- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:DLTR

How Might Dollar Tree’s (DLTR) Social Initiatives Shape Management’s View on Consumer Shifts?

Reviewed by Sasha Jovanovic

- Dollar Tree recently reaffirmed its commitment to diversity and inclusion with new Associate Resource Groups, educational partnerships, and the release of its 2024 Sustainability and Social Impact Report.

- This announcement comes just ahead of Dollar Tree’s third quarter earnings report, which will be closely watched for management’s outlook on consumer trends and updated financial guidance amid ongoing inflation.

- We’ll examine how investor attention on management’s comments about shifting consumer behavior could influence Dollar Tree’s investment outlook.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dollar Tree Investment Narrative Recap

To invest in Dollar Tree, you must believe in its ability to capture a broader base of consumers seeking value, particularly as economic pressures shift shopping habits. The recent announcement on diversity and inclusion signals positive internal culture, but is unlikely to materially affect the most important near-term catalyst, management’s commentary on changing consumer behavior amid inflationary headwinds, or ease investor concerns about demand risk among core value shoppers.

The release of Dollar Tree’s 2024 Sustainability and Social Impact Report is especially relevant, reflecting the company’s effort to demonstrate accountability and strengthen stakeholder trust at a time when customer loyalty is critical. This aligns with the business’s ongoing expansion and evolving pricing strategies, both of which will be under scrutiny as investors consider near-term risks and long-term growth potential.

Yet, despite these positive moves, pay close attention to the risk of eroding brand loyalty if pricing changes begin to alienate core customers and...

Read the full narrative on Dollar Tree (it's free!)

Dollar Tree's narrative projects $22.1 billion revenue and $1.4 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $0.3 billion earnings increase from the current $1.1 billion.

Uncover how Dollar Tree's forecasts yield a $107.13 fair value, a 3% downside to its current price.

Exploring Other Perspectives

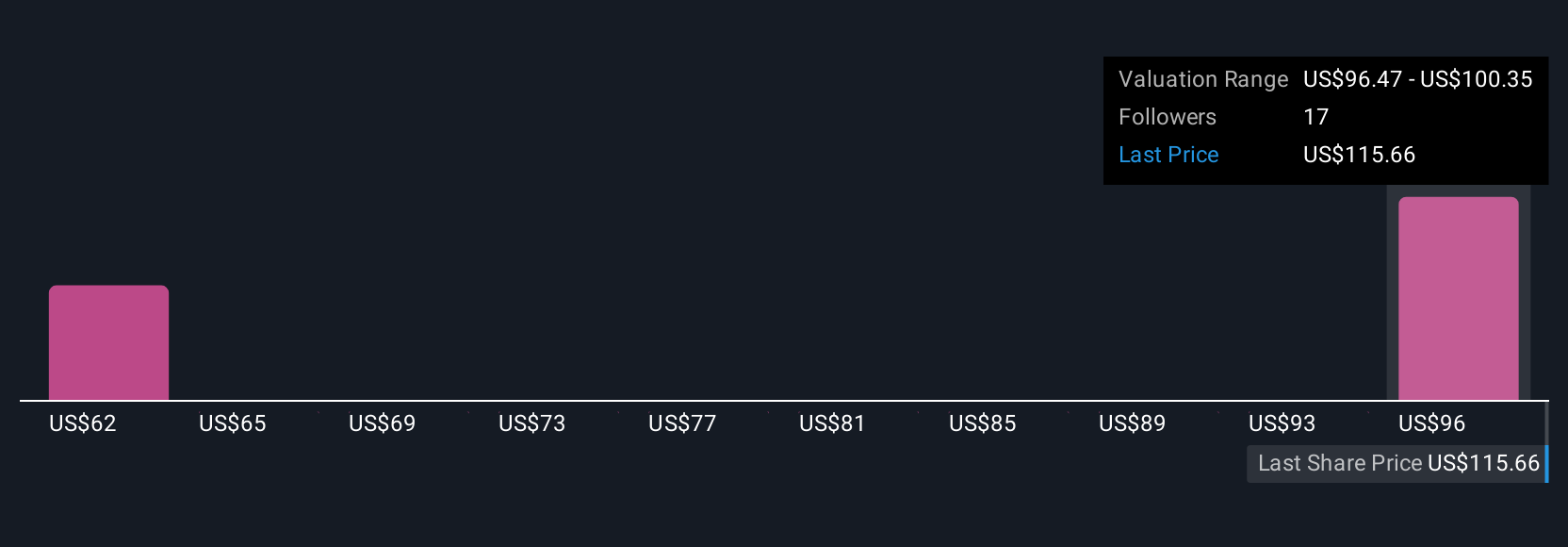

Four fair value estimates from the Simply Wall St Community range from US$58 to US$107 per share, reflecting wide views on Dollar Tree’s prospects. With price increases as a key lever, your stance on Dollar Tree may depend on how these decisions impact customer loyalty and future revenue.

Explore 4 other fair value estimates on Dollar Tree - why the stock might be worth as much as $107.13!

Build Your Own Dollar Tree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar Tree research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Dollar Tree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar Tree's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DLTR

Dollar Tree

Operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands in the United States and Canada.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026