- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:ANDE

How Investors May Respond To Andersons (ANDE) Renewables Strength and Earnings Beat Amid Share Buyback

Reviewed by Sasha Jovanovic

- Andersons, Inc. recently completed a share buyback and announced strong third-quarter earnings, with sales reaching US$2.68 billion and adjusted earnings per share of US$0.84, surpassing analyst expectations.

- The company's Renewables segment outperformed, supported by full ownership of ethanol plants and the benefit of 45Z clean fuel tax credits, positioning Andersons for further growth in renewable fuels and expanded operational capacity.

- We'll explore how Renewables segment growth and above-estimate earnings update Andersons' investment narrative and future profit outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Andersons Investment Narrative Recap

To be a shareholder in Andersons, Inc., you need to believe in the company's ability to boost profitability by expanding its Renewables segment and capturing regulatory benefits like the 45Z tax credits. The recently completed share buyback underscores management’s confidence, but the most important near-term catalyst remains sustained growth from renewable fuels, while the biggest risk continues to be margin volatility from challenges in core agribusiness. The buyback itself does not materially change short-term risks or drivers.

Among recent announcements, the third-quarter earnings release stands out, with adjusted EPS of US$0.84 topping estimates. This result was fueled largely by Renewables, illustrating how the segment’s performance is crucial to offset headwinds in the traditional agribusiness operations and underpin future growth targets. Still, these earnings were reported alongside a year-over-year decline in net income, signaling the importance of achieving consistency across all business segments.

In contrast, investors should be aware of the potentially significant impact that rising capital expenditures and increased debt from recent acquisitions could have on free cash flow if renewables growth does not meet expectations...

Read the full narrative on Andersons (it's free!)

Andersons' outlook forecasts $13.3 billion in revenue and $186.7 million in earnings by 2028. This is based on analysts projecting 4.8% annual revenue growth and a $106 million increase in earnings from the current level of $80.6 million.

Uncover how Andersons' forecasts yield a $49.84 fair value, in line with its current price.

Exploring Other Perspectives

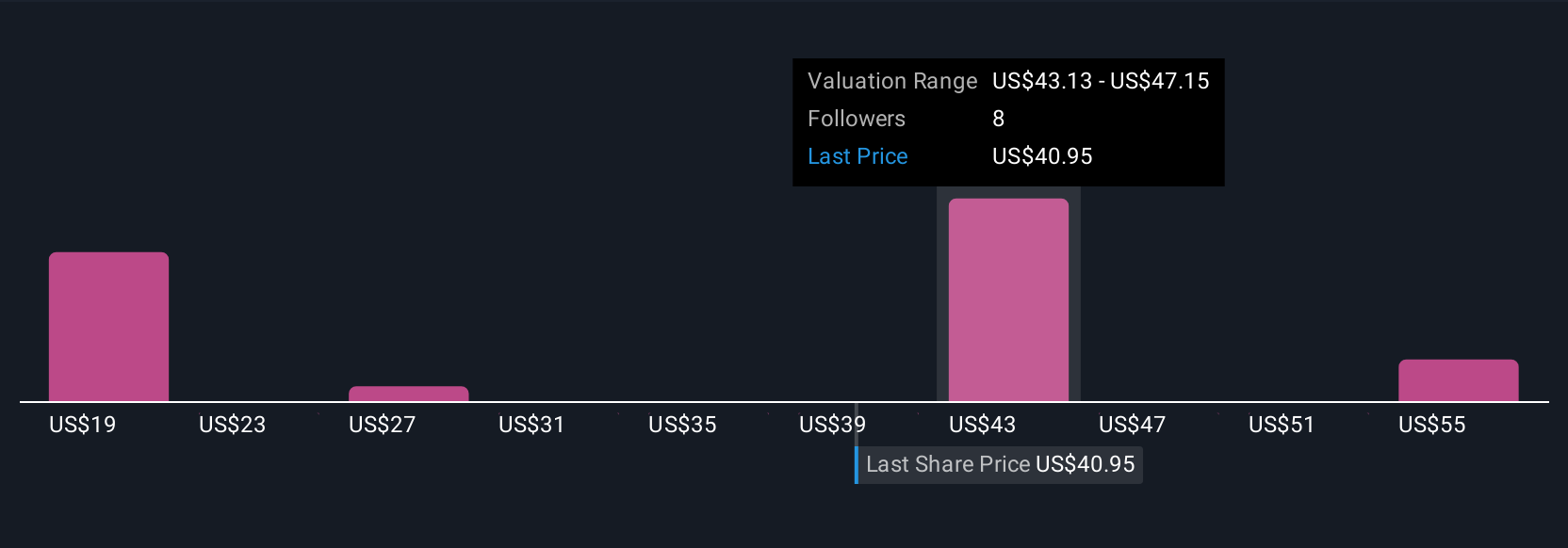

Four fair value estimates from the Simply Wall St Community range from US$17.64 to US$59.24, reflecting widely different growth outlooks. This diversity stands against ongoing margin volatility risks, highlighting why you may want to compare several viewpoints before deciding where Andersons fits in your portfolio.

Explore 4 other fair value estimates on Andersons - why the stock might be worth less than half the current price!

Build Your Own Andersons Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Andersons research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Andersons research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Andersons' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ANDE

Andersons

Operates in trade, renewables, and nutrient and industrial sectors in the United States, Canada, Mexico, Egypt, Switzerland, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives