- United States

- /

- Food and Staples Retail

- /

- NYSE:PFGC

A Look at Performance Food Group’s (PFGC) Valuation After Strong Q1 Growth and Raised Full-Year Guidance

Reviewed by Simply Wall St

Performance Food Group (PFGC) delivered impressive revenue growth in its first quarter, fueled by recent acquisitions and increased case volumes. The company raised its full-year sales guidance, signaling continued momentum across key business segments.

See our latest analysis for Performance Food Group.

PFGC’s stock has maintained a healthy upward trend, with a year-to-date share price return of 17.47% and a one-year total shareholder return of 14.84%. Recent volatility has reflected mixed quarterly results and raised guidance. Momentum appears steady, supported by robust long-term gains. Total shareholder return has climbed nearly 75% over three years and more than doubled over five years, hinting at persistent growth optimism among investors.

If you want to see what else is catching investors’ attention, now’s the perfect time to broaden your outlook and discover fast growing stocks with high insider ownership

With shares riding years of steady gains and analyst targets suggesting upside, the question now is whether PFGC’s strong outlook is fully reflected in today’s price or if there is still a buying opportunity for investors.

Most Popular Narrative: 18.3% Undervalued

The most widely followed narrative assigns Performance Food Group a fair value of $120.92 per share, which is significantly above its last closing price of $98.73. This highlights attractive upside potential as the company builds on recent growth momentum.

PFG's ongoing shift toward higher-margin independents, specialty, and foodservice categories, along with targeted procurement synergies from recent acquisitions, supports incremental margin expansion and improved operating leverage. This creates upside in both net margin and EBITDA growth.

Want to see exactly what’s driving this bullish fair value? This popular narrative is built on ambitious margin expansion, big acquisition effects, and bold profit forecasts. Curious how robust earnings targets and future growth myths unlock a price well above today’s? The full calculation might surprise you.

Result: Fair Value of $120.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressure in the convenience segment or tougher industry competition could quickly erode margins and disrupt Performance Food Group's current growth trajectory.

Find out about the key risks to this Performance Food Group narrative.

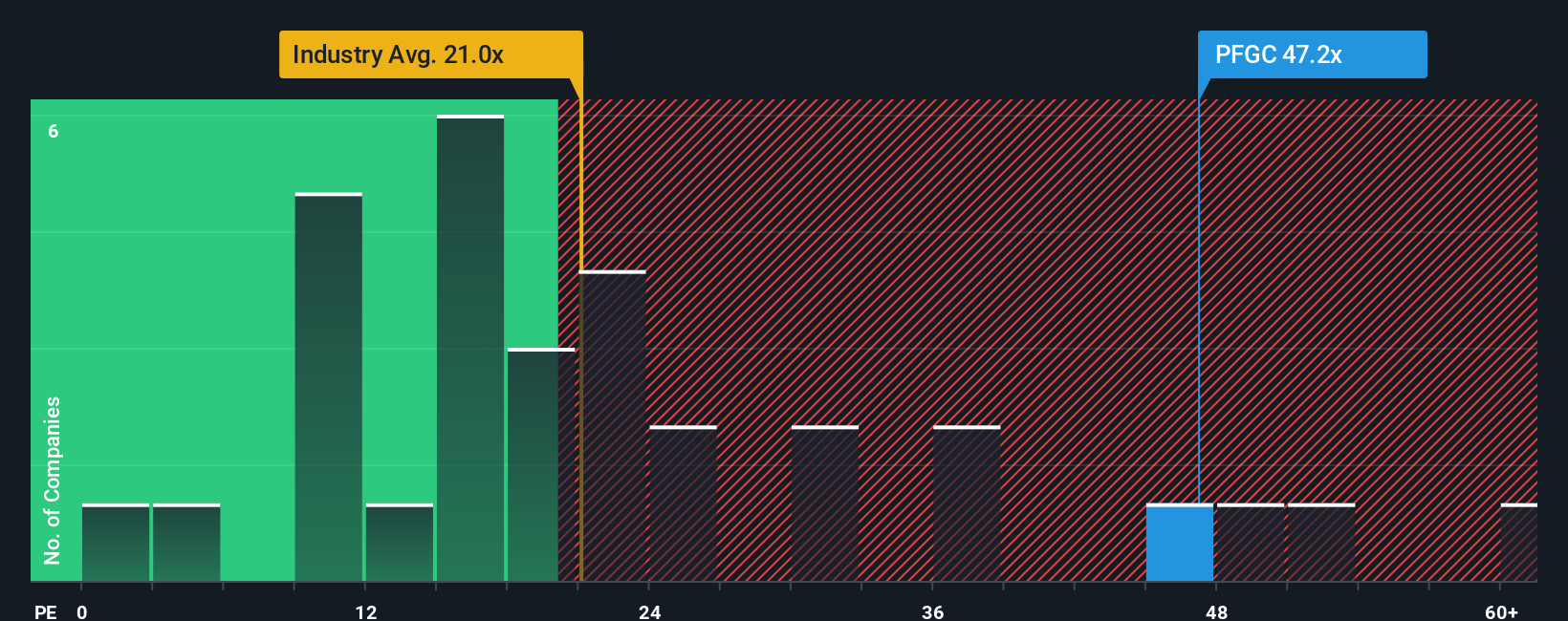

Another View: Multiples Tell a Different Story

Looking at valuation through the lens of the price-to-earnings ratio, Performance Food Group trades at 47.5x, which is significantly higher than both the peer average (26.6x) and the US Consumer Retailing industry average (19.2x). The so-called fair ratio, based on market regression, is 32x. These elevated figures could point to valuation risk if market sentiment shifts. Might investors be stretching too far for future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Performance Food Group Narrative

If the existing outlook doesn’t match your perspective, you can dive into the data and shape your own take in just minutes with Do it your way.

A great starting point for your Performance Food Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one standout. Expand your portfolio potential with timely opportunities others might overlook. Savvy investors are already moving; make sure you’re ahead of the curve.

- Unlock growth by tapping into these 24 AI penny stocks, which are fueling advancements in artificial intelligence and reshaping how entire industries operate.

- Supercharge your returns with these 870 undervalued stocks based on cash flows, where solid businesses are trading below their intrinsic worth and may be ready to rebound.

- Maximize income with consistent payouts from these 16 dividend stocks with yields > 3%, offering attractive yields above 3% for dependable long-term cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFGC

Performance Food Group

Through its subsidiaries, engages in the marketing and distribution of food and food-related products in North America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives