairer approach in such cases.

Growth expectations and perceived risk both influence what represents a "normal" or "fair" P/S ratio. Companies with higher revenue growth and lower risks tend to command higher P/S ratios, reflecting investor optimism for future sales expansion and the potential for profit down the line.

Currently, DraftKings trades at a P/S ratio of 4.04x. This is above the industry average of 1.61x and also surpasses the peer group’s average of 3.69x. However, proprietary analysis from Simply Wall St derives a Fair Ratio of 3.98x for DraftKings, factoring in growth expectations, margins, industry context, company size, and risk profile.

Unlike typical comparisons to industry or peer averages, the Fair Ratio captures a more nuanced view by considering DraftKings’ unique blend of risk, profitability trajectory, scale, and competitive advantages. This provides a rating tailored to the company’s particular situation, rather than a simplistic "one-size-fits-all" benchmark.

With DraftKings’ current P/S ratio just slightly above its Fair Ratio, the stock appears to be fairly valued against these sophisticated expectations.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your DraftKings Narrative

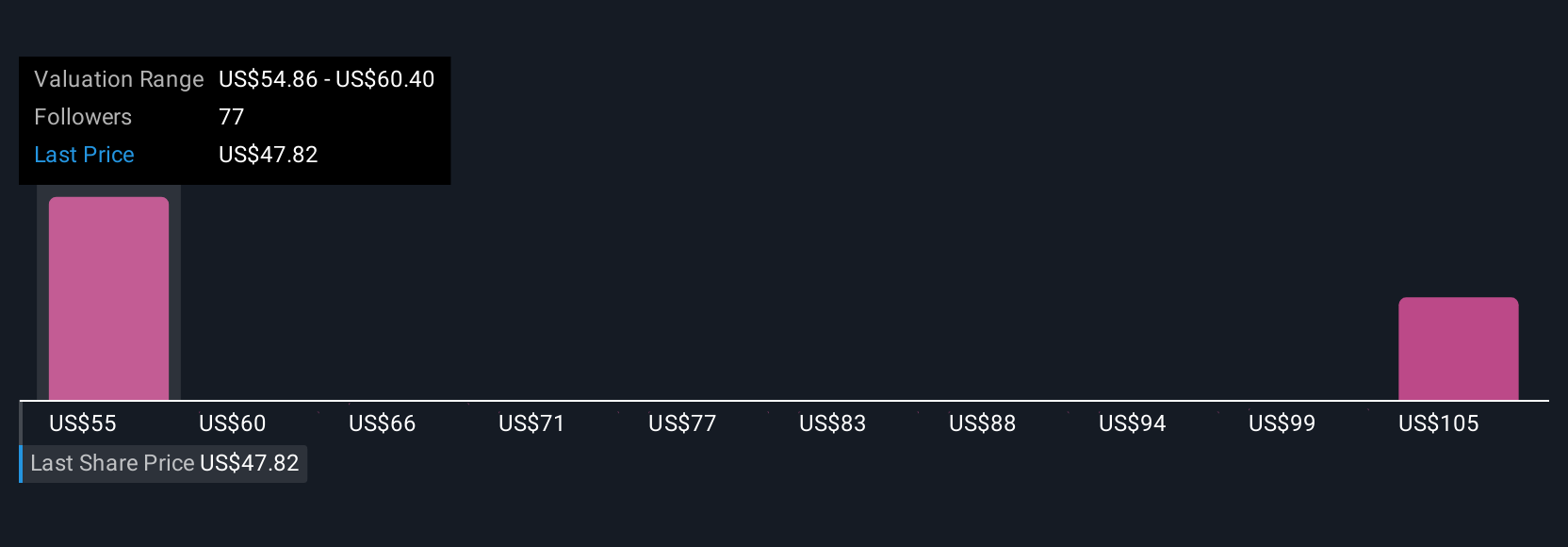

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is essentially your unique story about a company, connecting your perspective and expectations, such as what you think fair value is and how you see revenue, earnings, and margin evolving, to an actionable investment framework.

This approach moves beyond just numbers by tying DraftKings' business developments and future outlook to a forecast, which then leads to a personal fair value estimate. Narratives are designed to be easy and accessible, available directly within the Simply Wall St Community page, where millions of investors share and compare their perspectives.

By using Narratives, investors can make more informed buy or sell decisions by comparing their fair value estimate to the current share price and seeing how quickly their story adjusts as new information, like earnings or breaking news, comes to light.

For example, one investor might believe DraftKings’ rapid state expansion justifies a bullish Narrative, setting a fair value target at the high end of analyst expectations, while another more cautious investor might focus on regulatory risks and choose a far lower target. Both approaches coexist transparently, making it simple to see how your own story stacks up.

Do you think there's more to the story for DraftKings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DKNG

DraftKings

Operates as a digital sports entertainment and gaming company in the United States and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives