- United States

- /

- Food and Staples Retail

- /

- NYSE:UNFI

Has United Natural Foods Stock Rallied Too Far After Recent Q2 Earnings Beat?

Reviewed by Bailey Pemberton

If you are eyeing United Natural Foods right now, you are not alone. The stock has made serious waves lately, and plenty of investors are asking whether this surge means it is time to buy, sell, or just watch. When a company’s shares climb 30.3% in a single week and 42.9% in just a month, people notice. Add to that a jaw-dropping 114.1% gain over the last year and a significant 138.2% increase in five years, and there is good reason United Natural Foods is in the spotlight.

Much of this momentum can be traced back to optimism in the market about the natural foods sector, along with renewed investor interest as the company adapts to changing consumer preferences. While not every movement in price is directly tied to news, the recent uptick in demand for healthier food options and evolving supply chain strategies has certainly influenced how the market perceives United Natural Foods’ risks and potential rewards.

Of course, headlines and recent returns can only tell part of the story. If you are looking for a more grounded take, it is worth noting that United Natural Foods currently scores a 5 out of 6 on our undervaluation checklist. This means it passes almost every test investors use to spot a stock trading for less than its true worth, which is no small feat.

With that in mind, let us dive deeper into the different ways analysts break down valuation and see if the numbers really back up the enthusiasm. There is also a smarter, more holistic approach to valuation that we will tackle at the end of this article.

Approach 1: United Natural Foods Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company should be worth based on expected future cash flows. These cash flows are projected into the future and then discounted back to today’s value. For United Natural Foods, the DCF is built using projected Free Cash Flow (FCF), which helps investors focus on the actual cash the company can generate after covering its operating expenses and investments.

Currently, United Natural Foods produces free cash flows of $163 million a year. Analysts forecast these cash flows could rise steadily, reaching $542 million by 2030. While analysts generally provide estimates for the next five years, projections beyond that are modeled by Simply Wall St based on recent trends and reasonable expectations.

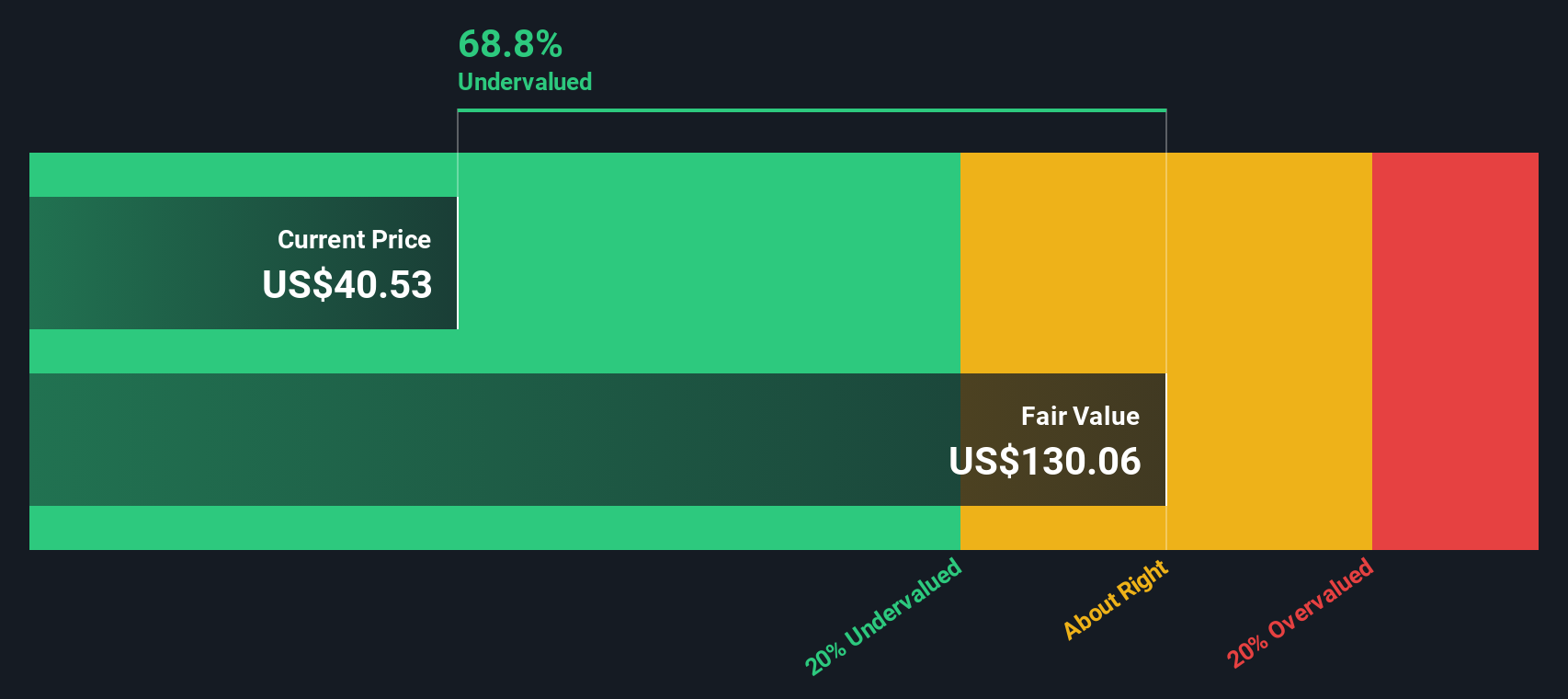

Using these cash flow projections and discounting them appropriately, the DCF model calculates United Natural Foods’ intrinsic value at $130.75 per share. This represents a 68.4% premium over the current market price, suggesting that the stock may be significantly undervalued at today’s levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Natural Foods is undervalued by 68.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: United Natural Foods Price vs Sales (Price-to-Sales)

The Price-to-Sales (P/S) ratio is often favored for valuing companies like United Natural Foods, especially when earnings may be volatile or negative, but revenue growth remains strong and consistent. The P/S ratio allows investors to focus on the company's top-line expansion, which is a critical metric in retail and distribution sectors.

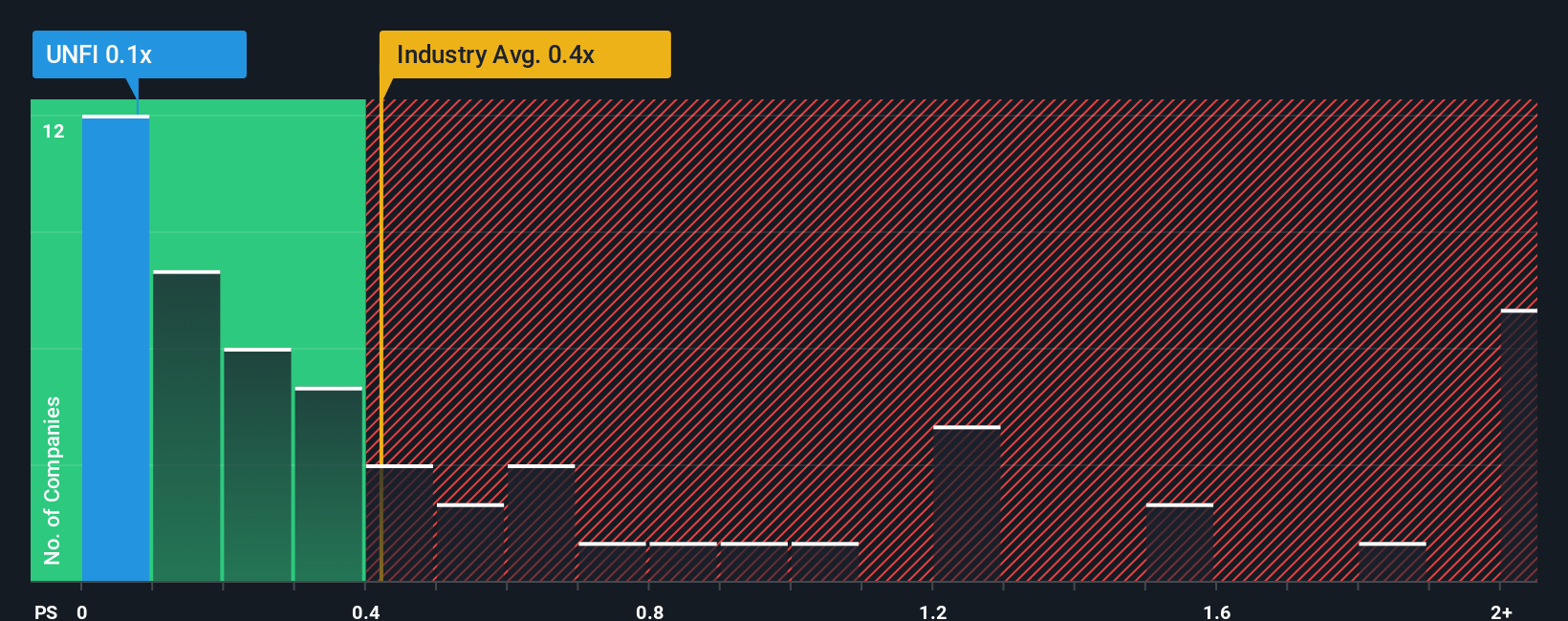

Generally, higher growth expectations or lower risk warrant a higher “normal” or fair P/S ratio. Businesses facing more uncertainty or slower growth tend to have a lower one. United Natural Foods currently trades at a P/S ratio of 0.08x, which is in sharp contrast with the Consumer Retailing industry average of 0.45x and a peer average of 0.35x. This positions United Natural Foods as appearing much cheaper than many of its direct competitors based solely on the revenue it generates.

Instead of just comparing these benchmarks, Simply Wall St uses a proprietary Fair Ratio. For United Natural Foods, this ratio is 0.18x. The Fair Ratio takes into account a suite of important factors, including the company’s expected growth, profit margins, risk profile, market cap and industry conditions, offering a more nuanced and tailored view of what the stock’s valuation should be.

By weighing the Fair Ratio of 0.18x against United Natural Foods’ current P/S ratio of 0.08x, it becomes evident the shares are trading below what would be considered fair value, even after factoring in all key fundamentals and risks.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Natural Foods Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Simply put, a Narrative is your personal story or thesis about United Natural Foods, where you outline what you believe will drive the company’s future by tying together the numbers you expect for revenue, profit margins, and fair value with the reasons behind those expectations.

Narratives take investing beyond raw data, letting you connect the dots between what is happening in the business, your forecasts, and how much you think the stock should be worth. On Simply Wall St, Narratives are easy to build and share right on the Community page. Millions of investors use them to turn research into actionable decisions.

What makes Narratives particularly powerful is their ability to update dynamically whenever new information such as news or earnings updates comes in, meaning your analysis always stays relevant. With Narratives, you can compare current market prices to your fair value instantly, helping you decide whether it is time to buy, sell, or hold.

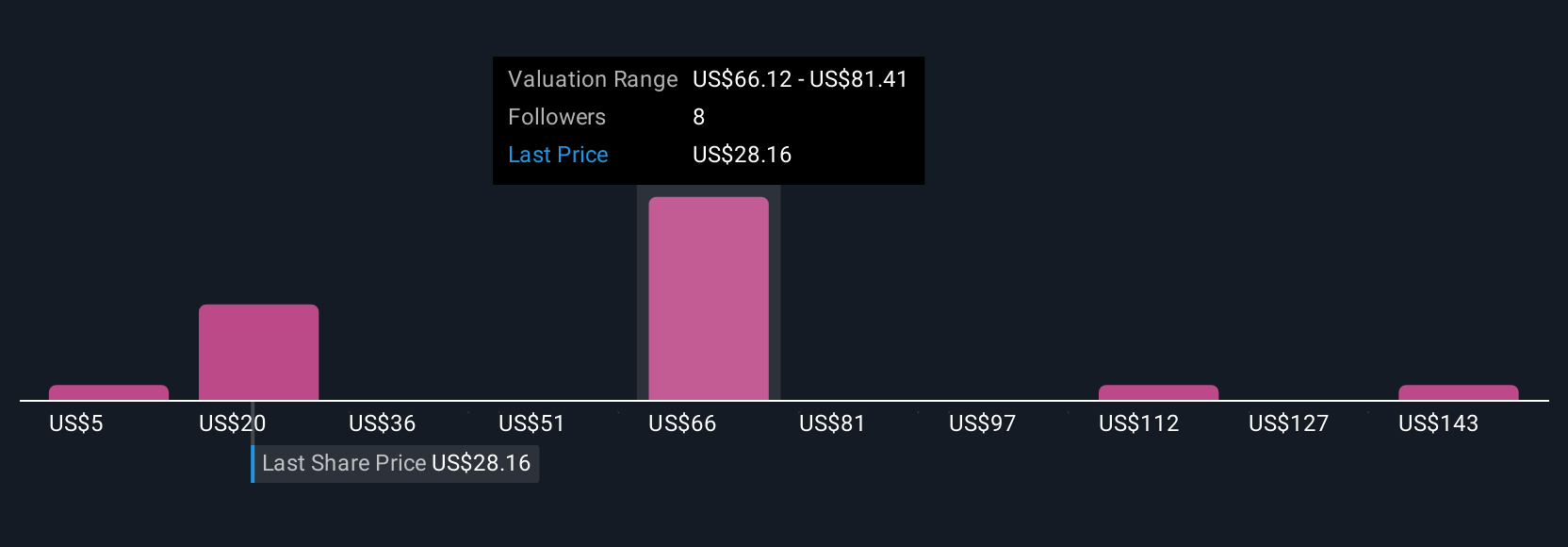

For example, one investor may believe United Natural Foods will outpace industry growth and set a fair value at $36.00 per share, while another might be more cautious, seeing risks and estimating fair value at $24.00. Narratives make it easy to see all perspectives in one place, empowering you to make smarter, more informed decisions.

Do you think there's more to the story for United Natural Foods? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNFI

United Natural Foods

Engages in the distribution of natural, organic, specialty, produce, and conventional grocery and non-food products in the United States and Canada.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives