- United States

- /

- Food and Staples Retail

- /

- NYSE:UNFI

A Closer Look at United Natural Foods (UNFI) Valuation Following Strong Earnings and Upbeat 2026 Guidance

Reviewed by Kshitija Bhandaru

United Natural Foods (UNFI) recently reported earnings that outpaced expectations for the fourth quarter and fiscal year, along with an improved outlook for 2026. This positive momentum has been fueled by upwardly revised analyst forecasts and visible progress on the company’s financial health.

See our latest analysis for United Natural Foods.

Investor optimism around United Natural Foods has been reflected in the share price, which jumped nearly 45% in the past month alone and has increased over 49% year-to-date. With a total shareholder return of almost 100% over the last year and 111% over five years, momentum is clearly building as the company delivers on strategic goals despite ongoing challenges.

If recent momentum in the sector has you looking for what else could be poised for strong gains, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares reaching new highs and analysts revising their estimates upward, the crucial question for investors now is whether United Natural Foods offers genuine value at today’s price or if future growth is already fully reflected in the stock.

Most Popular Narrative: 4% Overvalued

United Natural Foods' widely followed valuation narrative puts its fair value at $39.63, just below the last closing price of $41.20. This setup has investors debating whether the market has already priced in the company’s future potential.

The accelerating consumer demand for organic, natural, and specialty products is translating into robust growth for UNFI's core categories, as reflected by 12% sales growth in the Wholesale Natural Products business and sustained volume momentum. This long-term consumption shift supports future revenue expansion.

Curious what powers this lofty valuation? Behind the scenes, there is an ambitious forecast for future sales, margin expansion, and bottom-line turnaround. Want a breakdown of the detailed financial targets and the assumptions analysts are banking on? Take a deeper look; one surprising projection could shift how you see the entire stock.

Result: Fair Value of $39.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as recent cybersecurity disruptions or major customer losses could quickly undermine the current optimism surrounding United Natural Foods’ growth story.

Find out about the key risks to this United Natural Foods narrative.

Another View: What Do the Numbers Say?

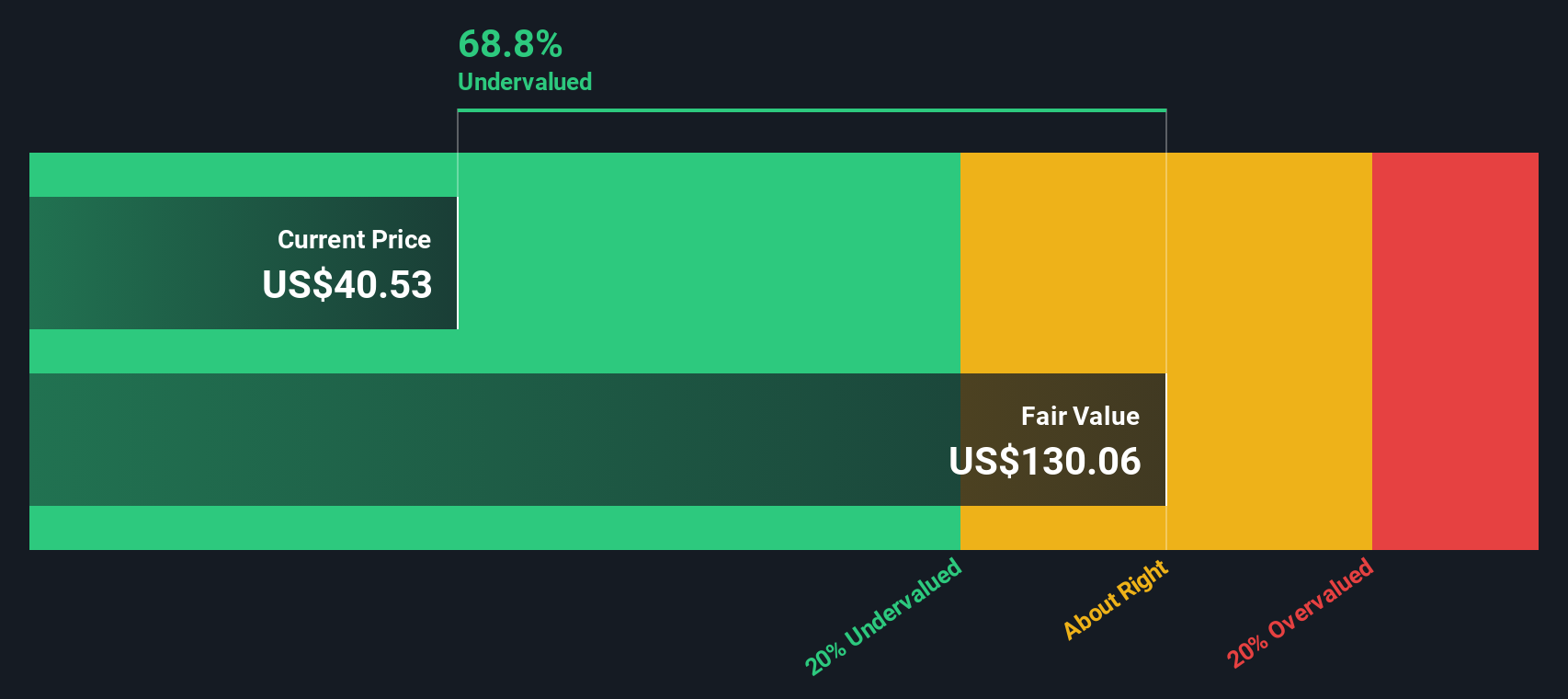

While analyst forecasts imply United Natural Foods is a touch overvalued, the SWS DCF model takes a very different view, estimating the business is trading at a steep 69% discount to its intrinsic fair value of $133.06 per share. This represents a major disconnect between perception and discounted cash flow reality. Which approach is more reliable for predicting future returns?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own United Natural Foods Narrative

If you want to see the numbers from your own perspective or dig deeper into the data, you can build your own view of United Natural Foods in just a few minutes. Do it your way

A great starting point for your United Natural Foods research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next smart portfolio move with insights that could unlock new wins. Start ahead of the crowd by checking out these fresh opportunities:

- Tap into the surge of machine learning advancements by evaluating these 24 AI penny stocks making headlines for innovative breakthroughs.

- Capitalize on strong cash flow opportunities by filtering for these 901 undervalued stocks based on cash flows with hidden upside potential.

- Position yourself for long-term growth by reviewing these 32 healthcare AI stocks driving transformation in patient care and medical technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNFI

United Natural Foods

Engages in the distribution of natural, organic, specialty, produce, and conventional grocery and non-food products in the United States and Canada.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives