- United States

- /

- Food and Staples Retail

- /

- NYSE:KR

Does Kroger’s Recent Strategic Investments Signal Stronger Value for 2025?

Reviewed by Bailey Pemberton

- Wondering if Kroger is a hidden gem in today’s market? Take a fresh look at its value and what might set it apart from the pack.

- After a gain of 2.0% in the past week, but a dip of 4.1% over the last month, Kroger stock has still delivered an impressive 11.2% return over the past year.

- Recent headlines highlight Kroger’s ongoing strategic investments and strong sales momentum, especially in digital growth and partnerships with major suppliers. These developments have helped fuel investor interest and could be influencing both upside potential and perceived risks around the stock.

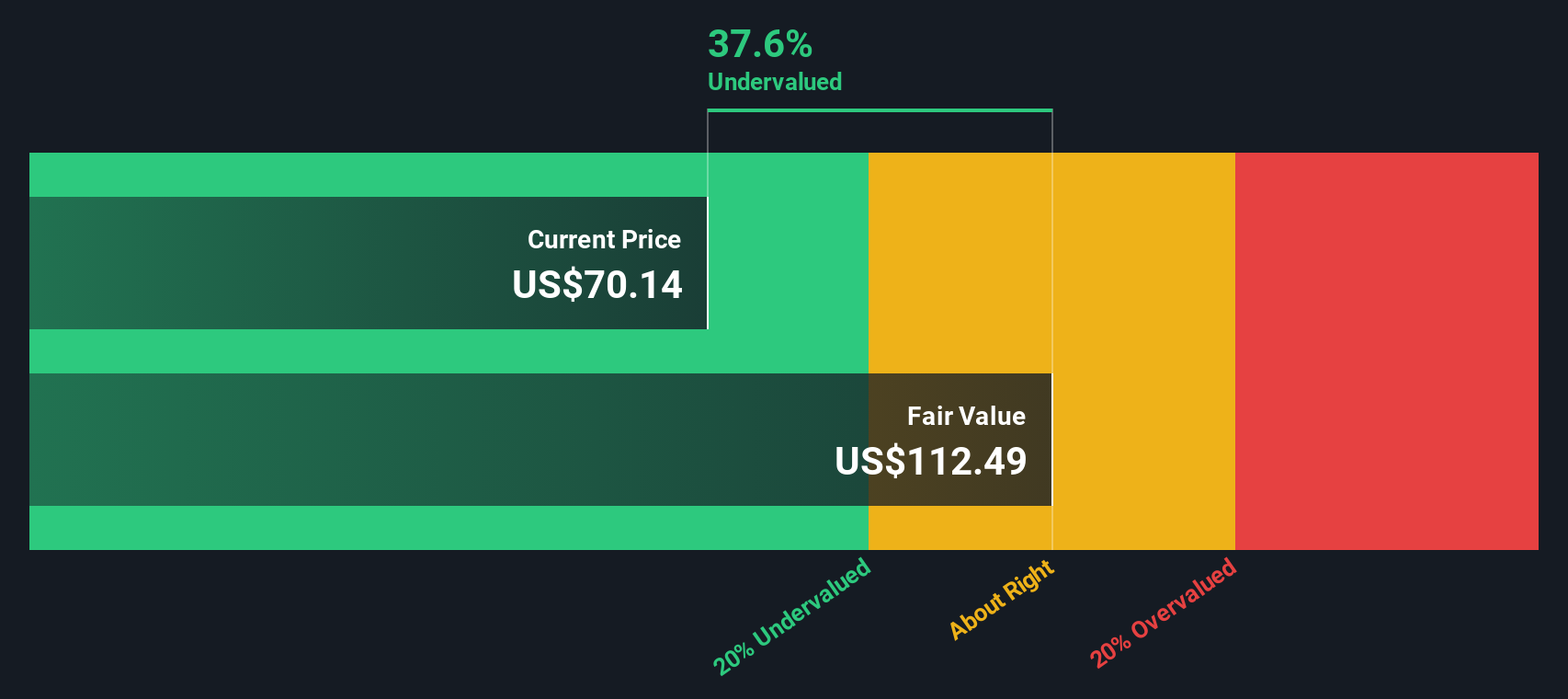

- Kroger currently scores 5 out of 6 on our valuation checks, indicating it may be undervalued on several metrics. Next, the article will break down what drives that score, along with a unique perspective on valuation that could be important for long-term investors.

Approach 1: Kroger Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s value. This method helps investors understand what the business might be worth based on expected cash generation, not just current profits or assets.

For Kroger, the model uses data in US dollars and begins with its latest twelve months’ Free Cash Flow at $2.21 billion. Analyst estimates extend for the next five years, showing steady Free Cash Flow increases, with projections reaching $3.16 billion in 2030. Beyond that, forecasts continue using moderate growth assumptions.

These cash flows are discounted to their present value using the current rates and risk factors relevant to Kroger’s industry. According to the DCF, the company’s intrinsic value is about $87.28 per share, which is 25.5% higher than the current share price. This means, based on this model, Kroger stock is considered significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kroger is undervalued by 25.5%. Track this in your watchlist or portfolio, or discover 872 more undervalued stocks based on cash flows.

Approach 2: Kroger Price vs Earnings (PE)

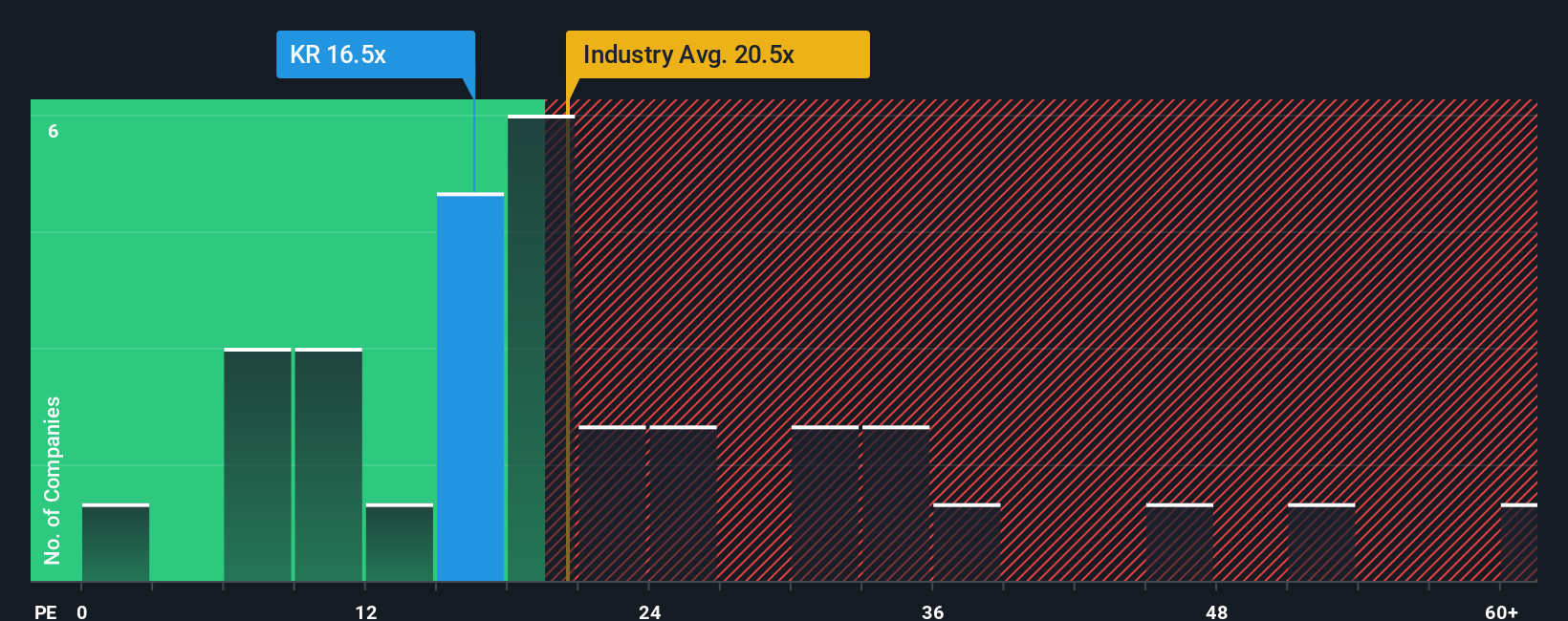

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies because it directly links a company's share price to its underlying earnings. For investors, PE offers a straightforward view of how much they are paying for each dollar of Kroger’s net income.

It’s important to remember that what counts as a “normal” or “fair” PE ratio depends on expectations for future growth and risk. A company expected to grow faster or with less risk can justify a higher PE, while one facing headwinds usually deserves a lower multiple.

Kroger currently trades at a PE ratio of 15.9x, which is below both the Consumer Retailing industry average of 19.7x and the peer average of 20.2x. This might look attractive at first glance, but simply comparing PE ratios can miss some nuances.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, set at 22.1x for Kroger, is calculated using a model that weighs factors like the company’s earnings growth, industry outlook, profit margins, market capitalization and risk profile. Because it takes all of these variables into account, it’s a more robust gauge of what Kroger’s PE should be rather than relying only on broad industry numbers or peer averages.

Comparing Kroger’s current PE of 15.9x to its Fair Ratio of 22.1x suggests the stock could be undervalued, offering a potential opportunity for value-focused investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kroger Narrative

Earlier, we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple tool that lets you attach your own story and assumptions to a company, connecting what you believe about Kroger’s future to concrete forecasts for its revenue, earnings and profit margins, and ultimately producing your own fair value estimate.

Narratives bridge numbers and perspective, helping you see how the company’s real-world catalysts and risks might play out in financial terms. With the Narratives tool, used by millions on Simply Wall St’s Community page, you can craft and compare different investment cases. Whether you see Kroger as a digital retail winner or you’re more cautious about costs and competition, Narratives allow you to explore multiple viewpoints.

Narratives empower you not just to interpret, but also to update your view as new news or earnings are announced, automatically revising your fair value when fresh data arrives. They make decision making more personalized and dynamic by letting you quickly spot when Fair Value outweighs the Price, or vice versa, and revealing how your thesis stacks up against the crowd.

For example, some investors project a bullish fair value of $85.0 per share for Kroger based on rapid digital expansion, while others set a more cautious target of $63.0, emphasizing e-commerce profitability and competitive pressure.

Do you think there's more to the story for Kroger? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kroger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KR

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives