- United States

- /

- Consumer Durables

- /

- NYSE:PHM

PulteGroup (PHM): Evaluating Fair Value After Housing Market Optimism Boosts Homebuilder Stocks

Reviewed by Kshitija Bhandaru

PulteGroup (PHM) has caught the eye of investors after a recent upswing in homebuilder stocks across the sector. The main catalysts include an August spike in Pending Home Sales and a dip in mortgage rates, both factors that have lifted sentiment around the housing market.

See our latest analysis for PulteGroup.

PulteGroup’s share price has gained fresh momentum recently, climbing alongside other homebuilders as optimism rises due to stronger housing data and falling rates. A notable jump came in July, when the stock surged after quarterly results highlighted renewed homebuyer demand. Over the past year, total shareholder return has essentially flatlined, but the stock’s performance over the past three years suggests resilience and long-term growth potential.

If you’re interested in what else is driving markets right now, this is a perfect time to expand your search and discover fast growing stocks with high insider ownership

The question now is whether PulteGroup’s recent gains signal a bargain for investors, or if the market has already built in expectations for future growth, leaving little room for upside.

Most Popular Narrative: 20% Overvalued

PulteGroup’s latest fair value estimate from the most widely followed narrative stands at $137.38, surprisingly close to the last close price of $137.61. Despite the slim discount, the narrative suggests that expectations for growth and margins may already be factored in, creating a potentially limited margin for error.

PulteGroup's strategic expansion and strong performance in active adult communities (Del Webb and Del Webb Explorer), which command higher prices and margins, positions the company to benefit from sustained demand among aging but financially strong demographics. This is likely to support both revenue growth and margin expansion, particularly as these communities come online more fully in 2026.

Curious about what financial levers drive this razor-thin fair value estimate? The key assumption centers on future sales in new markets and a powerful shift in demographic demand. Want the full story behind the numbers? Dive into the full narrative and see how bold forecasts shape this valuation.

Result: Fair Value of $137.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as weakening homebuyer demand and rising input costs could threaten the company’s earnings outlook and challenge current market optimism.

Find out about the key risks to this PulteGroup narrative.

Another Perspective: Multiples Paint a Different Picture

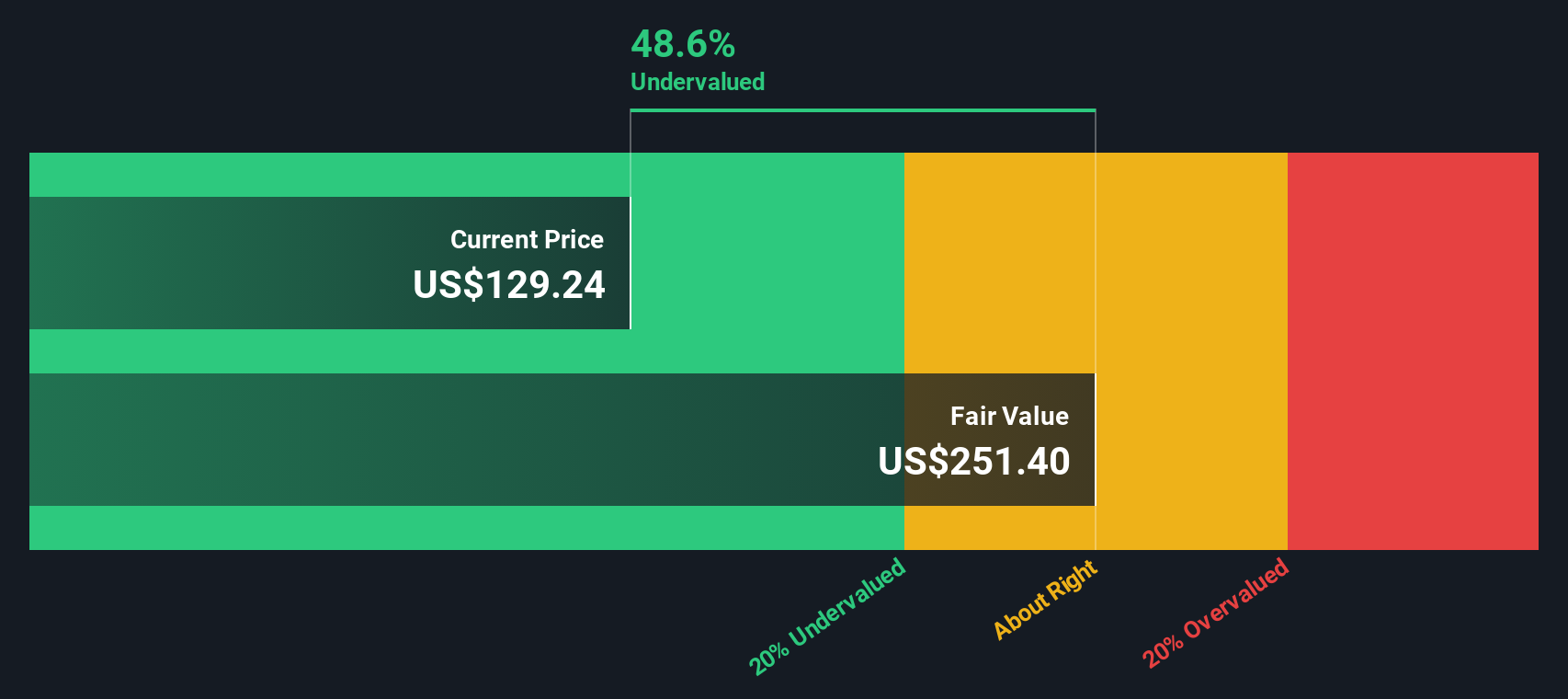

While analyst consensus values PulteGroup at about $137 per share, our SWS DCF model suggests something very different. According to our DCF valuation, the company may actually be trading at a significant discount to its intrinsic worth, potentially offering much more upside than the multiples approach implies. Which measure is the market really following right now?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own PulteGroup Narrative

If you think there’s a different story to tell, or want to shape your own research, it only takes a few minutes to build your narrative. Do it your way

A great starting point for your PulteGroup research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on the market’s most exciting opportunities. Use the Simply Wall Street Screener to jump ahead and spot stocks that could set your portfolio apart.

- Grow your passive income ambitions and see which companies are rewarding shareholders with attractive yields by checking out these 19 dividend stocks with yields > 3%.

- Ride the next technological surge by checking out artificial intelligence disruptors transforming entire industries via these 25 AI penny stocks.

- Get a head start on future trends by scouting early-stage opportunities through these 3568 penny stocks with strong financials before everyone else spots them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHM

PulteGroup

Through its subsidiaries, engages in the homebuilding business in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives