- United States

- /

- Leisure

- /

- NYSE:MODG

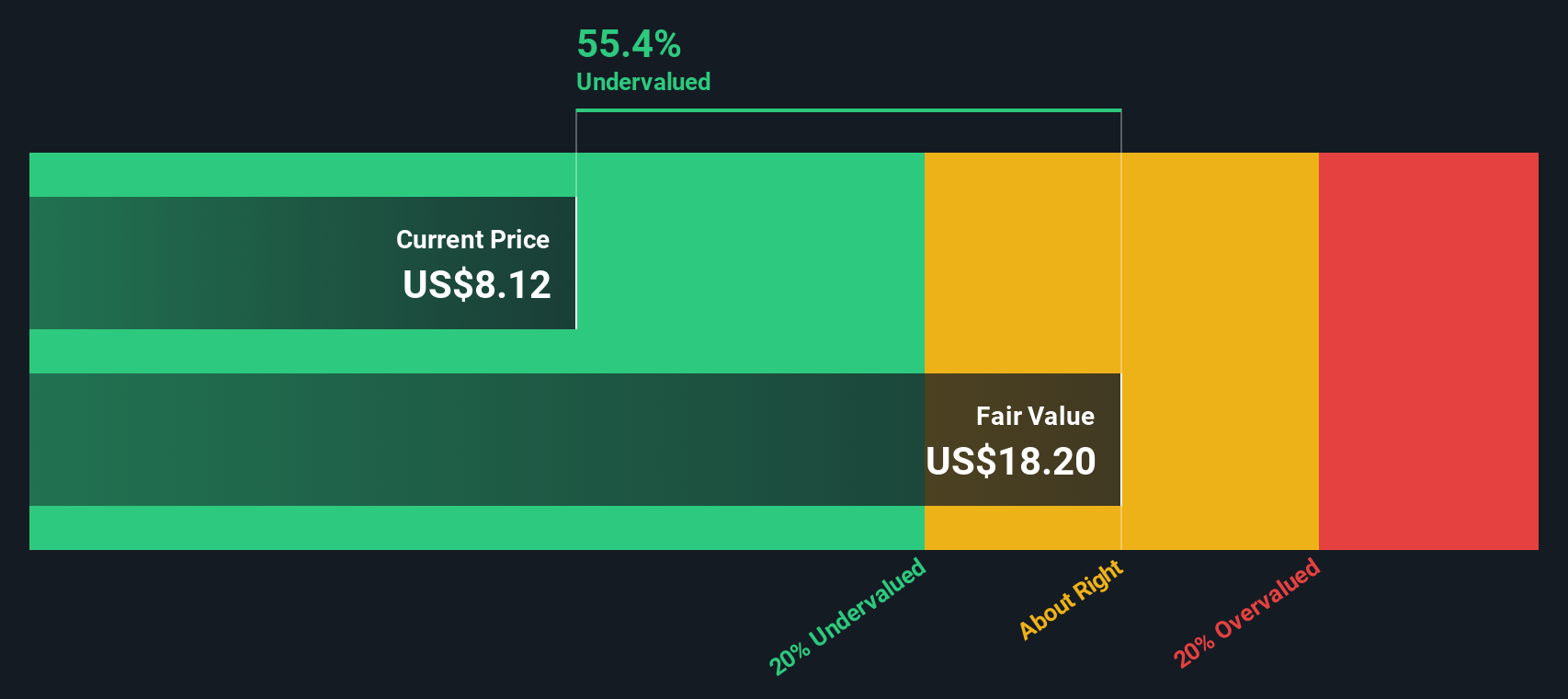

Is Topgolf Callaway Brands (MODG) Still Undervalued After Recent Rally? A Fresh Look at Valuation

Reviewed by Simply Wall St

See our latest analysis for Topgolf Callaway Brands.

Momentum has been building for Topgolf Callaway Brands, as shown by its 25.95% total shareholder return over the past year. This comes after a long stretch of underperformance. Recent share price gains suggest investors are growing more optimistic about its turnaround potential and future growth story.

If you're interested in uncovering other market trends, now might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the recent rally pushing shares higher, investors are left to wonder if Topgolf Callaway Brands is truly undervalued at current levels, or if the market has already priced in a full recovery and future growth prospects.

Most Popular Narrative: 4.3% Undervalued

Topgolf Callaway Brands’ most closely followed narrative sets its fair value at $11.06, just above the last close of $10.58. This small margin positions the stock as moderately undervalued, creating an interesting dynamic between current optimism and future expectations.

The successful rollout of digital technology and new point-of-sale systems across Topgolf venues is enabling higher spend per visit, better customer experience, and increasing operating efficiencies. This points to improved net margins and enhanced ancillary revenues over time.

Want to know exactly why the narrative’s target is above today’s price? This story is powered by aggressive revenue acceleration, margin upgrades, and profitability assumptions rarely seen in this sector. Which financial drivers enable that fair value? The full narrative exposes the projections you might not expect.

Result: Fair Value of $11.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still risks that could disrupt this trajectory, such as ongoing margin pressures and uncertainty regarding a potential Topgolf spin-off or sale.

Find out about the key risks to this Topgolf Callaway Brands narrative.

Another View: Discounted Cash Flow Tells a Different Story

Despite the consensus that Topgolf Callaway Brands is moderately undervalued based on fair value estimates, the SWS DCF model offers a contrasting perspective. According to this method, the current share price actually exceeds its calculated fair value. This suggests the stock may be more expensive than it appears. Which approach best captures the real risk and opportunity here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Topgolf Callaway Brands for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Topgolf Callaway Brands Narrative

If you’d like to dig deeper or want to analyze Topgolf Callaway Brands from your own perspective, you can generate your own view in just a few minutes. Do it your way.

A great starting point for your Topgolf Callaway Brands research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize your edge by investigating stocks with serious upside, stable income, or game-changing technology. Your next opportunity might already be on our radar. Don’t wait for the crowd to catch up and leave you behind.

- Jump into fast-growing healthcare innovation and browse these 31 healthcare AI stocks, which are redefining medicine and diagnostics through artificial intelligence and cutting-edge data science breakthroughs.

- Capture reliable income streams by checking out these 15 dividend stocks with yields > 3%, offering strong yields and a track record of rewarding shareholders.

- Ride the wave of high potential tech by scouting these 27 AI penny stocks, pushing the boundaries in automation, machine learning, and digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topgolf Callaway Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MODG

Topgolf Callaway Brands

Designs, manufactures, and sells golf equipment, golf and lifestyle apparel, and other accessories in the United States, Europe, Asia, and Internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives