- United States

- /

- Consumer Durables

- /

- NYSE:MHO

Evaluating M/I Homes (MHO) Valuation: What Recent Share Price Trends Reveal for Investors

Reviewed by Simply Wall St

See our latest analysis for M/I Homes.

While M/I Homes’ share price has faced some renewed pressure lately, this comes on the back of a year when housing names broadly cooled off. Despite a recent 1-day loss, what really stands out is the company’s three- and five-year total shareholder returns, both soaring near 194%. This shows that long-term momentum remains impressive even as short-term sentiment wobbles.

If market shifts in housing stocks have you rethinking your own approach, now's an interesting time to broaden your perspective and discover fast growing stocks with high insider ownership

That leaves investors facing a classic dilemma. Is M/I Homes an undervalued sleeper stock ready for a rebound, or is the market already factoring in every bit of its future growth potential?

Most Popular Narrative: 20.4% Undervalued

At $128.99, the current share price sits well below the widely followed narrative fair value estimate of $162. This gap puts the spotlight on whether the market is missing long-term upside catalysts for M/I Homes.

Strategic expansion in high-demand regions, a robust land position, and operational discipline position the company for outsized growth and market share gains as housing demand improves. A strong balance sheet and proactive cost management provide financial stability and downside protection, setting the stage for potential earnings outperformance as market conditions normalize.

Why are analysts so bullish? There is a core set of assumptions driving this bold estimate, from ramping community expansion to expectations for future profit resilience. A key question is how ambitious the margin and growth forecasts are. What results are being projected, and can reality keep up? See which major factors drive the target value and consider whether you agree.

Result: Fair Value of $162 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent interest rate pressures or a continued drop in new home contracts could challenge the optimistic outlook and put pressure on future growth.

Find out about the key risks to this M/I Homes narrative.

Another View: SWS DCF Model Raises Questions

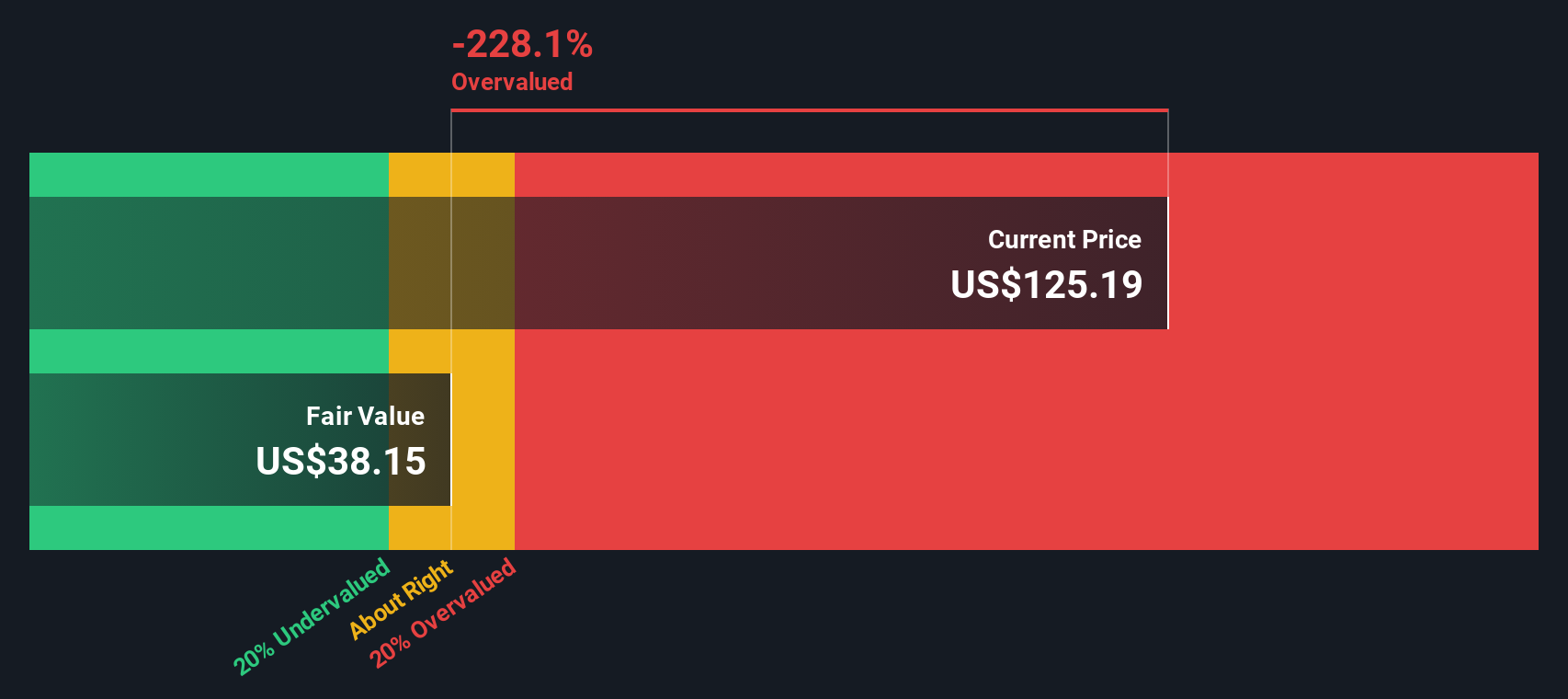

While analyst consensus points to M/I Homes being undervalued, our SWS DCF model paints a starkly different picture. According to this discounted cash flow approach, the company appears significantly overvalued, with its current price coming in well above what intrinsic cash flows might justify. Such a wide gap between models highlights real uncertainty. Could the more cautious DCF estimate be capturing market risks others are missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out M/I Homes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own M/I Homes Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a couple of minutes to shape an independent view. Do it your way

A great starting point for your M/I Homes research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to get ahead by finding unique opportunities beyond M/I Homes. Shape your portfolio with focused stock ideas you can act on right now.

- Tap into tomorrow’s technology wave by adding smart picks from these 27 AI penny stocks, where leaders in artificial intelligence are setting the pace for future gains.

- Unlock income potential by choosing from these 14 dividend stocks with yields > 3%, featuring companies with attractive yields and a track record of rewarding their shareholders.

- Position yourself early with these 3585 penny stocks with strong financials, highlighting financially strong prospects that could offer outsize returns before mainstream attention hits.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MHO

M/I Homes

Engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives