- United States

- /

- Consumer Durables

- /

- NYSE:MHK

Why Mohawk Industries (MHK) Is Up 5.4% After Beating Q3 Estimates and Announcing CFO Transition

Reviewed by Sasha Jovanovic

- Mohawk Industries recently reported third quarter 2025 results that topped analyst estimates, with adjusted earnings per share of US$2.67 and revenue of US$2.76 billion, and announced Chief Financial Officer James F. Brunk will retire in April 2026 to be succeeded by Nicholas P. Manthey.

- This period also saw insider activity from Helen Suzanne and brings significant leadership transition at a time of strong operational performance for the company.

- We'll consider how the combination of a CFO transition and standout quarterly results may reshape Mohawk Industries’ investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Mohawk Industries Investment Narrative Recap

To be a shareholder in Mohawk Industries, you need to believe in a recovery for global housing and flooring demand, along with the company's capacity to improve margins through innovation, operational transformation, and sustainability. The recent Q3 2025 results that outpaced analyst expectations reinforce this narrative, and while the announced CFO transition is significant, it does not materially alter the near-term catalysts or the most pressing risk: persistently weak demand due to subdued remodeling and new construction activity.

The announcement of James F. Brunk’s planned retirement as CFO and the appointment of Nicholas P. Manthey is the most relevant update, reflecting ongoing leadership evolution at Mohawk. This event comes as the company aims to leverage recent operational gains amidst challenging sector conditions, providing continuity and perhaps new perspective as Mohawk looks to address its core demand shortfall.

By contrast, investors should be aware that even strong quarterly results do not shield the company from the impact of ongoing weak consumer demand and...

Read the full narrative on Mohawk Industries (it's free!)

Mohawk Industries' outlook anticipates $11.5 billion in revenue and $827.2 million in earnings by 2028. This is based on a 2.5% annual revenue growth rate and an increase in earnings of $352.9 million from current earnings of $474.3 million.

Uncover how Mohawk Industries' forecasts yield a $138.12 fair value, a 19% upside to its current price.

Exploring Other Perspectives

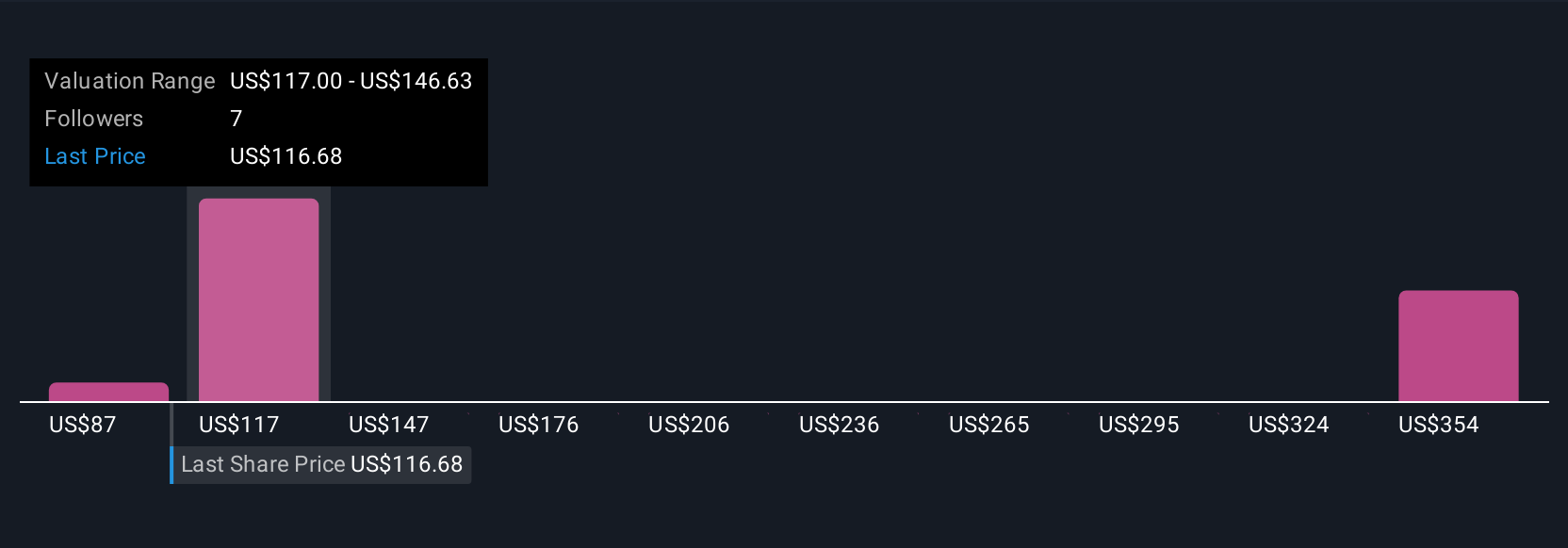

Three separate fair value estimates from the Simply Wall St Community put Mohawk’s share worth between US$87.37 and US$165.05. Analyst consensus still highlights persistent softness in the residential market as a key challenge, so consider how differently market participants can interpret the same set of risks and opportunities.

Explore 3 other fair value estimates on Mohawk Industries - why the stock might be worth as much as 42% more than the current price!

Build Your Own Mohawk Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mohawk Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Mohawk Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mohawk Industries' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MHK

Mohawk Industries

Designs, manufactures, sources, distributes, and markets flooring products for residential and commercial remodeling, and new construction channels in the United States, Europe, Latin America, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026