- United States

- /

- Hospitality

- /

- NasdaqGS:CAKE

Cheesecake Factory (CAKE): Examining Valuation After Strong Q3 Earnings Growth and Dividend Reaffirmation

Reviewed by Simply Wall St

Cheesecake Factory (CAKE) turned heads after releasing third quarter results, revealing higher sales and net income compared to last year. Investors are digging into the details to gauge if this momentum can continue.

See our latest analysis for Cheesecake Factory.

Cheesecake Factory’s third quarter didn’t just deliver stronger sales and net income; it also arrived alongside a fresh dividend affirmation and steady buyback activity. While the share price has slipped 18% over the last three months, investors who stuck it out for the past year saw a 29% total shareholder return. That kind of long-term momentum suggests the market is valuing both improved profitability and ongoing shareholder rewards.

If you’re interested in spotting other companies with accelerating growth and strong ownership incentives, this could be the perfect moment to discover fast growing stocks with high insider ownership

With shares trading below analysts’ price targets while having experienced a strong run-up over the past year, the key question now is whether the stock remains undervalued or if the market has already accounted for future growth.

Most Popular Narrative: 26.4% Undervalued

According to Zwfis, the narrative puts Cheesecake Factory’s fair value nearly $20 above where shares last closed, drawing attention from bargain hunters and growth optimists alike. The substantial gap brings focus to the company’s expansion strategy and potential for multi-brand, multi-decade returns.

This is one thing that I absolutely love about CAKE. Not only do they already have a large restaurant that is bringing in revenue for them, but they also have new concepts that are starting to spread nationally and are continually working to create even more for future growth. Especially from FRC, that is what one of the biggest benefits from that acquisition is, the fact that it is able to continue to test out new concepts and find something that sticks and then push it out nationally.

Want to know the bold math behind that high fair value? The secret sauce includes expansion plans, segment-by-segment sales projections, and margin targets most investors overlook. Which numbers are steering this narrative to its bullish conclusion? Click through and uncover the model’s most pivotal assumptions before you make your next move.

Result: Fair Value of $73.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower-than-expected consumer spending or challenges with new concept rollouts could limit the growth story that is driving today’s bullish outlook.

Find out about the key risks to this Cheesecake Factory narrative.

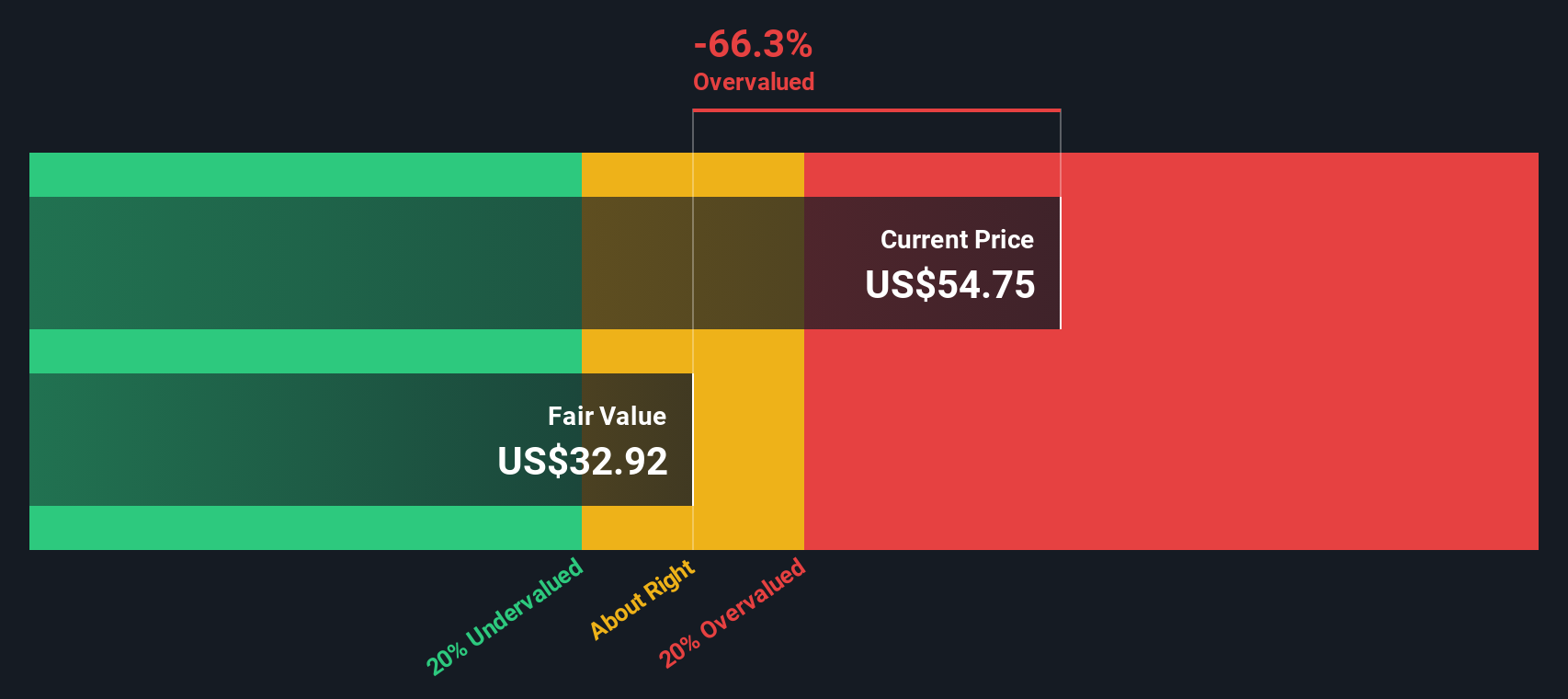

Another View: SWS DCF Model Puts a Lower Value on CAKE

Taking a step back from fair value estimates based on future earnings or multiples, the SWS DCF model tells a more conservative story. Our DCF approach places Cheesecake Factory’s value at $33.24 per share, which is well below its current price. Why is there such a big difference between methods? Could the market be pricing in more optimism than fundamentals justify?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cheesecake Factory for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cheesecake Factory Narrative

If you have your own take on CAKE’s outlook or want to dig into the numbers directly, you can build a personalized narrative in just a few minutes, so why not Do it your way

A great starting point for your Cheesecake Factory research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always scan the horizon for the next standout opportunity. Use these targeted lists to spot trends, get ahead, and avoid missing out on tomorrow’s winners.

- Tap into companies at the forefront of healthcare innovation by checking out these 34 healthcare AI stocks delivering breakthroughs in medical technology and artificial intelligence.

- Unlock high-yield potential by seeing which top businesses are offering strong returns through these 21 dividend stocks with yields > 3% with reliable payouts above 3%.

- Pounce on early-stage opportunities poised for explosive growth with these 3578 penny stocks with strong financials showing robust financials and future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CAKE

Cheesecake Factory

Operates and licenses restaurants in the United States and Canada.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives