- United States

- /

- Luxury

- /

- NYSE:RL

Can Ralph Lauren’s (RL) Cultural Collaborations Reinforce Brand Momentum in a Competitive Market?

Reviewed by Sasha Jovanovic

- Ralph Lauren recently unveiled the Polo Ralph Lauren x TOPA collection, the fourth launch in its Artist in Residence program, highlighting a creative partnership with Indigenous-led brand TOPA for the Fall/Holiday 2025 offering.

- This collaboration not only blends traditional artistry and cultural heritage but also directs a portion of proceeds to support Lakota language and education initiatives.

- We'll consider how this artist-led initiative and cultural collaboration could impact Ralph Lauren's broader investment story and future brand momentum.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Ralph Lauren Investment Narrative Recap

To believe in Ralph Lauren as a shareholder, it’s important to trust in the brand’s enduring appeal, premium pricing power, and ability to capitalize on global consumer trends, especially through innovation and cultural relevance. While the Polo Ralph Lauren x TOPA collection furthers the narrative of brand authenticity and cultural connection, its impact on short-term financial catalysts such as direct-to-consumer digital expansion and Asian market growth is likely limited. The primary risks remain macroeconomic pressures, inflation, and sensitivity to price increases in key markets.

Among this year’s announcements, Ralph Lauren’s latest earnings report stands out, with both sales and net income showing year-on-year growth and the company raising its dividend by 10%. Momentum in core markets and recent international expansion efforts continue to be relevant, as these support revenue diversification and couldhelp offset channel volatility or softer regional demand if macro conditions worsen.

By contrast, investors should be aware that persistent inflation or tariff pressures could still affect consumer sentiment and place unexpected stress on margins if...

Read the full narrative on Ralph Lauren (it's free!)

Ralph Lauren's outlook projects $8.4 billion in revenue and $1.0 billion in earnings by 2028. This scenario assumes a 5.0% annual revenue growth rate and reflects a $205 million increase in earnings from the current $794.7 million.

Uncover how Ralph Lauren's forecasts yield a $366.75 fair value, in line with its current price.

Exploring Other Perspectives

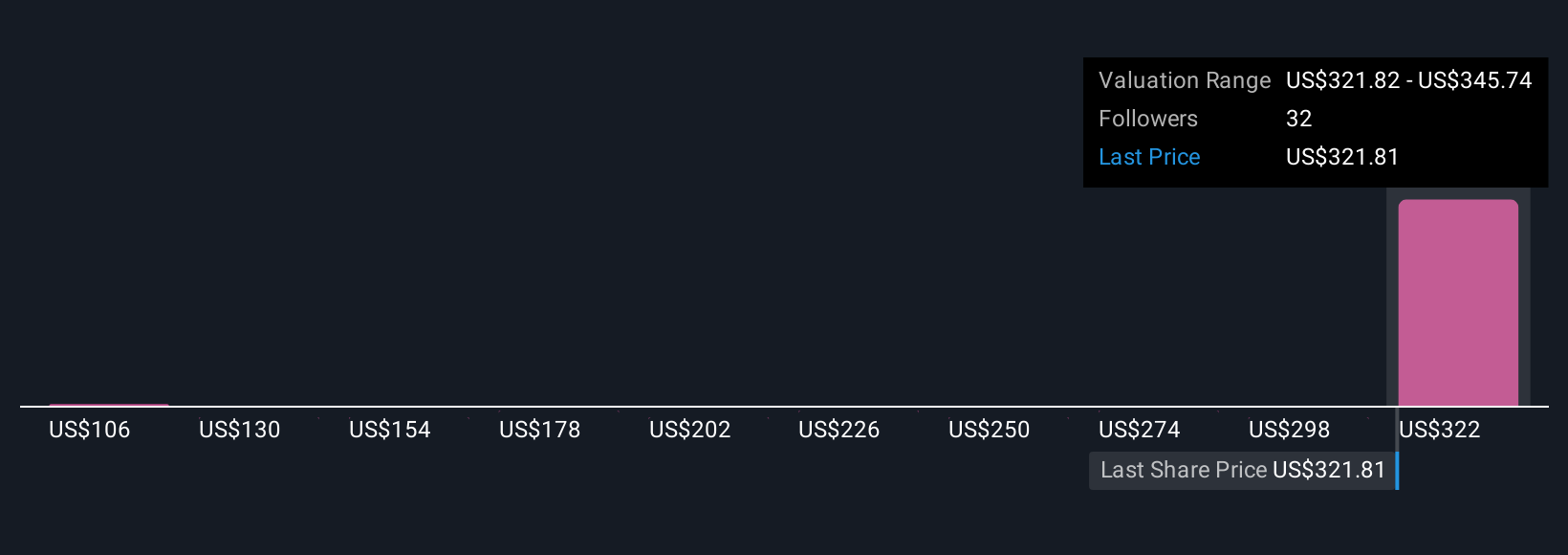

Seven estimates from the Simply Wall St Community put Ralph Lauren’s fair value as low as US$106.47 and as high as US$374.14. Pricing power and premium positioning support brand strength, but as opinions diverge, you have good reason to seek out alternative viewpoints.

Explore 7 other fair value estimates on Ralph Lauren - why the stock might be worth as much as $374.14!

Build Your Own Ralph Lauren Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ralph Lauren research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Ralph Lauren research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ralph Lauren's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RL

Ralph Lauren

Designs, markets, and distributes lifestyle products in North America, Europe, Asia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026