- United States

- /

- Banks

- /

- NasdaqGS:CCB

Top Growth Stocks With Strong Insider Backing December 2025

Reviewed by Simply Wall St

As December begins, U.S. stock indexes have slipped amid a risk-off sentiment, with notable declines in big tech and cryptocurrency-tied shares. In this environment of cautious investor behavior, growth companies with high insider ownership can offer a reassuring signal of confidence and alignment between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 14.0% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 29.2% | 114.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| FTC Solar (FTCI) | 22.6% | 78.8% |

| Credo Technology Group Holding (CRDO) | 10.9% | 30.4% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.9% | 29.1% |

| AppLovin (APP) | 27.5% | 26.5% |

Let's review some notable picks from our screened stocks.

Atour Lifestyle Holdings (ATAT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Atour Lifestyle Holdings Limited, with a market cap of $5.28 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People’s Republic of China.

Operations: Atour Lifestyle Holdings generates revenue primarily through its Atour Group segment, which reported CN¥9.09 billion.

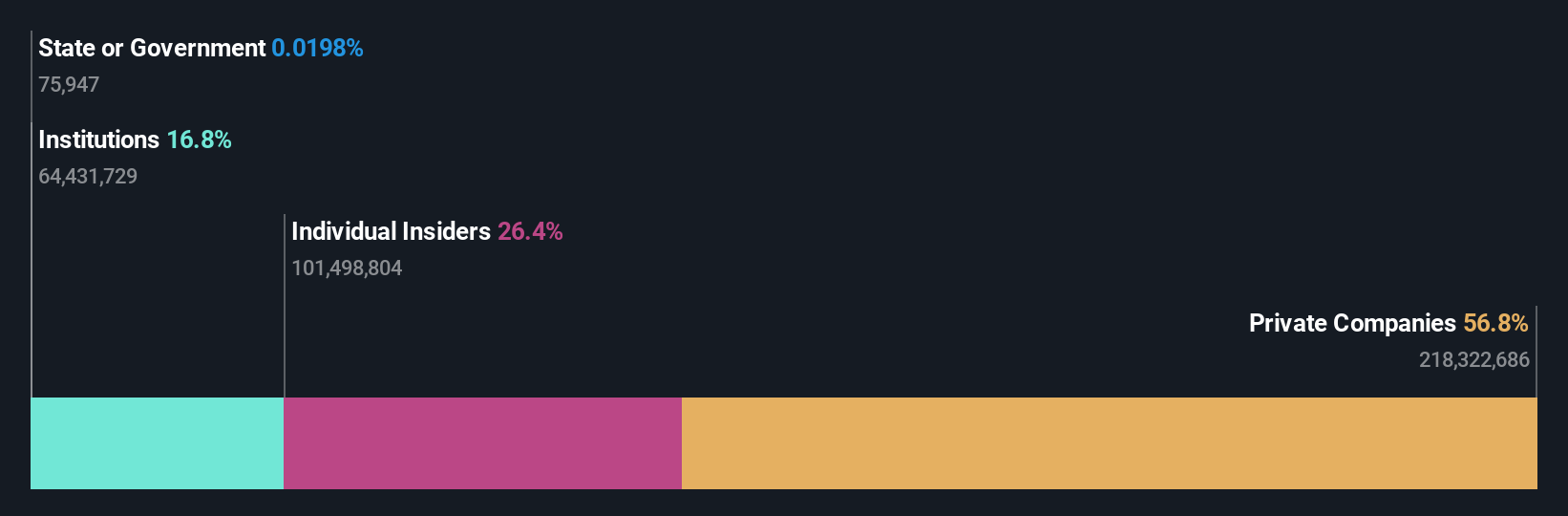

Insider Ownership: 18%

Atour Lifestyle Holdings exhibits strong growth potential with expected annual earnings growth of 24.4% and revenue growth forecasted at 20.7%, both outpacing the US market averages. The company recently announced a substantial dividend payout totaling approximately US$108 million for 2025, reflecting robust financial health. Despite trading below its estimated fair value by 37.4%, insider ownership remains significant, although no recent insider trading activity has been reported in the past three months.

- Unlock comprehensive insights into our analysis of Atour Lifestyle Holdings stock in this growth report.

- Our expertly prepared valuation report Atour Lifestyle Holdings implies its share price may be lower than expected.

Coastal Financial (CCB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation, with a market cap of $1.68 billion, operates as the bank holding company for Coastal Community Bank, offering a range of banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Operations: The company's revenue is primarily derived from its CCBX segment, contributing $241.19 million, followed by the Community Bank segment at $85.52 million, and Treasury & Administration at $16.96 million.

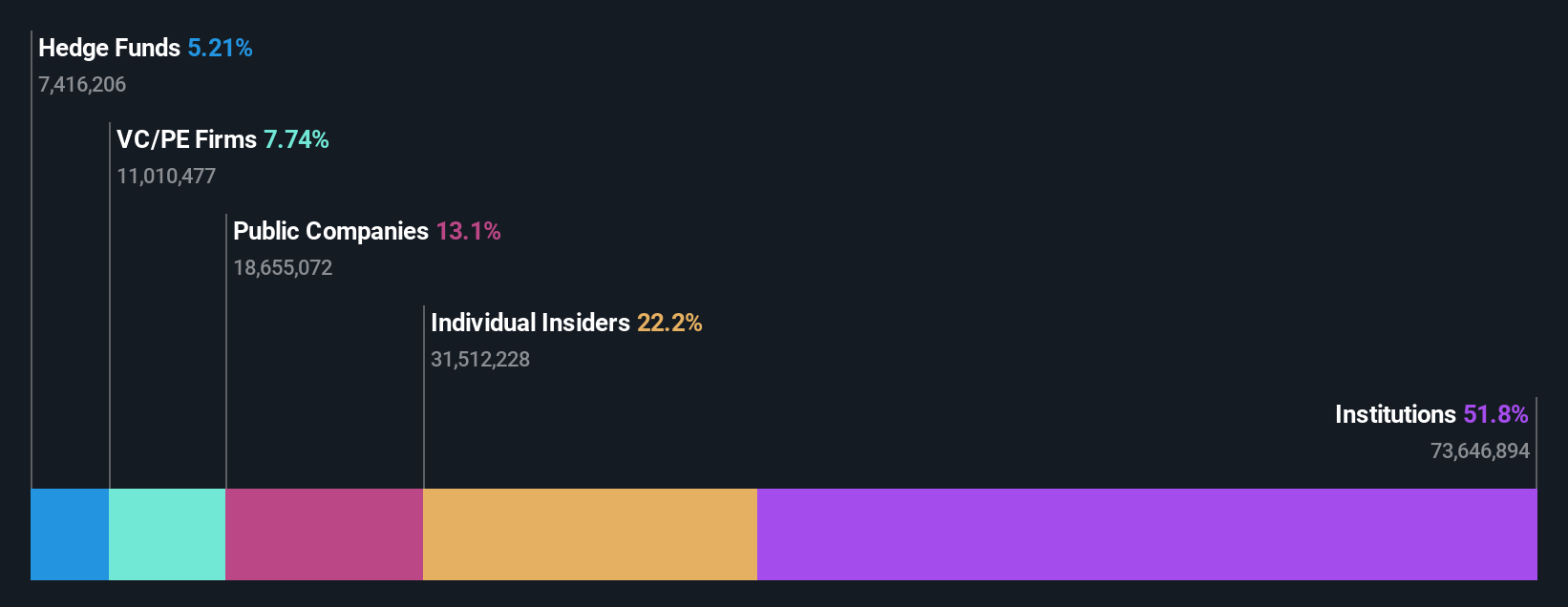

Insider Ownership: 13.9%

Coastal Financial demonstrates significant growth potential, with earnings expected to grow 45.4% annually and revenue projected to increase by 31.4%, both surpassing US market averages. Despite recent executive changes, including Brandon Soto's appointment as CFO, the company maintains strong insider ownership with more shares bought than sold in the past quarter. The stock trades at 17.7% below its estimated fair value, indicating potential undervaluation amidst robust financial performance and strategic leadership transitions.

- Delve into the full analysis future growth report here for a deeper understanding of Coastal Financial.

- The analysis detailed in our Coastal Financial valuation report hints at an inflated share price compared to its estimated value.

Playtika Holding (PLTK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtika Holding Corp., along with its subsidiaries, develops mobile games for a global audience and has a market cap of approximately $1.52 billion.

Operations: The company's revenue is primarily derived from its Computer Graphics segment, which generated $2.73 billion.

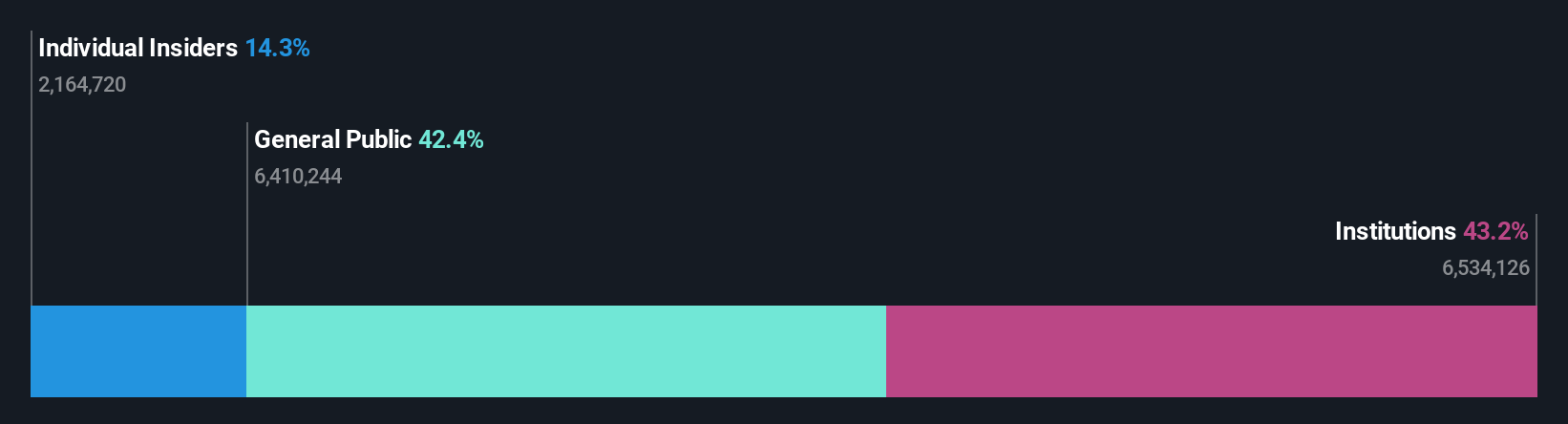

Insider Ownership: 26.6%

Playtika Holding's earnings are forecast to grow significantly at 34% annually, outpacing the US market. Despite lower profit margins and a dividend not well covered by earnings, the company trades at 62.8% below its estimated fair value. Recent announcements include a cash dividend of $0.10 per share and reaffirmed revenue guidance between US$2.70 billion and US$2.75 billion for 2025, highlighting strategic capital allocation through dividends, buybacks, and potential M&A activities.

- Click here and access our complete growth analysis report to understand the dynamics of Playtika Holding.

- Our valuation report here indicates Playtika Holding may be undervalued.

Key Takeaways

- Click here to access our complete index of 197 Fast Growing US Companies With High Insider Ownership.

- Ready For A Different Approach? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCB

Coastal Financial

Operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026