- United States

- /

- Hospitality

- /

- NasdaqGS:ABNB

Is Airbnb a Bargain After Regulatory Shake-Up and Shares Falling 11% in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Airbnb is a bargain or overpriced? You're not alone. We'll walk you through what really matters for its valuation.

- Airbnb's stock has bounced up 2.2% over the last week, but is still down 7.7% for the month and 11.2% year-to-date. This reflects shifting investor sentiment and evolving risks.

- Recent news has highlighted shifts in travel demand and emerging competition, both of which are stirring up conversations among analysts and investors. At the same time, regulatory changes in major cities continue to challenge the company's operating landscape.

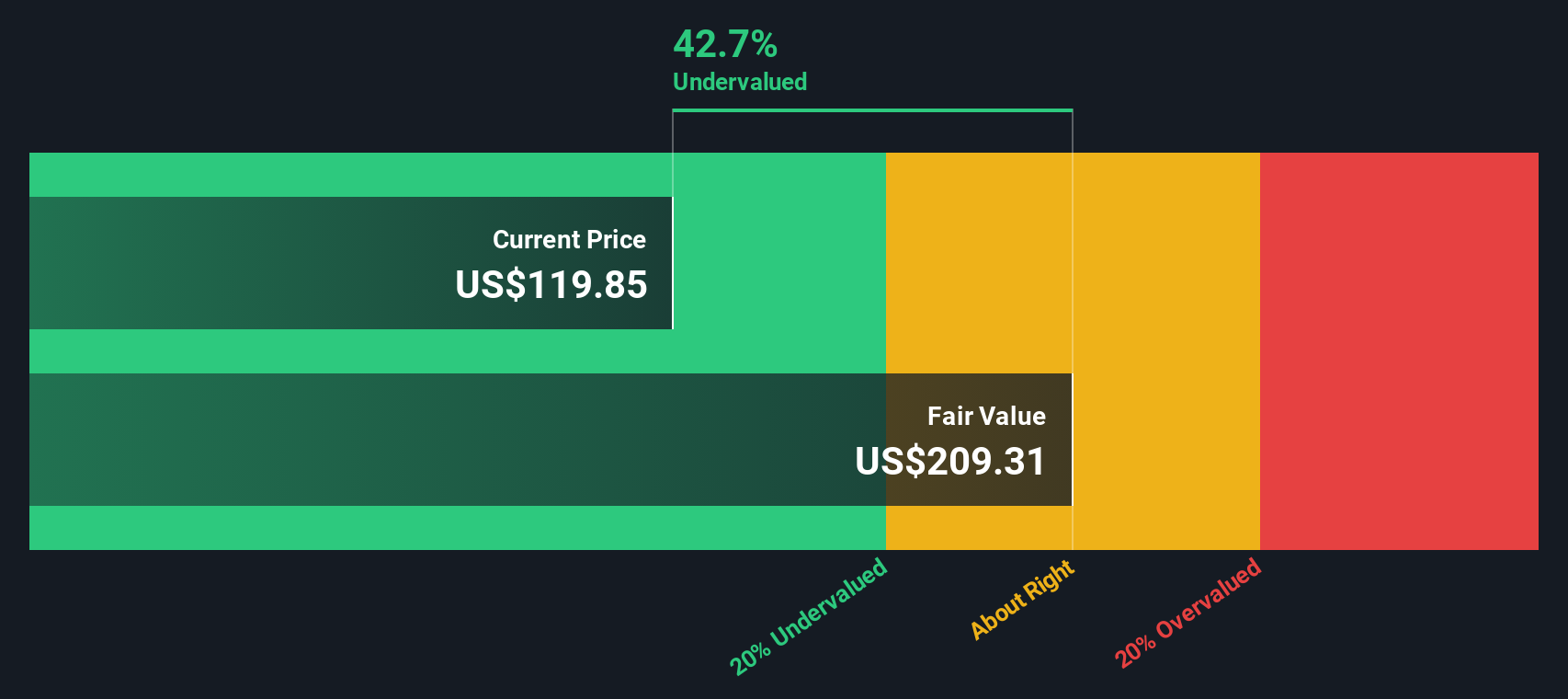

- On our valuation scorecard, Airbnb scores 4 out of 6 for being undervalued. This makes it a strong contender for value-seeking investors. Next, let’s dive into how we reach that number and why there might be an even more insightful way to judge Airbnb’s true worth by the end of this article.

Find out why Airbnb's -14.2% return over the last year is lagging behind its peers.

Approach 1: Airbnb Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company's shares should be worth by projecting future cash flows and then discounting them back to their value today. This method helps investors judge whether a stock's current price fairly reflects its long-term earning potential.

For Airbnb, the DCF model starts with its latest reported Free Cash Flow of $4.6 Billion. Analysts provide forward-looking estimates for several years, forecasting growth in cash flows over time. By 2029, Airbnb's Free Cash Flow is projected to reach approximately $7.2 Billion, with future years extrapolated based on industry and company growth trends.

Using these projections, the DCF analysis calculates an intrinsic value of $236.03 per share. Compared to the current price, the model suggests Airbnb may be trading at a significant 50.5% discount. This indicates the stock could be undervalued based on its expected long-term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Airbnb is undervalued by 50.5%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: Airbnb Price vs Earnings

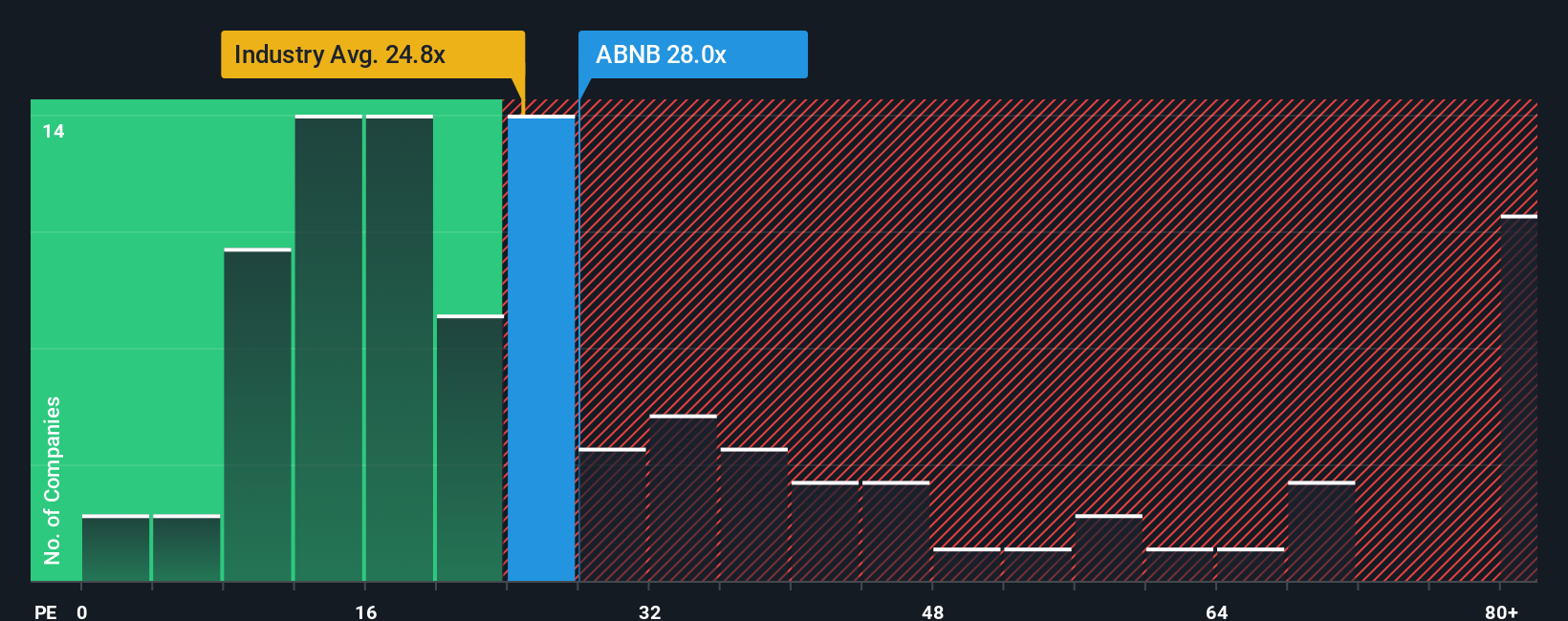

When evaluating a profitable company like Airbnb, the Price-to-Earnings (PE) ratio is especially useful. This metric divides the share price by earnings per share, giving investors a quick snapshot of how much they are paying for a dollar of the company’s profit. It is widely used for companies generating consistent earnings, as it blends both market expectations and real performance into a single figure.

However, what counts as a “normal” or “fair” PE ratio changes depending on growth and risk. A company growing quickly or facing fewer risks typically commands a higher PE, while slower growth or more uncertainty brings it down. For context, Airbnb currently trades at a 26.9x PE ratio. The Hospitality industry average sits at 21.4x, while similar peers average 30.1x. This places Airbnb firmly between broader industry sentiment and the price investors are willing to pay for its closest competitors.

Simply Wall St calculates a “Fair Ratio” for each company, which for Airbnb is 29.6x. Unlike a plain comparison against peers or industries, this proprietary figure factors in expected earnings growth, risk profile, profit margins, market cap and sector trends. That means it offers a more tailored view of what Airbnb should reasonably trade at, even if market or peer multiples swing.

Given Airbnb’s actual PE is 26.9x and its Fair Ratio is 29.6x, the shares are about right in value, trading only slightly below the figure most consistent with the company’s unique traits and the market environment.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

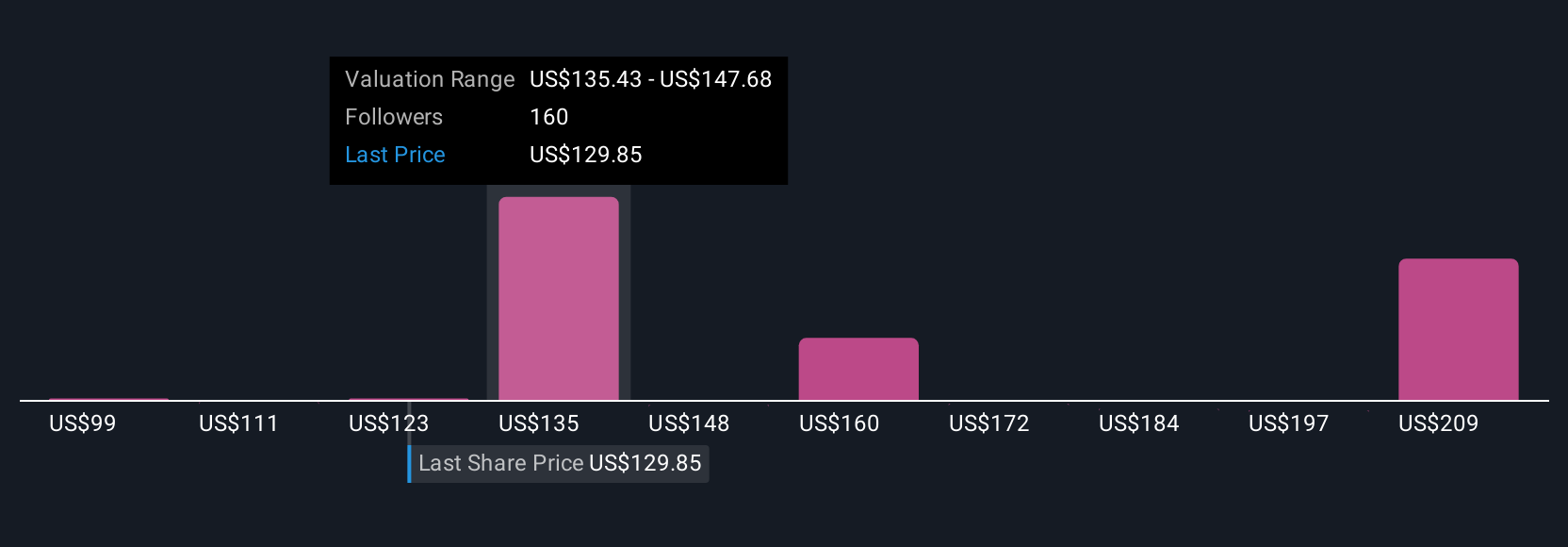

Upgrade Your Decision Making: Choose your Airbnb Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own perspective or “story” about a company. It is how you link what you believe about how Airbnb operates, the market trends you see, and your expectations for its future, all the way through to a financial forecast and an estimate of fair value. Rather than relying just on standard ratios or analyst targets, Narratives connect your insights with concrete numbers, like future revenue, profit margins, and discount rates so you can clearly see what drives your view of the company’s value.

Narratives are available to everyone on Simply Wall St’s Community page, used by millions of investors worldwide, and are designed to be approachable regardless of your background. These tools help you make smarter, more confident decisions about when to buy or sell by automatically comparing your calculated Fair Value to the current market price. Because Narratives update in real time when news or earnings are released, your view stays current.

For example, some investors see Airbnb’s international growth, product improvements, and profitable expansion and estimate a Fair Value near $181. Others focus on regulatory risk or slowing US momentum and might set it closer to $98, all based on their own assumptions and forecasts.

Do you think there's more to the story for Airbnb? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABNB

Airbnb

Operates a platform that enables hosts to offer stays and experiences to guests worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026