- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

What Airbnb (ABNB)'s CTO Departure and AI Push Mean for Shareholders

Reviewed by Sasha Jovanovic

- On November 18, 2025, Aristotle Balogh notified Airbnb that he will depart as Chief Technology Officer in December and will provide advisory services through at least February 2026.

- This leadership change comes as Airbnb reported record Q3 adjusted EBITDA, growth in bookings, and deeper AI integration to enhance personalization and user experience on its platform.

- Next, we will explore how Airbnb's focus on AI-driven improvements impacts the company's long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Airbnb Investment Narrative Recap

To be a shareholder in Airbnb, you need to believe in the company’s ability to leverage global travel trends, drive growth through innovative technology, and expand its unique platform worldwide. The recent CTO transition is not expected to materially affect Airbnb’s biggest short-term catalyst, AI integration for better guest and host experiences. However, regulatory oversight and potential slowdowns in key markets remain the primary risks for the business at this time.

Of the recent announcements, Airbnb’s partnership with Apartment List to offer an “Airbnb-friendly” filter stands out. This responds directly to younger renter demand and addresses a core growth catalyst: increasing urban supply and staying relevant among a younger, more flexible demographic. These moves may drive incremental listings and bookings, reinforcing the near-term importance of maintaining momentum in global inventory growth.

Yet, for investors, it’s important to note: in contrast, tightening local regulations on short-term rentals may still present significant headwinds that you should be aware of…

Read the full narrative on Airbnb (it's free!)

Airbnb's outlook anticipates $15.4 billion in revenue and $3.7 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 10.0% and represents a $1.1 billion increase in earnings from the current $2.6 billion.

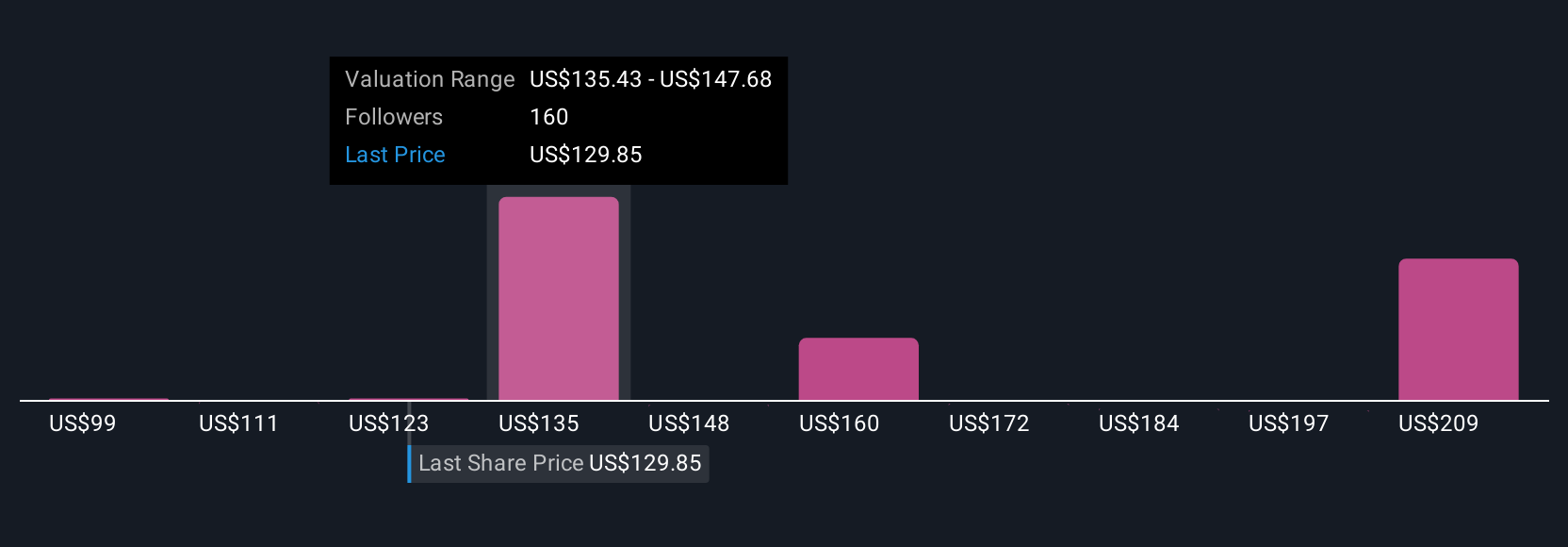

Uncover how Airbnb's forecasts yield a $138.12 fair value, a 18% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts saw Airbnb’s earnings potentially reaching US$4.3 billion and annual revenue at US$16.5 billion within a few years. These forecasts are markedly more bullish, especially in light of new executive changes and technology investments, reminding you that opinions about Airbnb’s future can differ widely, and so can the numbers you rely on.

Explore 23 other fair value estimates on Airbnb - why the stock might be worth 6% less than the current price!

Build Your Own Airbnb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbnb research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Airbnb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbnb's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026