- United States

- /

- Food and Staples Retail

- /

- NYSE:DG

Is Dollar General Still a Bargain After 37% Rally and Store Expansion News?

Reviewed by Bailey Pemberton

- Ever wondered if Dollar General is really a bargain right now, or if the stock’s run has gotten ahead of itself? You’re not alone. We’re breaking down exactly what you need to know before making a call.

- Shares have surged 4.3% over the last week, are up 4.9% this month, and have climbed 37.6% year-to-date, with a strong 42.1% gain over the past year. However, when you take a broader view, the 3-year and 5-year returns are still deeply negative. This points to both opportunity and lingering risks.

- A recent headline fueling the rally is the company’s announcement of planned store expansions, indicating that management is focusing on growth in underserved markets. Additionally, analyst discussions have centered on Dollar General’s strategy shifts and renewed focus on operational efficiency. This gives investors more reasons to re-evaluate the stock.

- According to our valuation checks, Dollar General scores a 4 out of 6 for being undervalued. We will walk through some classic valuation methods next, and if you stick around, reveal why there may be a smarter way to gauge value than meets the eye.

Approach 1: Dollar General Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them to today’s dollars. For Dollar General, this method helps investors gauge what the business might really be worth, instead of relying on current market sentiment.

According to the latest data, Dollar General generated $1.56 billion in free cash flow over the last twelve months. Analyst forecasts suggest that annual free cash flow will continue to grow, reaching approximately $1.83 billion by fiscal year 2030. The DCF analysis relies on a combination of direct analyst projections for the next five years and longer-term estimates extrapolated beyond that.

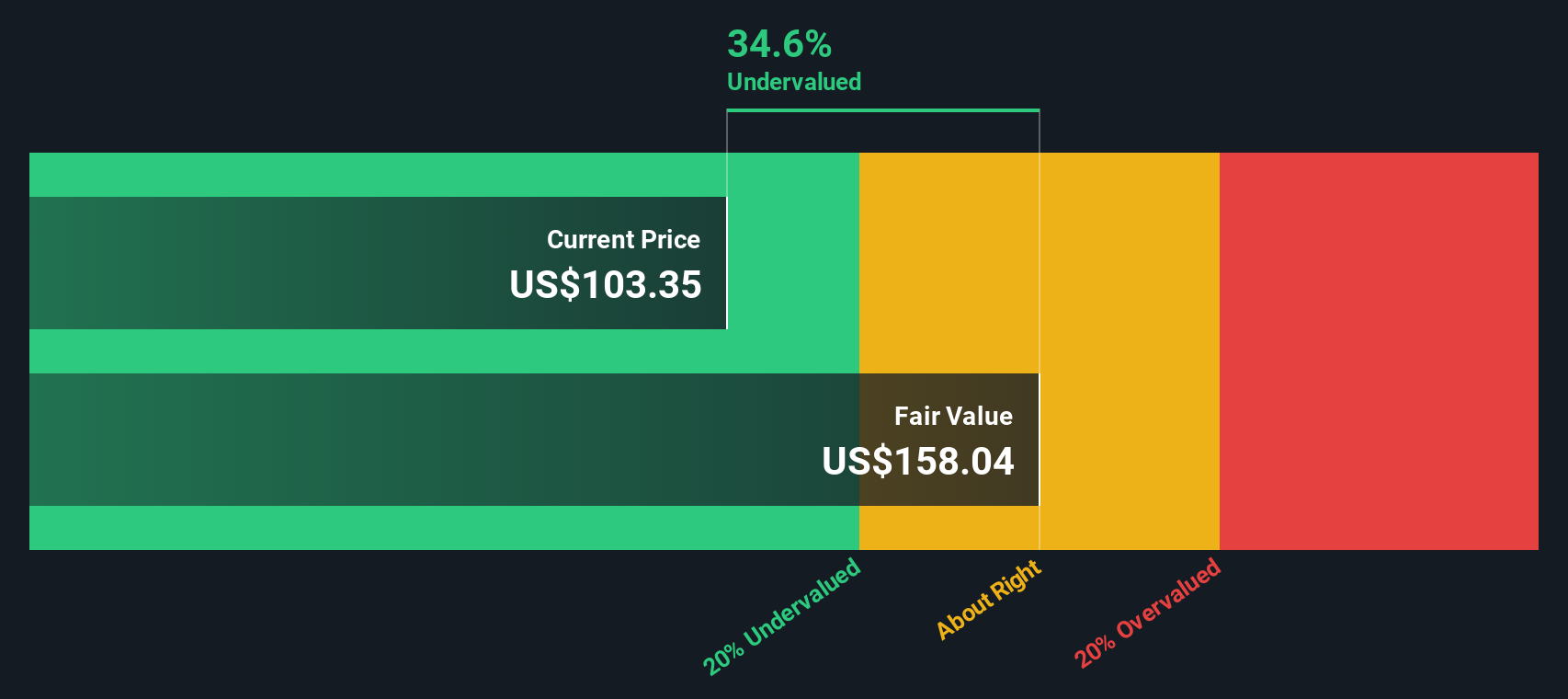

Based on these cash flow projections and after accounting for the time value of money, Dollar General’s estimated intrinsic value comes out to $156.96 per share. Given the current market price, this implies the stock is trading at a 33.7% discount to its fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Dollar General is undervalued by 33.7%. Track this in your watchlist or portfolio, or discover 868 more undervalued stocks based on cash flows.

Approach 2: Dollar General Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a standard valuation measure for profitable companies like Dollar General. It’s favored by investors as it compares a company’s current share price to its per-share earnings, giving a quick sense of how much the market is willing to pay for each dollar of profit.

A “normal” or “fair” PE ratio depends on several factors. Companies with higher expected earnings growth, greater profitability, or lower risk typically justify higher multiples, while slower growth or higher uncertainty can drag the PE lower.

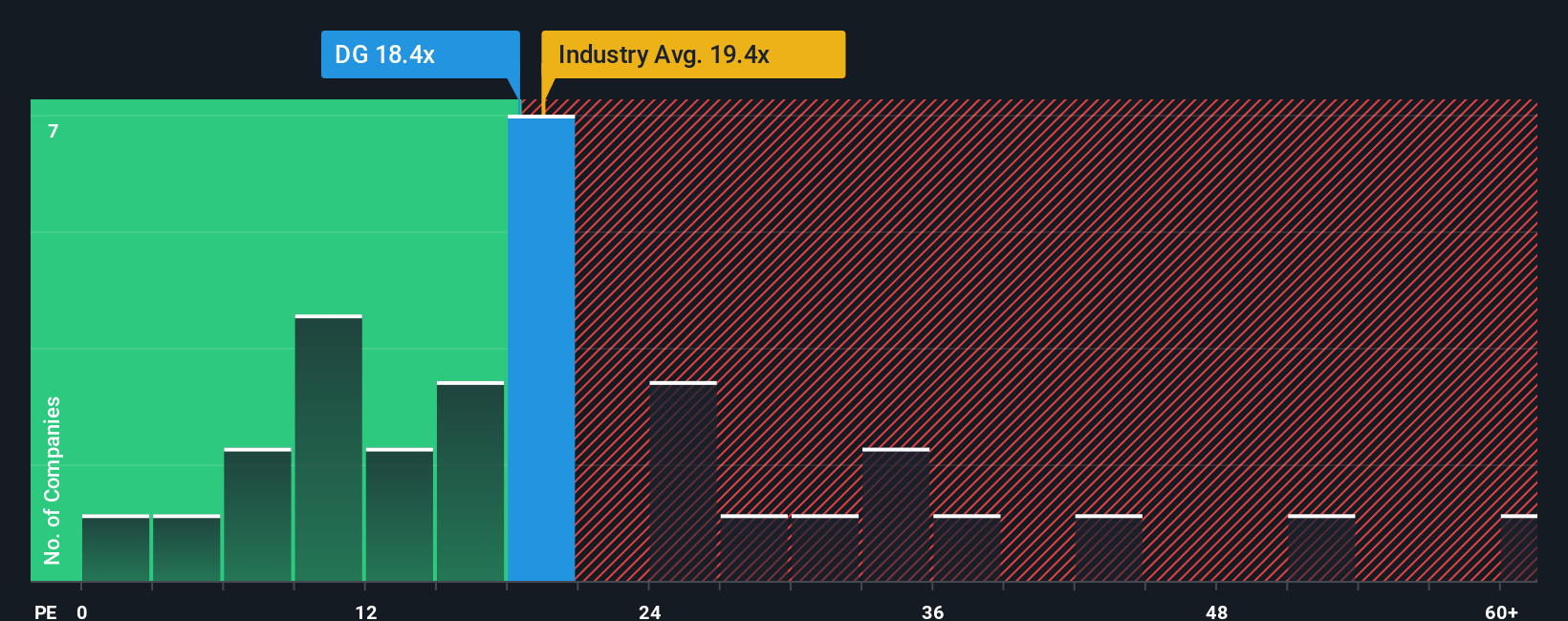

Dollar General is currently trading at a PE ratio of 19.2x. This stacks up slightly below the Consumer Retailing industry average of 19.7x, and just above the average of similar peers at 18.8x. While these comparisons are helpful, they do not account for company-specific circumstances like Dollar General’s growth prospects or risk profile.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. It is a tailored benchmark that accounts for Dollar General’s expected earnings growth, profit margins, industry factors, company size, and unique risks. This approach provides a clear-eyed view that goes beyond generic market comparisons.

For Dollar General, the Fair PE Ratio is 21.2x. Since the current ratio of 19.2x is noticeably below this fair value, it suggests that the stock is undervalued from an earnings perspective.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dollar General Narrative

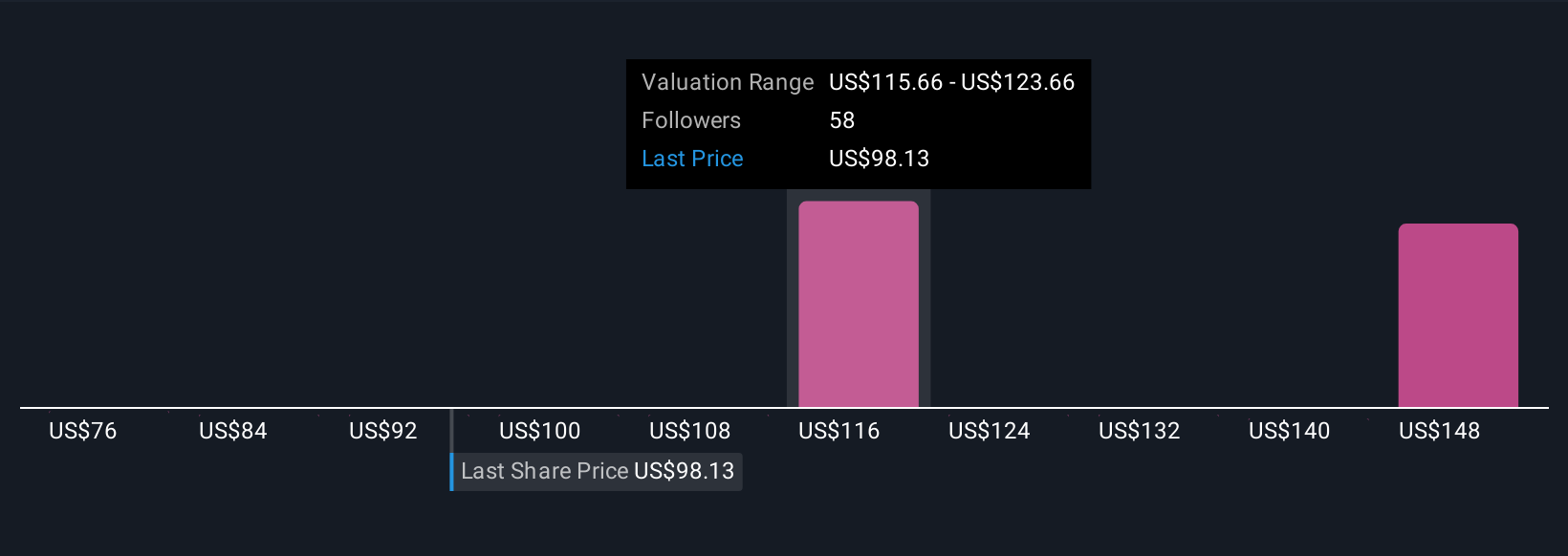

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, yet powerful tool that lets you build your own story about a company based on your assumptions for its future, such as revenue, earnings, and profit margins, and see how those ideas connect to an actual fair value.

By linking the company’s story to a financial forecast and then directly to an estimated fair value, Narratives turn investment opinions into actionable insights, helping you decide whether it makes sense to buy, hold, or sell based on your personal expectations. Narratives are available for free within the Simply Wall St Community page, used by millions of investors, and automatically update as new news or earnings come in, so your view always stays fresh.

For example, one investor might believe Dollar General’s expansion and margin initiatives will drive steady growth, supporting a higher fair value of $138, while another might see risks from rural dependence and competition, arriving at a more cautious $80. Narratives help you compare these perspectives side by side, then decide for yourself based on how each story fits with the current price.

Do you think there's more to the story for Dollar General? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DG

Dollar General

A discount retailer, provides various merchandise products in the southern, southwestern, midwestern, and eastern United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives