- United States

- /

- Hospitality

- /

- NasdaqGS:ATAT

Atour Lifestyle (ATAT) Is Up 11.8% After Q3 Beat And Dividend Hike Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Atour Lifestyle Holdings Limited recently reported third-quarter 2025 results showing higher revenue and net income year over year, and its board declared a US$0.12 per ordinary share (US$0.36 per ADS) cash dividend, with an ex-dividend date that passed on November 25, 2025.

- Combined with guidance for full-year 2025 net revenue to rise 35% versus 2024 and total cash dividends of about US$108 million, these updates highlight how Atour is using earnings strength to return capital while signaling confidence in its growth trajectory.

- Now we’ll explore how this earnings beat and higher 2025 revenue guidance may reshape Atour’s existing investment narrative for investors.

Find companies with promising cash flow potential yet trading below their fair value.

Atour Lifestyle Holdings Investment Narrative Recap

To own Atour Lifestyle Holdings, you need to believe its China-focused, asset-light hotel and lifestyle model can keep scaling profitably despite competition and macro uncertainty. The latest earnings beat and higher 2025 revenue guidance support the near-term growth catalyst but do not remove key risks around China concentration and potential pressure on margins and tax rates.

The most relevant update is Atour’s guidance for 2025 net revenue to increase 35% versus 2024, up from earlier guidance ranges. That guidance, paired with higher Q3 revenue and net income year over year, puts the pace and quality of network growth and franchising under the spotlight, especially given concerns that rapid expansion via franchisees could eventually dilute service quality and brand strength.

Yet beneath the higher revenue guidance, investors should be aware that franchise-driven expansion still leaves Atour exposed to...

Read the full narrative on Atour Lifestyle Holdings (it's free!)

Atour Lifestyle Holdings' narrative projects CN¥15.4 billion revenue and CN¥2.8 billion earnings by 2028. This requires 22.5% yearly revenue growth and roughly a CN¥1.4 billion earnings increase from about CN¥1.4 billion today.

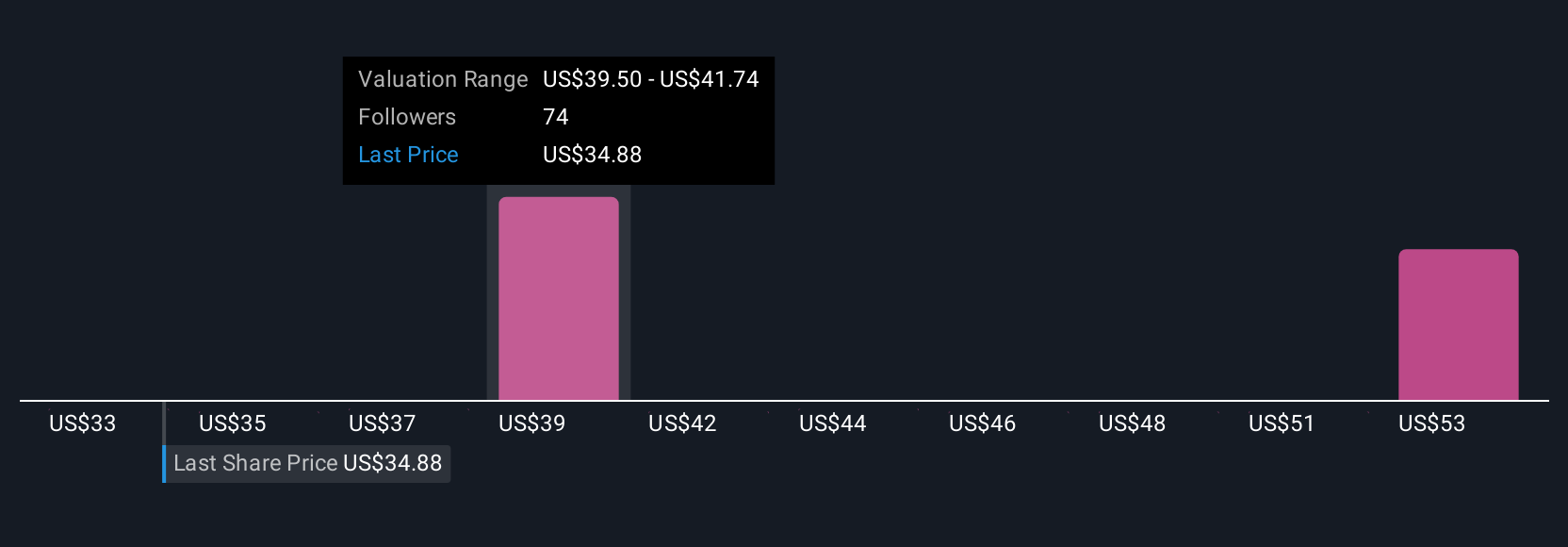

Uncover how Atour Lifestyle Holdings' forecasts yield a $46.57 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Ten members of the Simply Wall St Community estimate Atour’s fair value between US$32.78 and US$60.99, reflecting wide differences in expectations. As you weigh these views, remember that rapid, asset light expansion can support growth but may also test franchisee quality and the resilience of Atour’s brand over time.

Explore 10 other fair value estimates on Atour Lifestyle Holdings - why the stock might be worth 24% less than the current price!

Build Your Own Atour Lifestyle Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atour Lifestyle Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Atour Lifestyle Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atour Lifestyle Holdings' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATAT

Atour Lifestyle Holdings

Through its subsidiaries, develops lifestyle brands around hotel offerings in the People’s Republic of China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026