- United States

- /

- Food and Staples Retail

- /

- NYSE:PFGC

A Fresh Look at Performance Food Group (PFGC) Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Performance Food Group (PFGC) has drawn some attention lately, especially after its shares slipped nearly 2% in recent trading. This recent move has investors comparing short-term volatility to the company’s encouraging longer-term performance.

See our latest analysis for Performance Food Group.

While Performance Food Group’s share price has seen a modest decline in recent weeks, its momentum for the year remains positive. With a strong 13.5% year-to-date share price return and an impressive 99% total return over five years, the company’s longer-term track record suggests solid value creation despite some recent choppiness.

If this kind of steady growth profile has you looking for more opportunities, now is a good time to broaden your search and uncover fast growing stocks with high insider ownership

Given Performance Food Group’s notable long-term track record and recent dip, investors are left to wonder if PFG stock is now undervalued based on today’s fundamentals or if the market is already anticipating future growth.

Most Popular Narrative: 21.6% Undervalued

With the latest close at $95.40 and the most watched narrative implying a fair value over $115, Performance Food Group’s stock presents a notable gap between the current price and consensus growth expectations.

Ongoing investments in digital ordering platforms and e-commerce capabilities, particularly in the rapidly growing specialty and convenience divisions, are driving higher order frequency, increased client stickiness, and double-digit e-commerce sales growth. This contributes to recurring revenue and improved customer lifetime value.

Want to understand why a food distributor gets a valuation more typical of fast-growing tech? The narrative points to powerful structural tailwinds and bold profitability forecasts. Looking for the numbers behind this optimism? Unlock the full narrative and see what could be driving this eye-catching gap.

Result: Fair Value of $121.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, changing consumer habits and rising competition could quickly reshape the company’s outlook. This may make sustained growth more difficult than current forecasts imply.

Find out about the key risks to this Performance Food Group narrative.

Another View: Multiples Tell a Different Story

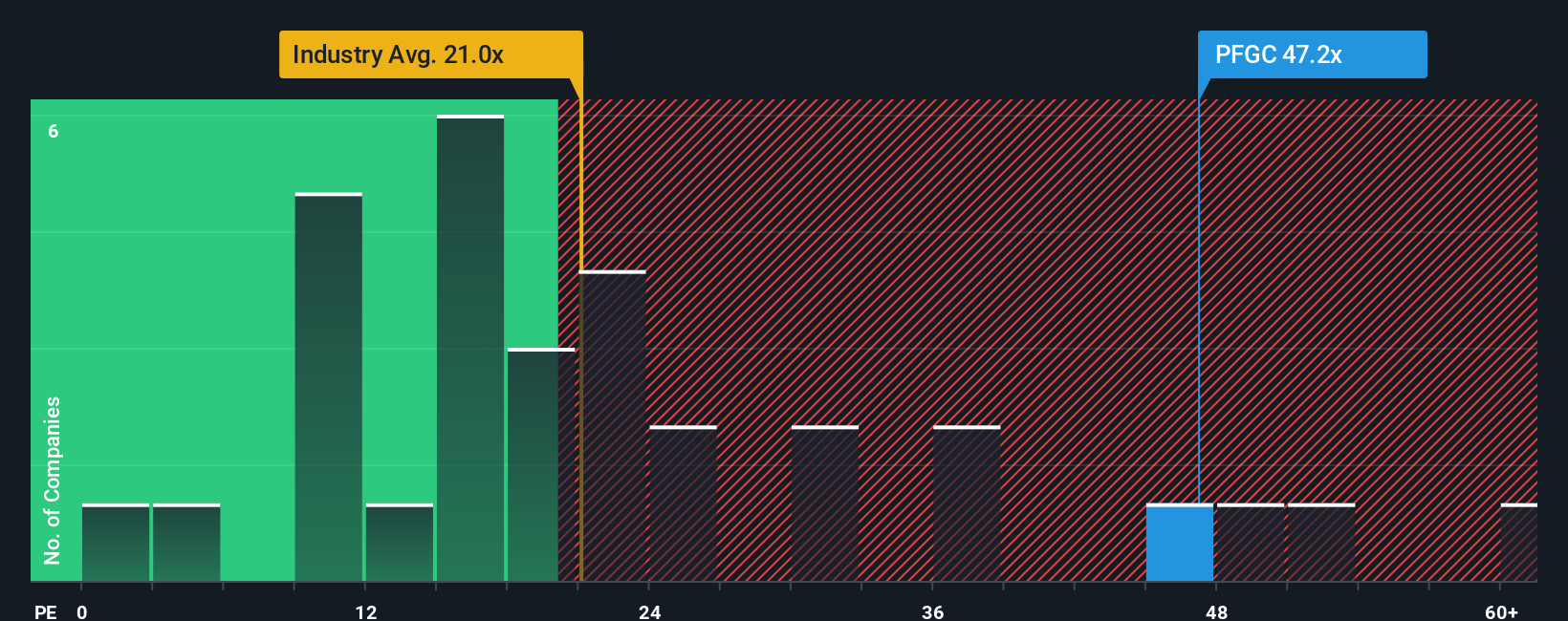

While our DCF model suggests Performance Food Group is trading well below its estimated fair value, traditional valuation ratios give a more cautious signal. The company's price-to-earnings ratio is 45.9x, which is notably higher than both the industry average of 20.1x and the calculated fair ratio of 32.6x. This significant gap hints at elevated expectations for future growth and increases valuation risk if earnings disappoint. Could this premium be justified, or is the optimism running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Performance Food Group Narrative

If these perspectives do not fully align with your own or you want to explore further, you can use the data to craft your own narrative in just a few minutes. Do it your way

A great starting point for your Performance Food Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Unlock more opportunities that fit your goals. Don’t let game-changing stocks pass you by. The right screen could spotlight the next standout for your watchlist.

- Spot the rising stars capturing Wall Street buzz when you size up these 3564 penny stocks with strong financials with strong financials and outsized upside potential.

- Target robust income streams as you evaluate these 14 dividend stocks with yields > 3% featuring consistent yields above 3% for your portfolio’s stability.

- Position yourself ahead of the digital revolution by scanning these 25 AI penny stocks taking artificial intelligence breakthroughs to the next level.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFGC

Performance Food Group

Through its subsidiaries, engages in the marketing and distribution of food and food-related products in North America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026