- United States

- /

- Software

- /

- NasdaqGS:APP

3 US Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market continues its rally, with the Dow Jones Industrial Average reaching record highs and the S&P 500 extending its gains, investors are keenly observing growth opportunities amid this bullish environment. In such a thriving market, companies that exhibit strong insider ownership often attract attention due to their potential for robust alignment between management and shareholder interests, making them compelling candidates for growth-focused portfolios.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| Clene (NasdaqCM:CLNN) | 21.6% | 60.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

| BBB Foods (NYSE:TBBB) | 22.9% | 50.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Pagaya Technologies (NasdaqCM:PGY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pagaya Technologies Ltd. is a technology company that utilizes data science and AI-powered technology to serve financial institutions and investors globally, with a market cap of approximately $704.88 million.

Operations: The company's revenue segment is primarily derived from Software & Programming, totaling $970.90 million.

Insider Ownership: 18.9%

Revenue Growth Forecast: 15.8% p.a.

Pagaya Technologies demonstrates potential as a growth company with high insider ownership, despite recent challenges. The company's revenue grew to US$257.23 million in Q3 2024 from US$211.76 million a year ago, though net losses widened to US$67.48 million. Recent debt financing deals totaling $1 billion reflect strong investor demand for its AI-enabled credit assets. However, the company has experienced significant share price volatility and substantial insider selling recently, highlighting possible concerns about future stability and performance.

- Unlock comprehensive insights into our analysis of Pagaya Technologies stock in this growth report.

- Upon reviewing our latest valuation report, Pagaya Technologies' share price might be too pessimistic.

AppLovin (NasdaqGS:APP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppLovin Corporation operates a software-based platform designed to help advertisers improve the marketing and monetization of their content both in the United States and internationally, with a market cap of approximately $111.86 billion.

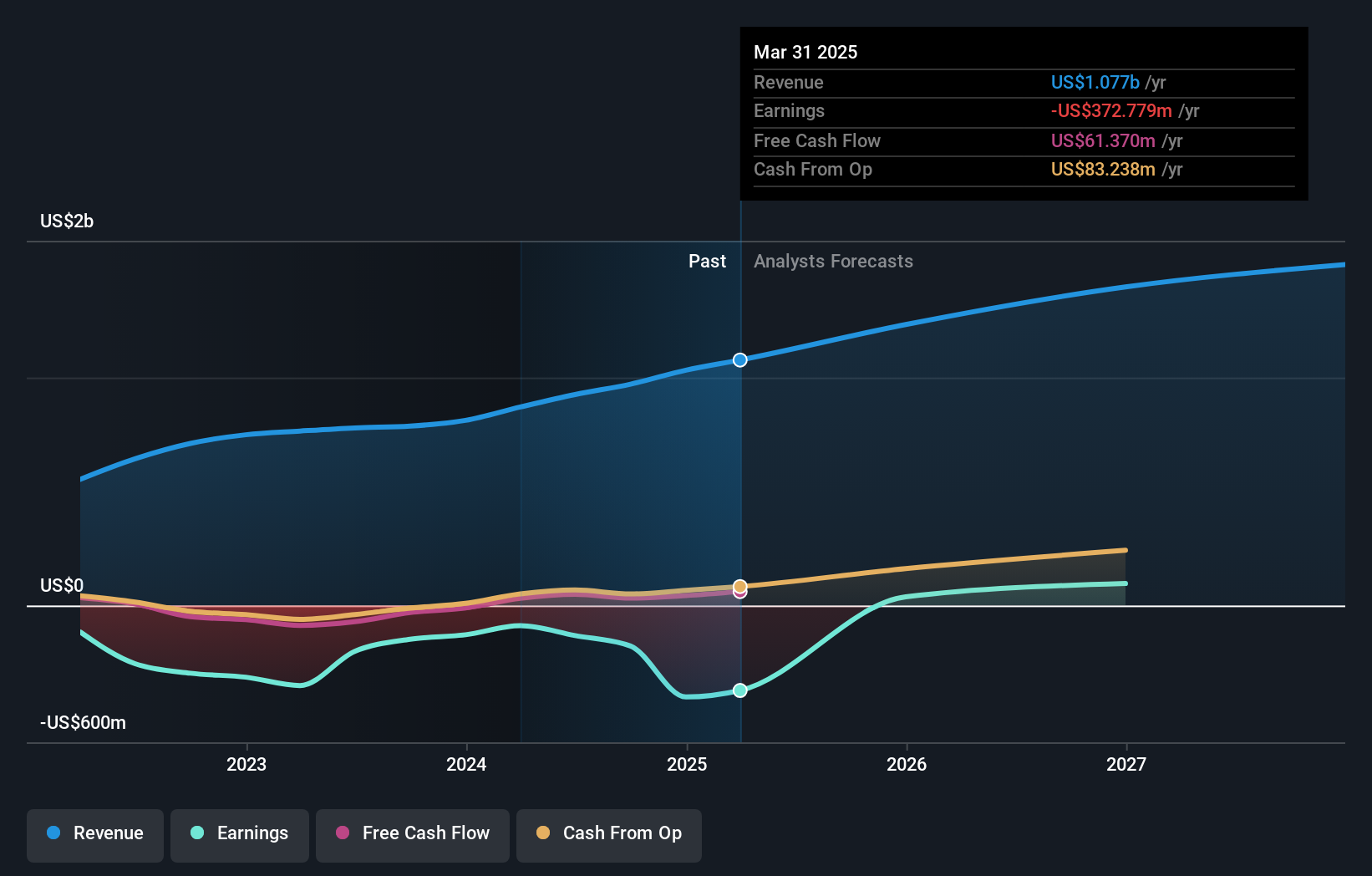

Operations: The company generates revenue through its Apps segment, which accounts for $1.49 billion, and its Software Platform segment, contributing $2.80 billion.

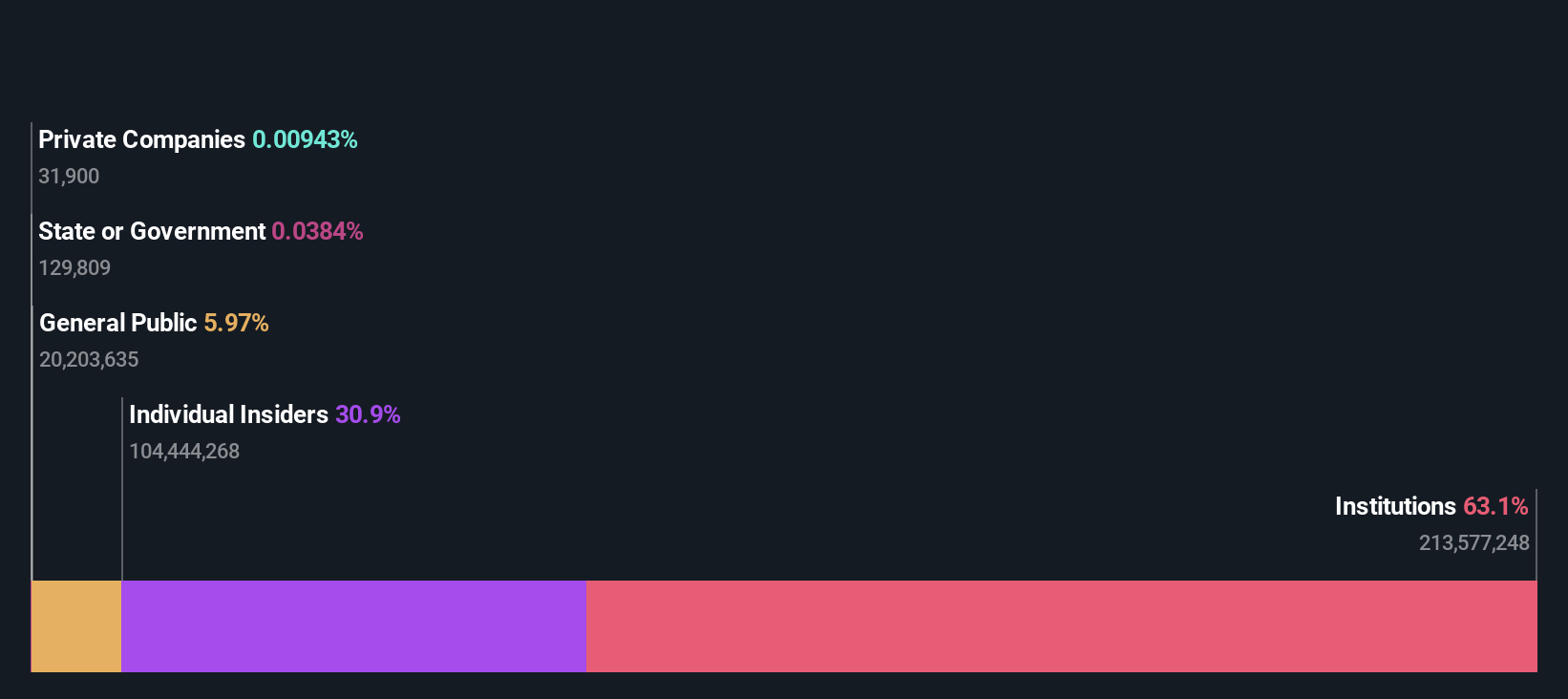

Insider Ownership: 35.9%

Revenue Growth Forecast: 18.3% p.a.

AppLovin shows strong growth potential with high insider ownership, evidenced by its substantial earnings increase of over 1000% in the past year. Despite a volatile share price and high debt levels, the company is trading below its estimated fair value. Recent financial maneuvers include a $999.62 million fixed-income offering and strategic buybacks totaling $2.4 billion, indicating robust capital management. Additionally, AppLovin's revenue and earnings are projected to grow significantly faster than the US market average.

- Click to explore a detailed breakdown of our findings in AppLovin's earnings growth report.

- Our valuation report here indicates AppLovin may be overvalued.

On Holding (NYSE:ONON)

Simply Wall St Growth Rating: ★★★★★★

Overview: On Holding AG is involved in the development and distribution of sports products globally, with a market cap of approximately $18.61 billion.

Operations: The company generates revenue primarily from its Athletic Footwear segment, which accounts for CHF 2.16 billion.

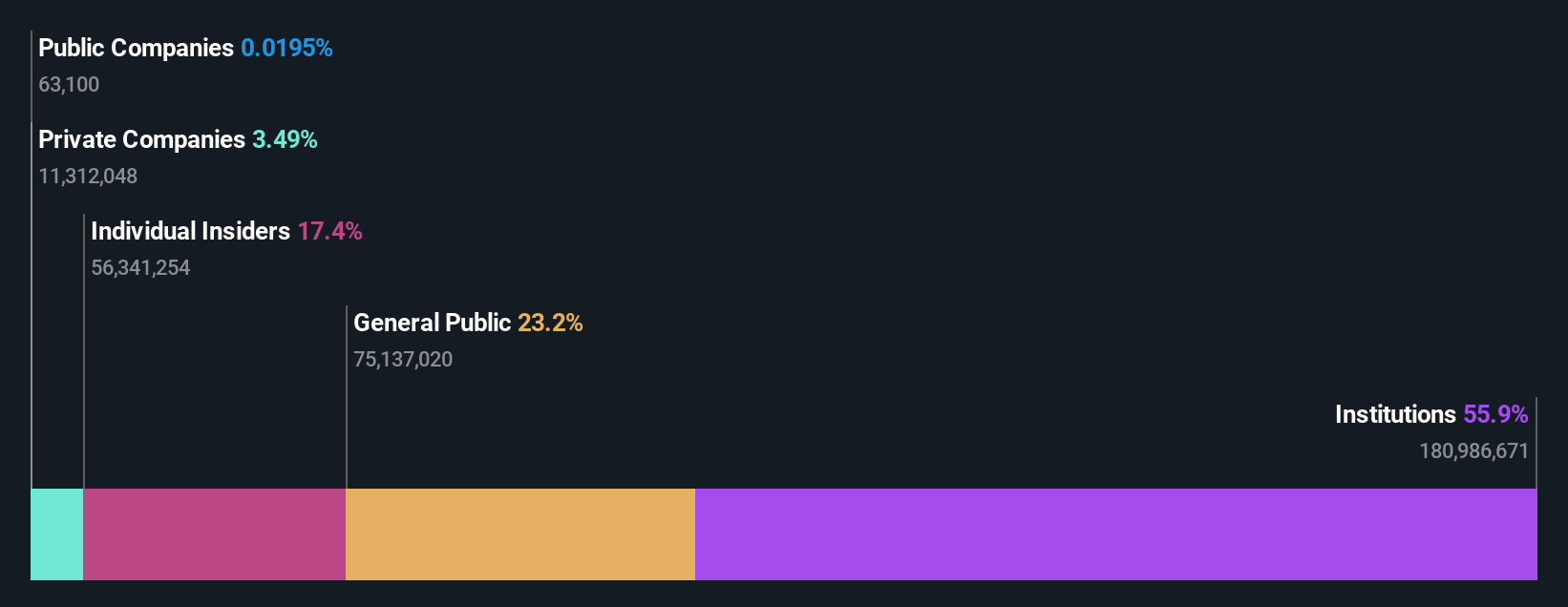

Insider Ownership: 19.1%

Revenue Growth Forecast: 20% p.a.

On Holding exhibits promising growth prospects with high insider ownership, supported by a 57.7% earnings increase over the past year and revenue forecast to grow at 20% annually, outpacing the US market. The company recently raised its financial guidance for 2024, projecting net sales of at least CHF 2.29 billion due to strong third-quarter results. Despite a decrease in quarterly net income to CHF 30.5 million, On Holding's long-term growth trajectory remains robust.

- Get an in-depth perspective on On Holding's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility On Holding's shares may be trading at a premium.

Turning Ideas Into Actions

- Unlock our comprehensive list of 206 Fast Growing US Companies With High Insider Ownership by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.