- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Will Bobbie's USDA Organic Formula Debut Reshape Costco's (COST) Appeal to Health-Conscious Families?

Reviewed by Sasha Jovanovic

- Bobbie announced that its USDA Organic infant formula is now available in select Costco warehouses across the US, following a highly successful online debut and rapid transition to in-store sales to meet rising demand among parents.

- This launch marks Bobbie as the only USDA Organic formula on Costco shelves and highlights an expanded range of health-focused, high-quality offerings for families shopping at the warehouse retailer.

- We'll explore how adding Bobbie's organic infant formula could influence Costco's brand positioning and reinforce its appeal to value-seeking families.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Costco Wholesale Investment Narrative Recap

To be a Costco shareholder, you typically want to believe in the company’s proven ability to consistently draw value-seeking members through a combination of scale, efficiency, and a curated product mix. The recent addition of Bobbie’s USDA Organic infant formula is a meaningful step in expanding Costco’s health-focused offerings but, in the near term, is unlikely to materially impact the company’s biggest catalyst, warehouse expansion and membership growth, or address the main risk from rising labor and import costs.

Among recent Costco announcements, the launch of Bobbie's organic formula stands out due to its tie-in with ongoing efforts to enhance high-quality, family-oriented value and to attract new members, a focus that complements broader catalysts like store expansion and digital channel investment. As Costco sharpens its appeal to families through exclusive lines and accessible high-quality essentials, it reinforces the pillars behind recurring membership and strong in-store traffic.

By contrast, one thing investors should watch for is the impact of higher labor costs, especially as Costco balances employee compensation with…

Read the full narrative on Costco Wholesale (it's free!)

Costco Wholesale's outlook anticipates $329.0 billion in revenue and $10.4 billion in earnings by 2028. This projection is based on 7.0% annual revenue growth and a $2.6 billion increase in earnings from the current $7.8 billion.

Uncover how Costco Wholesale's forecasts yield a $1056 fair value, a 16% upside to its current price.

Exploring Other Perspectives

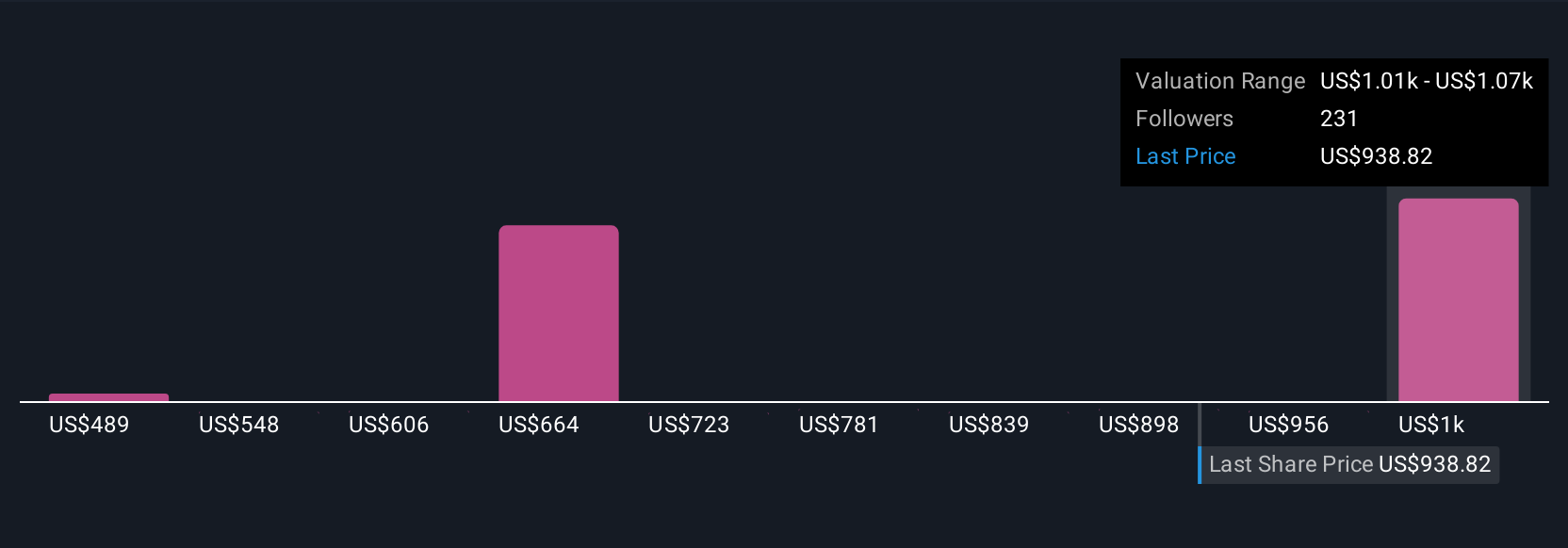

Simply Wall St Community members estimated fair values between US$691 and US$1,225 across 25 submissions, showing wide opinion spread. With labor cost pressures still a core risk, consider how these different views might reflect your own expectations on future profitability.

Explore 25 other fair value estimates on Costco Wholesale - why the stock might be worth as much as 35% more than the current price!

Build Your Own Costco Wholesale Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Costco Wholesale research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Costco Wholesale's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.