- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

Kroger (KR): Rethinking Valuation After a Mixed Q3, E‑Commerce Push, and Stock Selloff

Reviewed by Simply Wall St

Kroger (KR) is back in the spotlight after a bruising third quarter, where strong e commerce growth and better margins were overshadowed by a surprise net loss and softer sales guidance that hit the stock.

See our latest analysis for Kroger.

The recent selloff, including a sharp post earnings drop and a 7.8% 90 day share price return, contrasts with Kroger’s steadier 8.0% one year total shareholder return. This suggests long term investors still see value as management leans into e commerce and new stores.

If Kroger’s mixed quarter has you rethinking defensives, it might be a good time to broaden your search and discover fast growing stocks with high insider ownership.

With shares now trading at a roughly 18% discount to the average analyst target and about a 30% gap to some intrinsic value estimates, investors must decide: Is Kroger quietly undervalued or already pricing in its next phase of growth?

Most Popular Narrative Narrative: 15.7% Undervalued

With Kroger closing at $62.71 against a narrative fair value near $74, the story centers on whether digital scale can unlock sustained earnings power.

The rapid growth in Kroger's e commerce business highlighted by a 15% YoY increase and strong improvements in delivery suggests significant upside potential as more consumers shift to online grocery shopping. Ongoing investment in unified digital platforms and fulfillment operations is expected to drive future revenue growth and accelerate profit improvement as the business scales.

Curious how modest revenue growth expectations can still underpin punchy earnings expansion and a richer future multiple for a grocer, not a tech giant? The narrative spells out the profit mix shifts, capital intensity bets, and margin uplift assumptions that need to click in tandem. Want to see which forecasts really carry the valuation load?

Result: Fair Value of $74.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Kroger’s unprofitable e commerce and rising labor and benefit costs could squeeze margins, challenging the upbeat earnings and valuation trajectory.

Find out about the key risks to this Kroger narrative.

Another Angle on Valuation

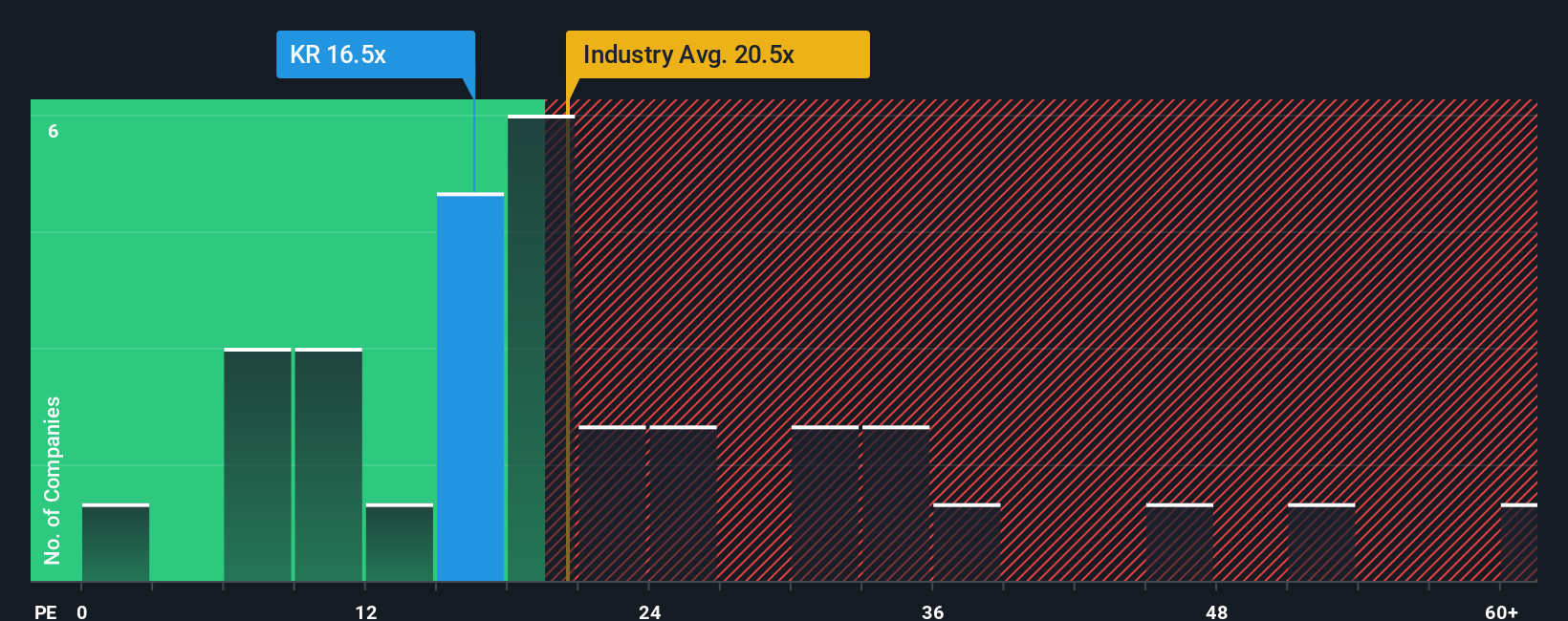

While our narrative fair value suggests Kroger is 15.7% undervalued, its current price to earnings ratio near 52.4 times looks steep versus the Consumer Retailing industry at 20.8 times and a fair ratio of 34.2 times. Is the market overpaying for a defensive grocer story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kroger Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized view of Kroger in just minutes: Do it your way.

A great starting point for your Kroger research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not leave your portfolio tied to a single story when you can quickly scan fresh opportunities built on solid fundamentals, growth momentum, and structural tailwinds.

- Explore potential mispricings by targeting companies trading below their intrinsic worth through these 907 undervalued stocks based on cash flows, which focuses on strong cash flow support.

- Identify transformative innovation by using these 26 AI penny stocks to find businesses applying artificial intelligence across real world products and services.

- Review these 15 dividend stocks with yields > 3% to help strengthen your income stream with securities that have historically delivered attractive yields and may offer long term sustainability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026