- United States

- /

- Consumer Durables

- /

- NYSE:LEN

Did Lennar's (LEN) Fixed-Income Exchange Offer Just Shift Its Capital Structure and Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Lennar Corporation announced a Fixed-Income Exchange Offer involving 33,298,764 Class A Common Stock shares, representing a notable move in the company's financial strategy.

- This transaction signals a significant adjustment to Lennar's capital structure, which could have material implications for investor perception and the company's financing flexibility.

- We'll examine how Lennar’s recent fixed-income exchange offer may influence its ongoing capital structure and the broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Lennar Investment Narrative Recap

To invest in Lennar today, you need to believe the company can sustain strong homebuilding volumes, manage margins despite headwinds, and leverage its asset-light model even as earnings are expected to decline in the next few years. The recent Fixed-Income Exchange Offer is an adjustment to Lennar’s capital structure, but does not materially change the near-term narrative, where higher mortgage rates and pressured consumer confidence continue to represent key risks to revenue and net margin potential.

Among recent announcements, Lennar’s continued quarterly dividends, most recently $0.50 per share declared in October, reflect ongoing efforts to return capital to shareholders and reinforce confidence in the company’s ability to generate strong cash flow. This commitment to shareholder returns becomes particularly relevant as management pursues more flexible financing options, aiming to maintain stability in an uncertain housing market.

However, against this, the risk of prolonged elevated mortgage rates remains a factor investors should keep a close eye on...

Read the full narrative on Lennar (it's free!)

Lennar's narrative projects $40.2 billion revenue and $2.5 billion earnings by 2028. This requires 4.3% annual revenue growth and a $0.7 billion earnings decrease from current earnings of $3.2 billion.

Uncover how Lennar's forecasts yield a $127.50 fair value, a 3% upside to its current price.

Exploring Other Perspectives

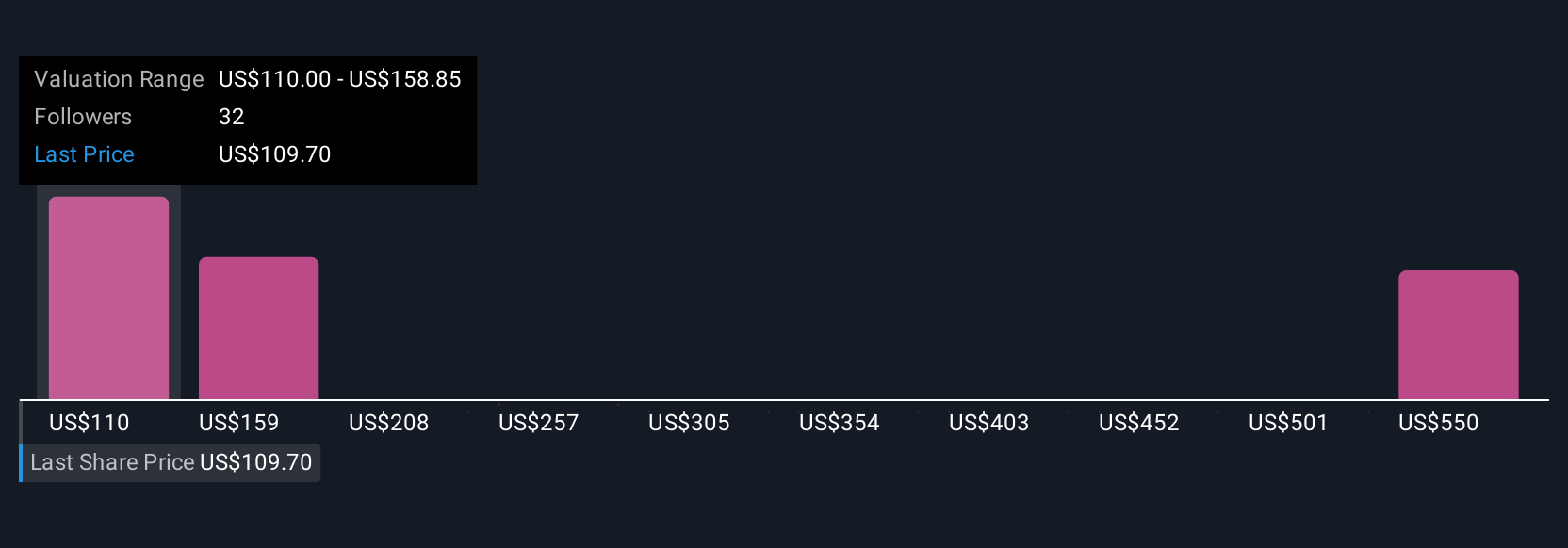

Seven Simply Wall St Community members estimate Lennar's fair value between US$80.84 and US$162.49 per share. Their wide range of opinions highlights how shifting mortgage rates could impact Lennar's future earnings and investor sentiment.

Explore 7 other fair value estimates on Lennar - why the stock might be worth as much as 31% more than the current price!

Build Your Own Lennar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennar research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Lennar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennar's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LEN

Lennar

Operates as a homebuilder primarily under the Lennar brand in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives