- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:CART

Does Recent Price Jump Signal an Opportunity in Maplebear?

Reviewed by Bailey Pemberton

- Wondering if Maplebear’s current share price represents an attractive opportunity or a potential red flag? You are not alone, and now is the perfect time to dig deeper into what the numbers and the recent activity are really saying.

- The stock has caught plenty of attention lately, jumping 5.8% over the past week and 16.1% in the last month, even though the year-to-date return sits slightly below zero at -0.6% and down -1.7% over the past 12 months.

- Recent headlines around Maplebear have revolved around shifting consumer preferences and industry-wide discussions on gig economy regulations. Both of these factors are reshaping sentiment and fueling price volatility. Investors and analysts are keeping a close watch as every new development seems to prompt a noticeable reaction in the share price.

- On paper, Maplebear scores 2 out of 6 on our value checks, which means there is still plenty of room for debate. Let’s walk through the usual valuation approaches and keep an eye out for a fresh perspective that could be even more insightful before we wrap up.

Maplebear scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Maplebear Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common valuation technique that estimates a company’s worth by forecasting its future cash flows and discounting them back to their present value. This approach aims to answer what the business is fundamentally worth today, based on how much cash it is expected to generate for shareholders in the years ahead.

For Maplebear, the current Free Cash Flow stands at $878.8 Million, and analysts anticipate steady growth in those cash flows over the next several years. By 2029, Free Cash Flow is projected to reach approximately $1.08 Billion. It is important to note that these longer-term forecasts rely more heavily on extrapolation beyond the initial five years, as analyst estimates only extend so far. All cash flows are denominated in US Dollars.

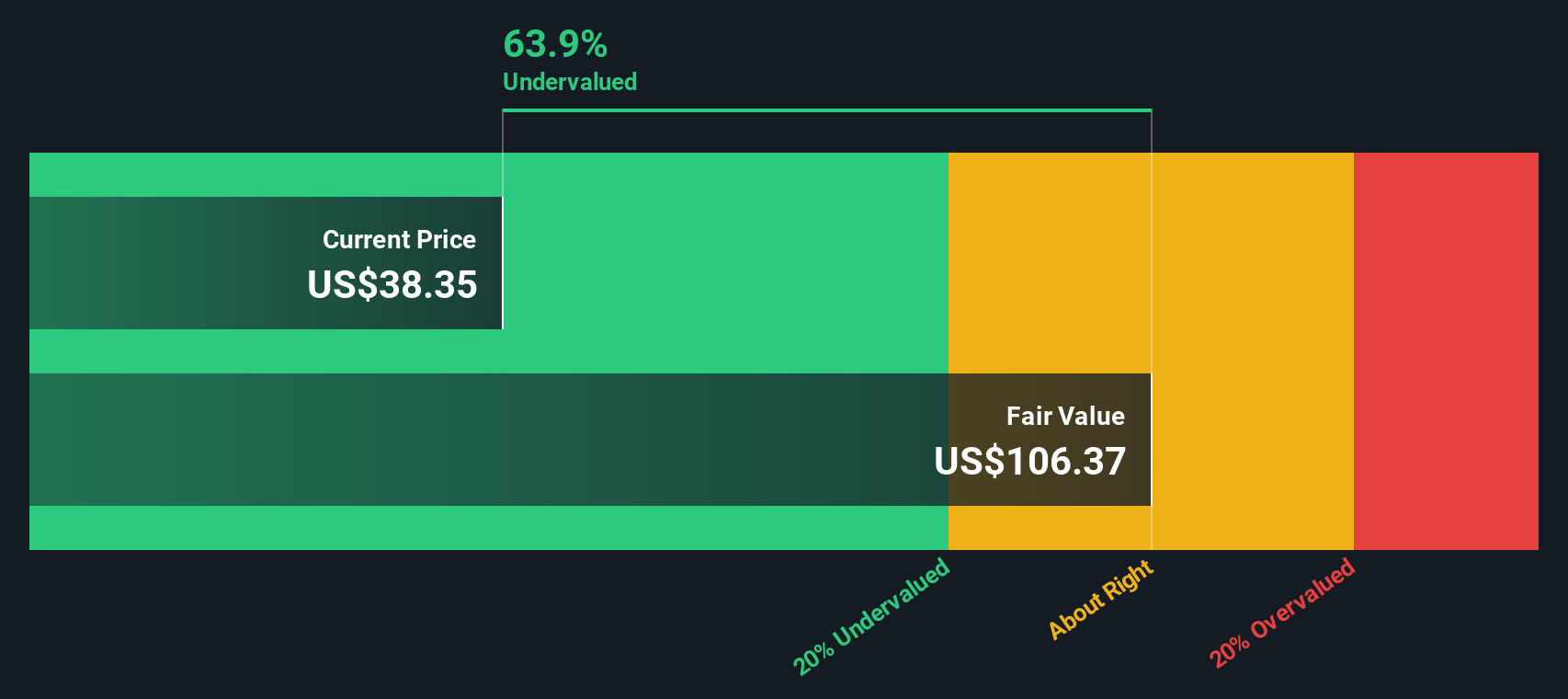

According to this two-stage DCF model, Maplebear’s estimated intrinsic value per share comes out at $94.63. When compared to its current share price, this represents a substantial implied discount of 54.8%, suggesting the stock is significantly undervalued at today’s levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Maplebear is undervalued by 54.8%. Track this in your watchlist or portfolio, or discover 922 more undervalued stocks based on cash flows.

Approach 2: Maplebear Price vs Earnings

For profitable companies like Maplebear, the Price-to-Earnings (PE) ratio is often the go-to valuation metric. This ratio helps investors gauge how much they are paying for each dollar of a company's earnings, making it a useful yardstick for comparing both absolute value and relative performance across peers and the broader industry.

The “right” PE ratio for a company depends on several factors. Higher expected earnings growth, strong profitability, and lower perceived risks typically justify a higher PE. In contrast, slower-growing or riskier companies tend to warrant a lower number. It is all about what investors are willing to pay today for a slice of future profits.

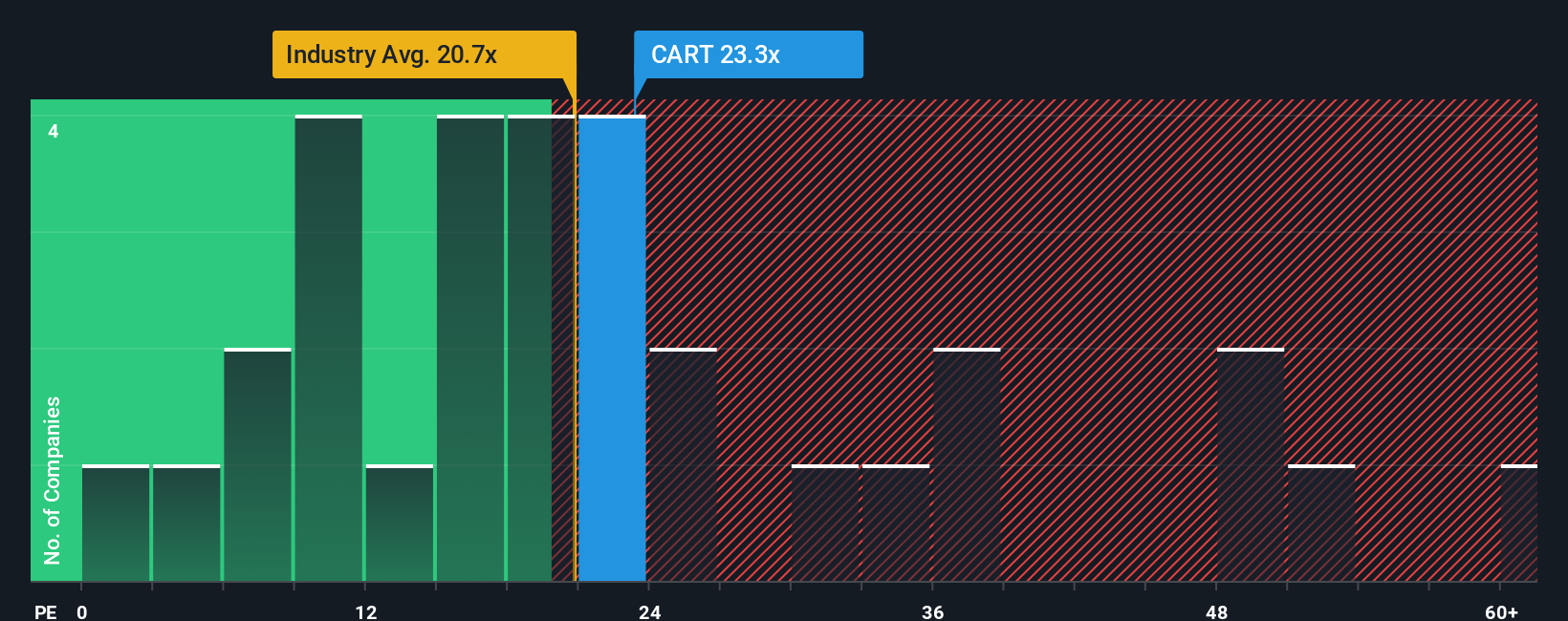

Currently, Maplebear trades at a PE ratio of 22.25x. This is above both the industry average of 20.23x and the peer group average of 19.84x, indicating the market values Maplebear’s earnings above its closest rivals. To provide an even more tailored benchmark, Simply Wall St has developed the “Fair Ratio.” This in-house metric analyzes key factors such as Maplebear’s earnings growth outlook, risk profile, profit margins, industry context, and market cap, delivering a nuanced multiple specifically calibrated for this company.

The Fair Ratio for Maplebear stands at 17.99x. Unlike mere peer or industry comparisons, this ratio aims to answer: What would investors pay for Maplebear, given its strengths and weaknesses in today’s environment? The company’s actual PE ratio of 22.25x is notably higher than its Fair Ratio, suggesting the stock is trading above what is justified by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Maplebear Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, an innovative and dynamic approach to investing now available on Simply Wall St’s Community page.

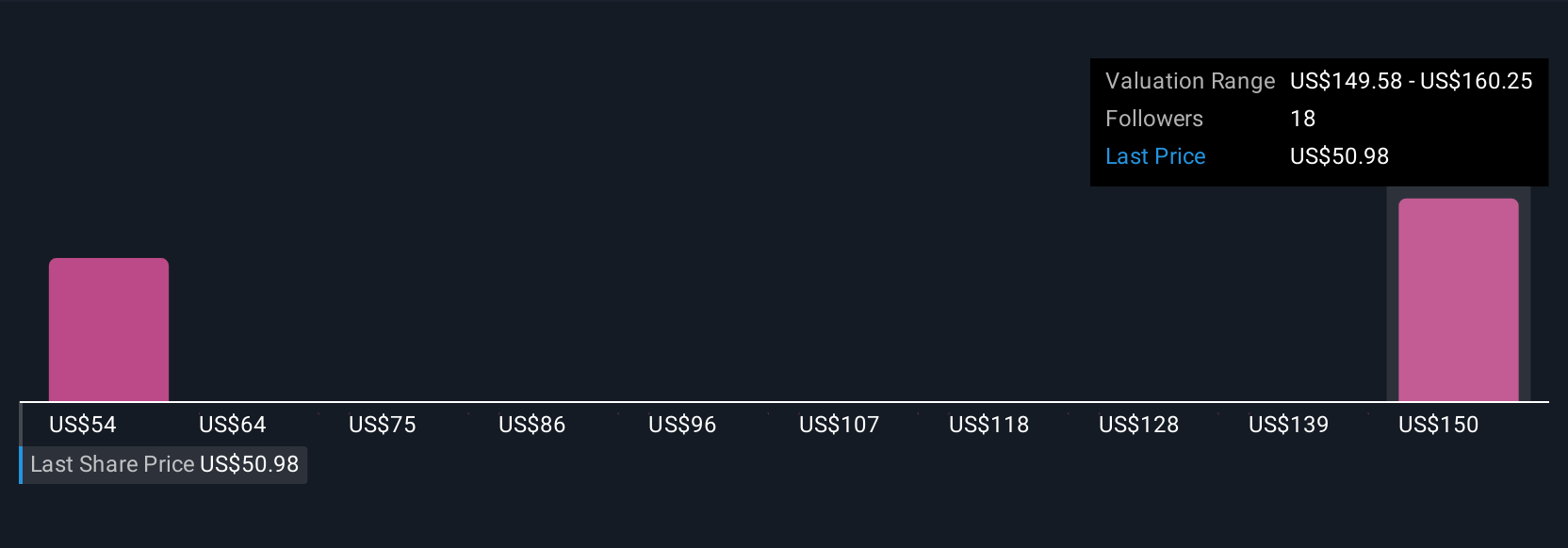

A Narrative is your personal story about a company. It is where investors connect the dots between what they believe about a business’s outlook, their assumptions for revenue, profits, and margins, and their own estimate of fair value.

Narratives give you the power to anchor your point of view in real numbers, linking your beliefs about Maplebear’s future to a live forecast and a calculated fair value, all in one place.

This tool makes investing more accessible and tailored. Anyone can create or follow Narratives relied on by millions of investors, and compare their own fair value with the current market price to decide when to buy or sell.

Even better, Narratives are updated dynamically whenever major news or earnings data changes, so you are always working with the latest analysis.

For Maplebear, for example, some investors believe in resilient technology-driven growth and see fair value above $67 per share, while others emphasize competitive risks and regulatory pressures and set their fair value as low as $42. The Narrative you choose can significantly shape your investment decisions.

Do you think there's more to the story for Maplebear? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CART

Maplebear

Maplebear Inc., doing business as Instacart, engages in the provision of online grocery shopping services to households in North America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026