- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:GO

Grocery Outlet (GO): Reassessing Valuation After a Steep Share Price Slide

Reviewed by Simply Wall St

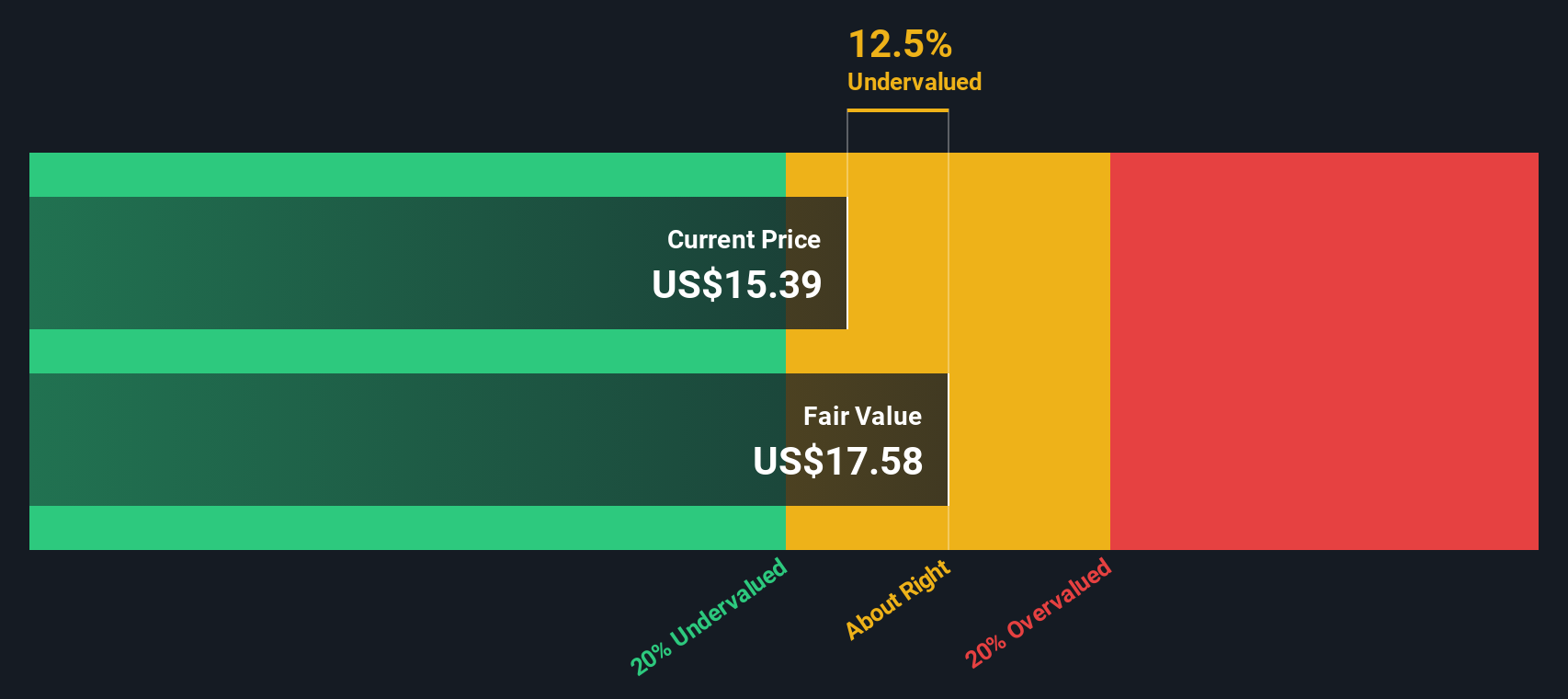

Grocery Outlet Holding (GO) has quietly slipped into value territory after a steep slide over the past 3 months, even as revenue and net income growth trends tell a more mixed and nuanced story.

See our latest analysis for Grocery Outlet Holding.

Over the past year, that weakness has added up, with a roughly 30 percent year to date share price decline and a 1 year total shareholder return of about negative 40 percent, suggesting sentiment has shifted from growth story to turnaround watch.

If Grocery Outlet’s slump has you rethinking where you look for opportunity, this could be a good moment to scan for fast growing stocks with high insider ownership.

With shares now trading well below analyst targets despite double digit net income growth, the key question becomes whether Grocery Outlet is a mispriced recovery story, or if the market is correctly discounting its future growth potential?

Most Popular Narrative: 33.7% Undervalued

With Grocery Outlet Holding’s fair value pegged around the high teens against an $11.38 last close, the prevailing narrative frames today’s slide as a potential mispricing rather than a structural collapse.

Analysts are assuming Grocery Outlet Holding's revenue will grow by 8.3% annually over the next 3 years.

Analysts assume that profit margins will increase from 0.2% today to 1.5% in 3 years time.

Curious how modest sales growth, rising margins, and a richer future earnings multiple can still justify a sizable upside from here? Unpack the full playbook behind this valuation call.

Result: Fair Value of $17.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if digital investments lag larger rivals and ongoing wage inflation squeezes margins more than analysts currently anticipate.

Find out about the key risks to this Grocery Outlet Holding narrative.

Another View on Value

Simply Wall St’s DCF model paints a far harsher picture than the upbeat narrative, suggesting Grocery Outlet is actually overvalued at $11.38 versus a fair value estimate of just $4.75. If cash flows indicate the stock is rich while sentiment suggests it is cheap, which signal do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Grocery Outlet Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Grocery Outlet Holding Narrative

If you are not fully convinced by this perspective or would rather dive into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Grocery Outlet Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Grocery Outlet does not fully match your next move, do not wait on the sidelines. Use Simply Wall Street’s Screener to target sharper opportunities now.

- Capture potential bargains early by scanning these 907 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows and fundamentals.

- Position yourself ahead of the next tech wave by targeting these 26 AI penny stocks harnessing artificial intelligence to reshape entire industries.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that can help support long term returns through consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GO

Grocery Outlet Holding

Operates as a retailer of consumables and fresh products sold through independently operated stores in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026