- United States

- /

- Luxury

- /

- NYSE:VFC

V.F Corporation (VFC): Evaluating Value After Lawsuits and Disappointing Fiscal 2025 Results

Reviewed by Simply Wall St

V.F (VFC) drew widespread attention after the company revealed disappointing fourth quarter and full-year fiscal 2025 results. This prompted a series of securities class action lawsuits. Investors are now taking a closer look at how these developments may impact the stock’s outlook.

See our latest analysis for V.F.

The wave of class action lawsuits and underwhelming financial results have clearly weighed on sentiment, with V.F’s share price falling 30.5% year-to-date and its one-year total shareholder return at negative 24.1%. That said, a recent 14.5% share price rebound over the last 90 days hints that some investors may see value emerging. However, the long-term five-year total return is still deep in the red at minus 79%.

If you’re curious about what’s gaining momentum beyond headline-grabbing stocks, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With such steep declines over recent years, along with a notable bounce in recent months, investors are left to consider whether V.F’s shares now represent a compelling bargain or if expectations for a turnaround are already reflected in the price.

Most Popular Narrative: 6% Undervalued

The most widely followed narrative puts V.F’s fair value at $16, a touch above the last close of $14.97. While this modest premium suggests recovery hopes still linger, investors are keen to see what’s fueling the optimism behind that target.

The strategic focus on expanding higher-margin channels, including direct-to-consumer and e-commerce, is beginning to drive improved gross margins and deeper customer engagement. This is expected to lift both revenue growth and net margins over time as V.F. capitalizes on the sustained consumer shift toward digital and premium shopping experiences.

Want to know the financial engine firing up this value call? The narrative is built around ambitious plans for profits, bold new sales channels, and the potential reshaping of V.F’s future. What are the juicy projections powering this fair value estimate? Unlock the full narrative for details that could surprise you.

Result: Fair Value of $16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness at Vans and ongoing tariff pressures could quickly undermine recovery hopes and lead to renewed valuation pressure for V.F.

Find out about the key risks to this V.F narrative.

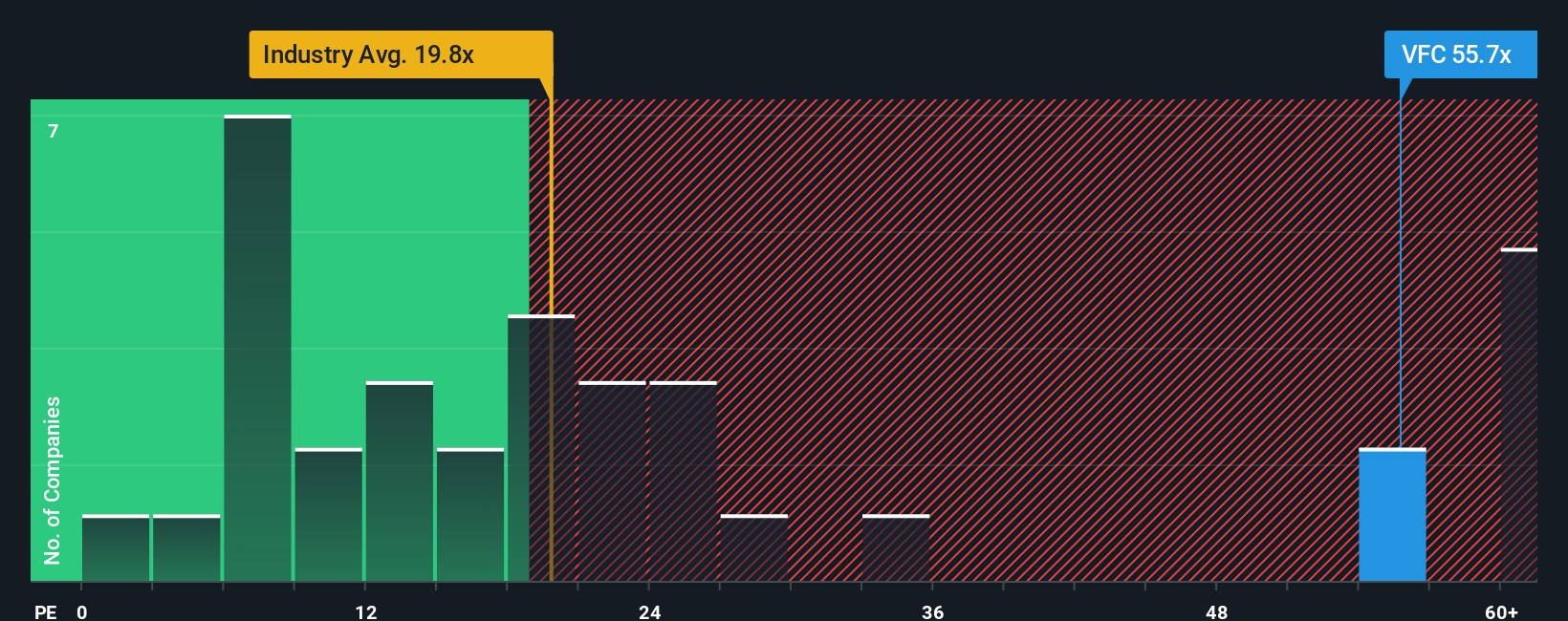

Another View: Price-to-Earnings Sends a Caution Signal

While the fair value calculation paints V.F as attractively priced, a glance at the price-to-earnings ratio tells a different story. Shares currently trade at 63.4 times earnings, far above the peer average of 14.5 and the US Luxury industry’s average of 18.9. The fair ratio, based on regression, sits at just 26.1. This wide gap suggests current optimism in the share price may be running ahead of business fundamentals. Could there be more risk lurking than the valuation headline reveals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own V.F Narrative

If you’re eager to draw your own conclusions or want to challenge the prevailing views, you can dive into the data and craft your own perspective in just a few minutes with Do it your way.

A great starting point for your V.F research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead of the market by scouting fresh opportunities before the crowd. Put your curiosity into action with these handpicked screens and spot what others might miss:

- Uncover promising upstarts by targeting potential growth stories early with these 3589 penny stocks with strong financials, which offer solid financials despite their small size.

- Secure your portfolio with steady cash flow by identifying income opportunities through these 16 dividend stocks with yields > 3%, featuring companies with yields above 3%.

- Ride the momentum of artificial intelligence trends and position yourself at the forefront with these 24 AI penny stocks fueling tomorrow’s innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VFC

V.F

Offers branded apparel, footwear, and accessories for men, women, and children in the Americas, Europe, and the Asia-Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives