- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Is Costco (COST) Still Undervalued? A Fresh Look at the Retail Giant’s Current Valuation

Reviewed by Simply Wall St

Costco Wholesale (COST) shares have seen some movement lately, and investors are keeping an eye on the stock as it trends across recent weeks. There has not been a single headline-making catalyst; however, the valuation remains a topic of discussion among market watchers.

See our latest analysis for Costco Wholesale.

Costco’s share price has hovered just above the $900 mark, reflecting a steady run despite only modest shifts in recent weeks. While short-term returns have been flat, big-picture investors are still ahead. Costco’s 3-year total shareholder return sits at an impressive 92%, suggesting momentum may simply be pausing after strong long-term gains.

If you’re interested in finding more opportunities with similar track records, take your next step and discover fast growing stocks with high insider ownership

So after years of rewarding patient investors, are Costco shares now trading at a bargain, or has the market already factored in every ounce of expected growth?

Most Popular Narrative: 13.5% Undervalued

Compared to the last close at $913.59, the most closely followed narrative pins Costco's fair value much higher. This sets investor expectations for significant upside if projections bear out.

Costco's extension of gas station hours is designed to enhance member convenience, which could lead to higher gasoline sales and increased store traffic, positively impacting revenue. The updated employee agreement with higher wages may initially increase SG&A expenses, but Costco's focus on labor productivity and cost discipline could help maintain net margins over time.

Want to discover what makes Costco’s premium price tag seem justified? The narrative relies on a bold set of growth targets and future margin optimism that separates this retailer from the crowd. The secret is a powerful mix of operational expansion and financial discipline driving a valuation that may surprise you. Don’t miss the details. See how these forecasts shape the story.

Result: Fair Value of $1,055.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising labor expenses and supply chain pressures could test Costco’s margins, which may potentially limit the upside predicted by the bullish narrative.

Find out about the key risks to this Costco Wholesale narrative.

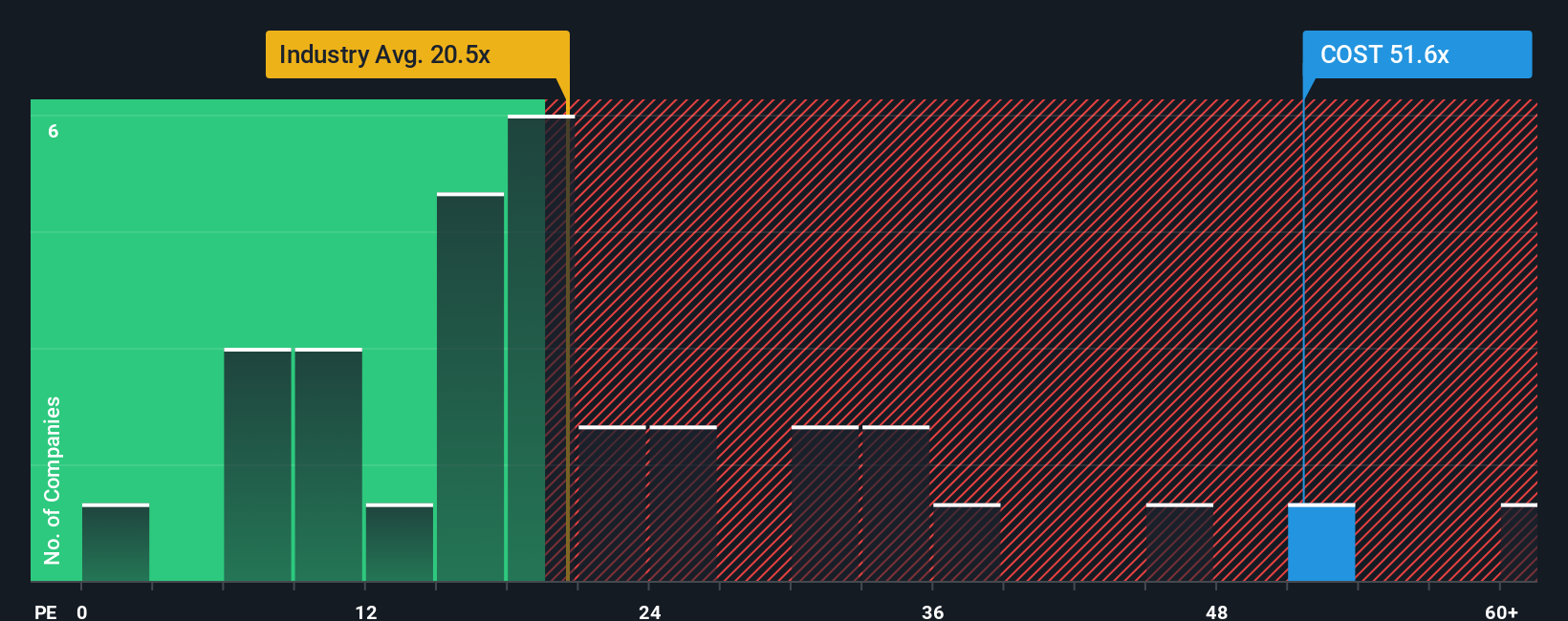

Another View: Looking at Valuation Multiples

While the analyst price target presents Costco as undervalued, its price-to-earnings ratio sits at 50 times earnings. This figure is well above the peer average of 22.5 and the fair ratio of 33.3. This sizable gap highlights just how much the market is willing to pay for Costco’s growth story, but it also raises the stakes if future results disappoint. Is the premium truly justified, or are expectations running too hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Costco Wholesale Narrative

Feel like the numbers tell a different story, or want to dig deeper for yourself? Try building your own view from the ground up in just a few minutes and Do it your way

A great starting point for your Costco Wholesale research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let your portfolio miss out on the next big opportunity. Simply Wall Street’s powerful Screener is your gateway to unique stocks and emerging trends worth your attention.

- Power up your returns with high-yield opportunities by evaluating companies among these 15 dividend stocks with yields > 3% offering strong income potential and consistent payouts.

- Tap into game-changing innovation by targeting future-focused businesses among these 25 AI penny stocks setting the pace in artificial intelligence breakthroughs.

- Take advantage of market mispricing by zeroing in on these 913 undervalued stocks based on cash flows that present exceptional value based on robust cash flows and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026