- United States

- /

- Hospitality

- /

- NasdaqGS:CHA

Chagee Holdings And 2 Other Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market experiences slight gains following a pause in its recent upward streak, investors are closely watching the tech and crypto sectors for signs of recovery amid fluctuating sentiment. In this environment, identifying undervalued stocks can be particularly appealing for those looking to capitalize on potential market inefficiencies, with Chagee Holdings and two other companies potentially offering such opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.20 | $17.95 | 48.8% |

| Warrior Met Coal (HCC) | $77.48 | $154.17 | 49.7% |

| Super Group (SGHC) (SGHC) | $10.94 | $21.64 | 49.4% |

| Sotera Health (SHC) | $17.35 | $33.65 | 48.4% |

| Nicolet Bankshares (NIC) | $126.48 | $242.17 | 47.8% |

| MoneyHero (MNY) | $1.25 | $2.42 | 48.4% |

| Flutter Entertainment (FLUT) | $204.12 | $391.77 | 47.9% |

| First Busey (BUSE) | $23.52 | $45.34 | 48.1% |

| DexCom (DXCM) | $63.52 | $126.54 | 49.8% |

| BioLife Solutions (BLFS) | $25.41 | $49.69 | 48.9% |

Let's dive into some prime choices out of the screener.

Chagee Holdings (CHA)

Overview: Chagee Holdings Limited, with a market cap of $2.95 billion, operates and franchises teahouses under the CHAGEE brand in China and internationally through its subsidiaries.

Operations: Chagee Holdings Limited generates revenue primarily from its restaurants segment, which accounted for CN¥13.27 billion.

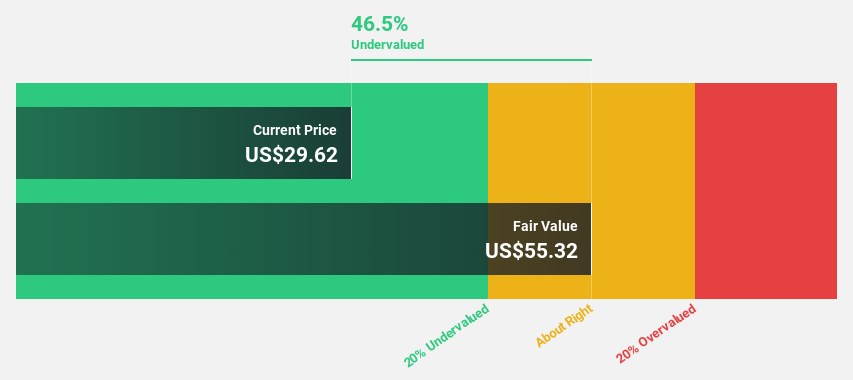

Estimated Discount To Fair Value: 46.7%

Chagee Holdings is trading at $15.9, significantly below its estimated fair value of $29.82, suggesting undervaluation based on cash flows. Despite a decline in net income from CNY 640.98 million to CNY 394.21 million year-over-year for Q3 2025, earnings are forecast to grow substantially at 45.1% annually, outpacing the US market's growth rate of 16.1%. Additionally, a special dividend of USD 0.92 per share was announced recently.

- Upon reviewing our latest growth report, Chagee Holdings' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Chagee Holdings.

American Healthcare REIT (AHR)

Overview: American Healthcare REIT, Inc., a self-managed REIT based in Maryland, owns and operates a diversified portfolio of clinical healthcare real estate across the U.S., U.K., and the Isle of Man, with a market cap of $9.15 billion.

Operations: The company's revenue segments include Integrated Senior Health Campuses ($1.72 billion), Shop ($307.15 million), OM ($128.91 million), and Triple-net Leased Properties ($42.53 million).

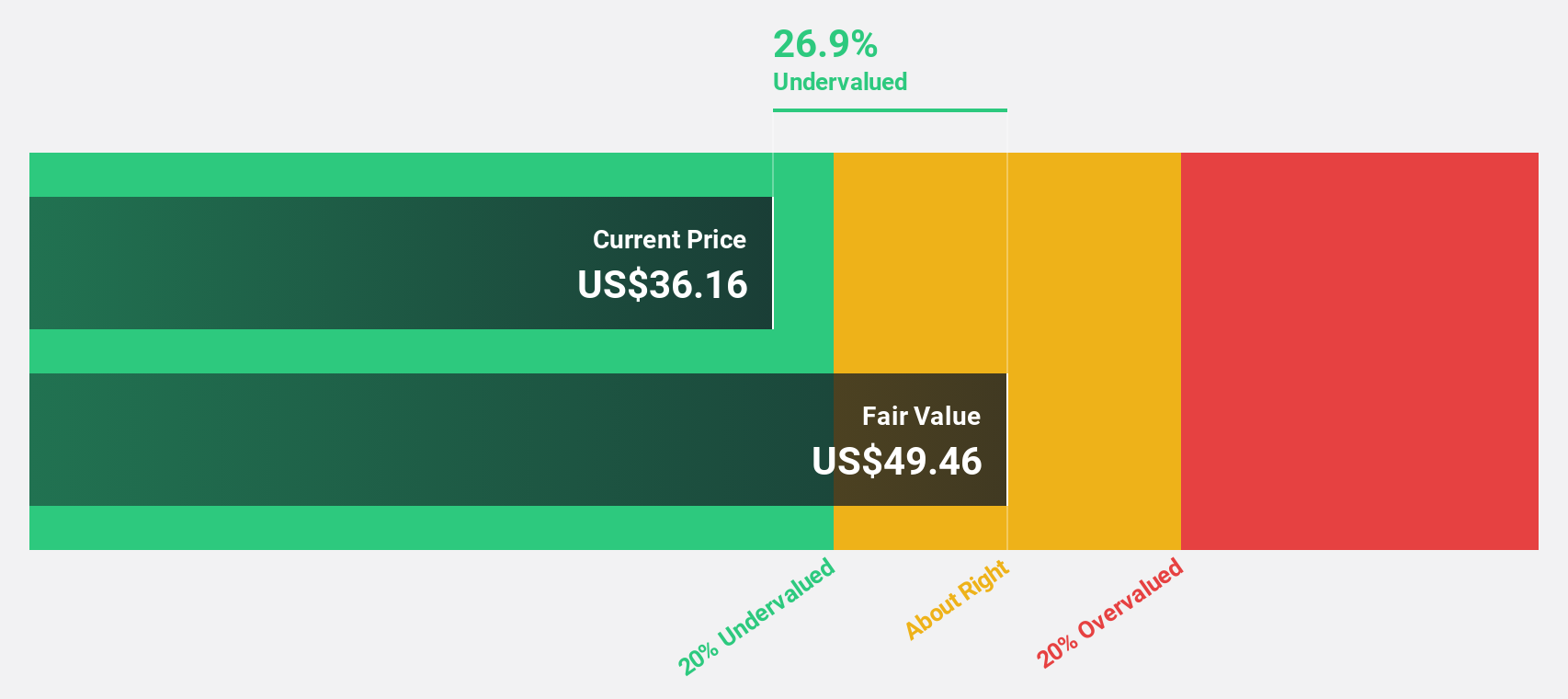

Estimated Discount To Fair Value: 33.7%

American Healthcare REIT is trading at $50.43, well below its estimated fair value of $76.02, indicating significant undervaluation based on cash flows. The company recently raised its financial guidance for 2025, projecting net income between $78 million and $83 million, a substantial increase from previous estimates. Despite shareholder dilution over the past year and interest payments not being fully covered by earnings, revenue is expected to grow faster than the US market average.

- In light of our recent growth report, it seems possible that American Healthcare REIT's financial performance will exceed current levels.

- Take a closer look at American Healthcare REIT's balance sheet health here in our report.

e.l.f. Beauty (ELF)

Overview: e.l.f. Beauty, Inc. is a global beauty company that offers cosmetics and skin care products with a market cap of approximately $4.57 billion.

Operations: The company generates its revenue from personal products, totaling $1.39 billion.

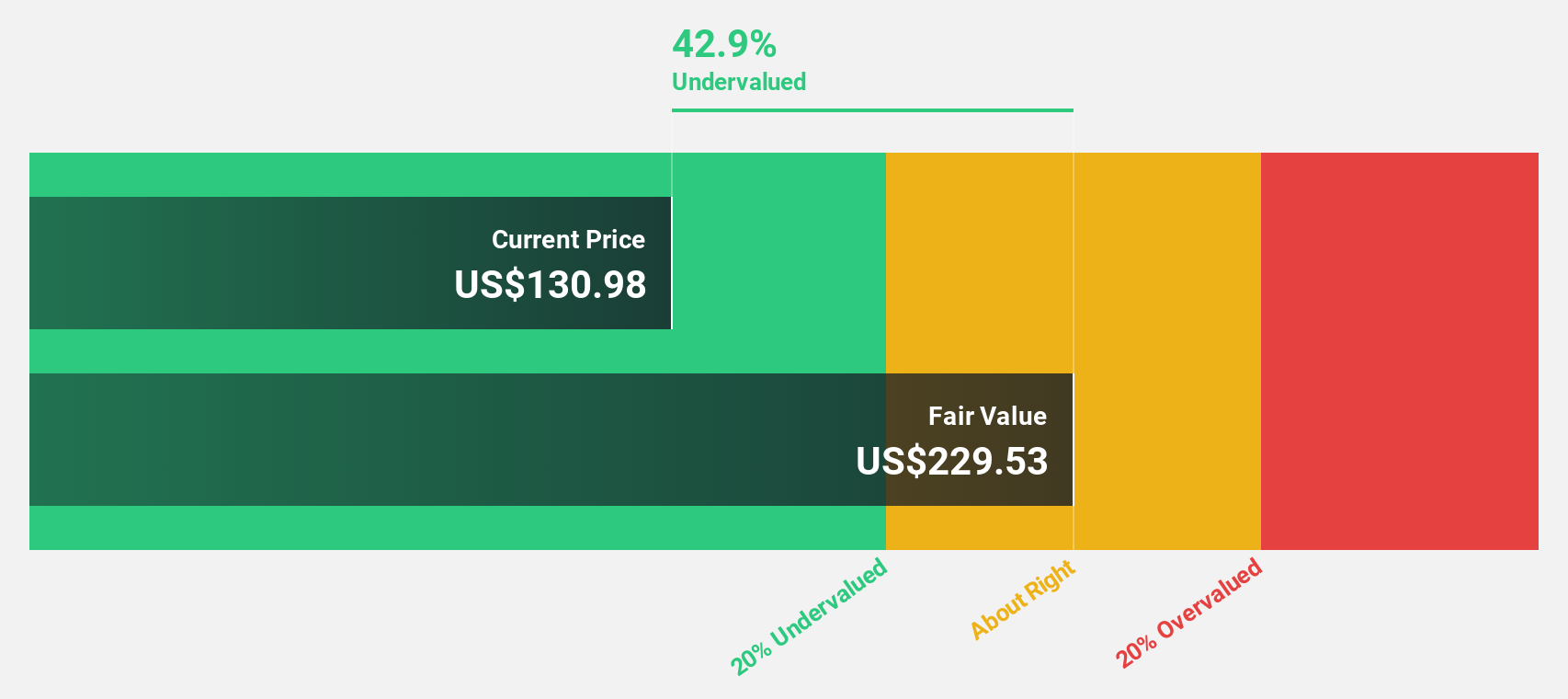

Estimated Discount To Fair Value: 36.8%

e.l.f. Beauty is trading at US$76.66, significantly below its estimated fair value of US$121.34, suggesting undervaluation based on cash flows. Despite a volatile share price and lower profit margins compared to last year, the company's earnings are projected to grow significantly faster than the US market average over the next three years. Recent expansion into Mexico with ULTA Beauty could bolster future revenue streams, aligning with its forecasted revenue growth above market expectations.

- Insights from our recent growth report point to a promising forecast for e.l.f. Beauty's business outlook.

- Dive into the specifics of e.l.f. Beauty here with our thorough financial health report.

Key Takeaways

- Navigate through the entire inventory of 212 Undervalued US Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHA

Chagee Holdings

Through its subsidiaries, owns, operates, and franchises teahouses under the CHAGEE brand name in the People’s Republic of China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026