- United States

- /

- Luxury

- /

- NYSE:PVH

How Might PVH's (PVH) CFO Transition Test Management Consistency Amid Earnings Reaffirmation?

Reviewed by Sasha Jovanovic

- In November 2025, PVH Corp. announced the upcoming departure of Chief Financial Officer Zachary Coughlin at year-end, with Executive Vice President Melissa Stone stepping in as interim CFO while a successor is sought.

- This leadership transition comes as PVH reaffirmed its 2025 earnings outlook and introduced a new Chief Supply Chain Officer, highlighting operational continuity amid a challenging retail landscape.

- Now, we'll examine how the reaffirmed 2025 earnings guidance and financial leadership changes might shape PVH's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

PVH Investment Narrative Recap

To own PVH shares, one needs confidence in the company’s ability to maintain resilience through brand strength, operational improvements, and cost discipline, despite global headwinds such as tariff pressures and shifting consumer sentiment. The recent CFO transition and the reaffirmed 2025 earnings outlook signal operational steadiness, suggesting that leadership changes are not expected to materially impact the immediate financial catalysts or magnify existing business risks in the short term.

Among the latest corporate actions, PVH’s appointment of Patricia Gabriel as Chief Supply Chain Officer stands out. This move directly addresses supply chain complexity, a key operational risk, while also supporting ongoing efforts to optimize costs and protect margins, both of which are central to the near-term investment case given ongoing margin pressures and evolving trade dynamics.

However, investors should also be alert to the fact that, against ongoing leadership changes, persistent global tariff risks still threaten PVH’s margin recovery, as ...

Read the full narrative on PVH (it's free!)

PVH's narrative projects $9.4 billion in revenue and $707.7 million in earnings by 2028. This requires 2.3% yearly revenue growth and a $239.2 million increase in earnings from $468.5 million today.

Uncover how PVH's forecasts yield a $96.79 fair value, a 14% upside to its current price.

Exploring Other Perspectives

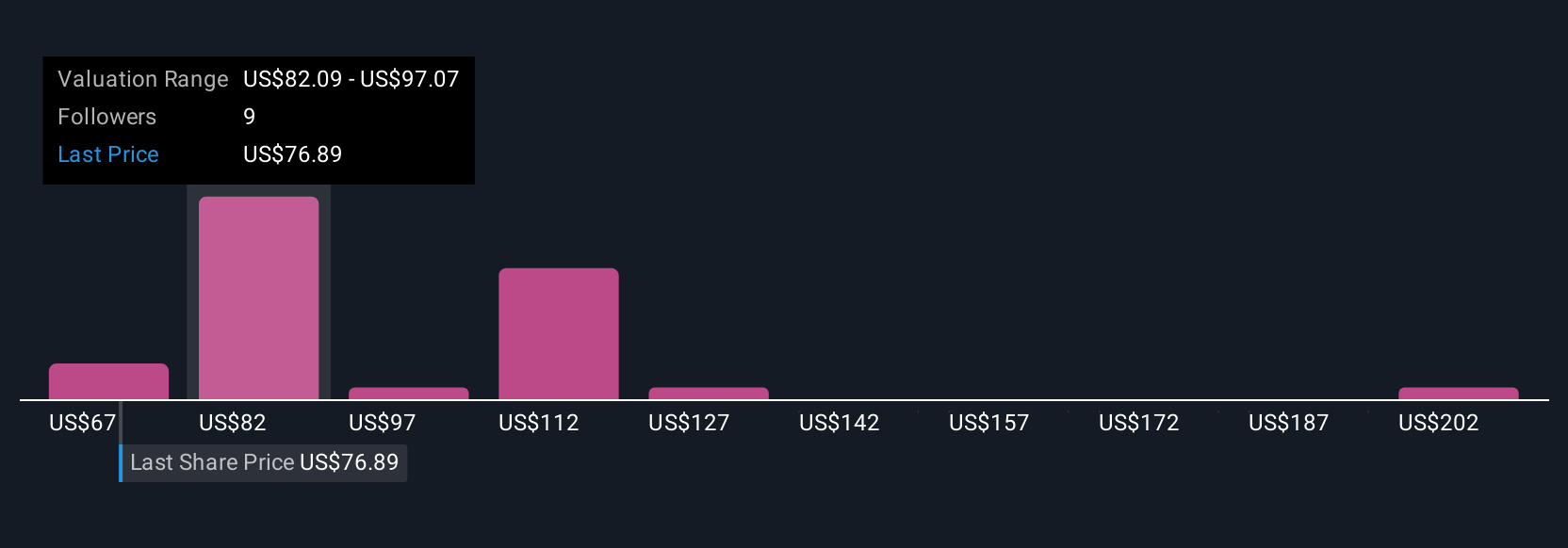

Simply Wall St Community members shared 7 unique fair value estimates for PVH, with a range from US$67.10 to US$216.96 per share. With global tariff pressures still a major risk, these differing views highlight just how much expectations can shift even within a single reporting cycle.

Explore 7 other fair value estimates on PVH - why the stock might be worth 21% less than the current price!

Build Your Own PVH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PVH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PVH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PVH's overall financial health at a glance.

No Opportunity In PVH?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PVH

PVH

Operates as an apparel company in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.