- United States

- /

- Consumer Durables

- /

- NYSE:SKY

Will Champion Homes’ New CFO Shift Its Capital Allocation Playbook in Meaningful Ways for SKY?

Reviewed by Sasha Jovanovic

- Champion Homes, Inc. recently announced that former WK Kellogg Co CFO Dave McKinstray will become its Chief Financial Officer, Executive Vice President and Treasurer on January 12, 2026, succeeding long-serving finance leader Laurie Hough, who will stay until May 31, 2026 to support the handover.

- This leadership transition brings in a finance executive with deep experience in manufacturing, consumer products and risk management, potentially influencing how Champion balances growth investments, capital allocation and financial discipline.

- Next, we’ll explore how McKinstray’s appointment could shape Champion Homes’ investment narrative, particularly around future capital allocation and margin focus.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Champion Homes Investment Narrative Recap

To own Champion Homes, you have to believe in long term demand for affordable, factory built housing and the company’s ability to convert that into durable earnings. The McKinstray hire looks more like a continuity move than a shift in the near term, so it does not materially change the key short term catalyst around policy support for manufactured housing or the biggest risk from moderating orders and softer demand in key channels.

The recent guidance that Q3 FY2026 revenue is expected to be flat versus Q3 FY2025 feels especially relevant alongside this CFO transition, because it underlines that execution on margins and cost control may matter more than top line growth for a period. How effectively McKinstray leans into Champion’s process improvements and cost discipline record could influence how investors weigh that flat revenue outlook against the long term affordability-driven demand story.

Yet investors also need to be aware that softer order trends and potential discounting in certain channels could...

Read the full narrative on Champion Homes (it's free!)

Champion Homes' narrative projects $2.8 billion revenue and $228.5 million earnings by 2028. This requires 3.5% yearly revenue growth and an earnings increase of about $11.2 million from $217.3 million today.

Uncover how Champion Homes' forecasts yield a $87.00 fair value, in line with its current price.

Exploring Other Perspectives

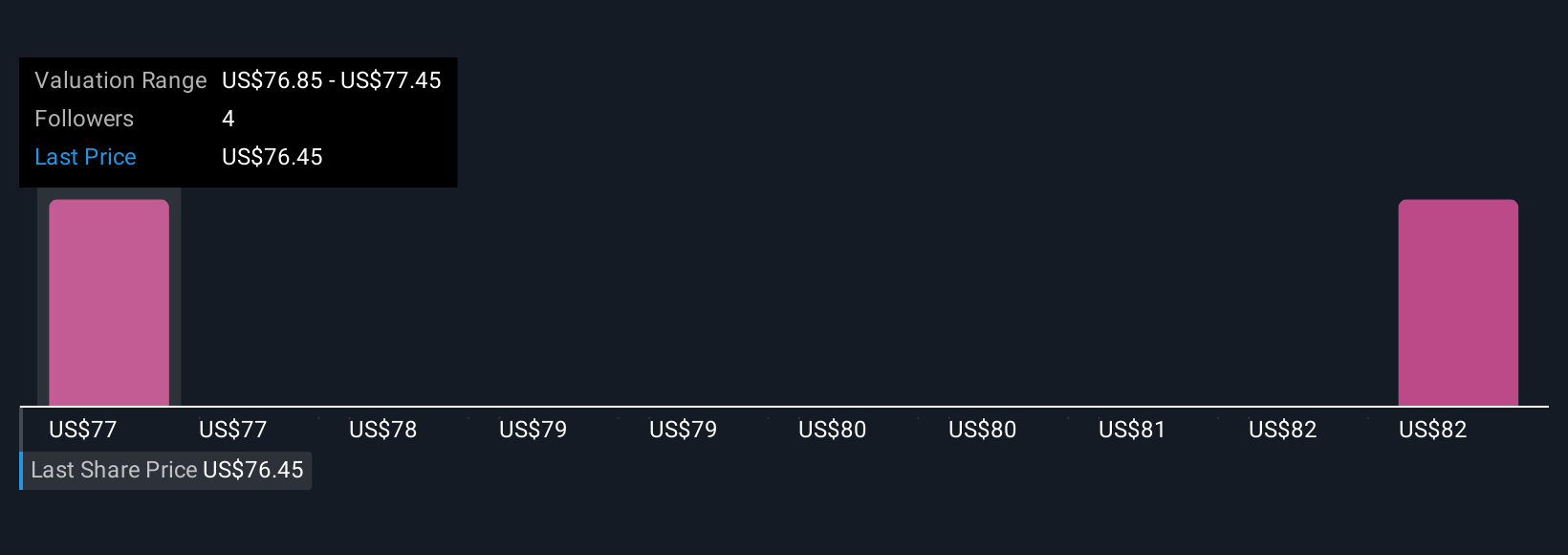

Two members of the Simply Wall St Community currently place Champion’s fair value between US$65.22 and US$87.00, highlighting how far apart individual views can be. When you set that against the risk of moderating order rates and softer demand in certain regions, it becomes even more important to compare several viewpoints before deciding how Champion might fit in your portfolio.

Explore 2 other fair value estimates on Champion Homes - why the stock might be worth 24% less than the current price!

Build Your Own Champion Homes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Champion Homes research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Champion Homes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Champion Homes' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SKY

Champion Homes

Produces and sells factory-built housing in the United States and Canada.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026