- United States

- /

- Consumer Durables

- /

- NYSE:KBH

Is KB Home’s (KBH) Energy‑Efficient Expansion Deepening Its Competitive Moat or Stretching Its Strategy?

Reviewed by Sasha Jovanovic

- In recent weeks, KB Home announced the grand openings of four new communities in Washington, Florida and Orlando, featuring personalized, ENERGY STAR® certified homes with modern layouts and family-focused amenities priced from the low US$300,000s to around US$970,000.

- These launches highlight KB Home’s emphasis on customer customisation, energy efficiency and expansion into diverse, employment-rich markets, reinforcing its positioning as a highly rated national homebuilder.

- Next, we’ll examine how KB Home’s new Washington and Florida communities, especially their energy-efficient designs, influence its existing investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

KB Home Investment Narrative Recap

To own KB Home, you need to believe it can convert its customer-centric, energy efficient communities into steady demand despite softer housing conditions and guiding lower 2025 revenues. The newest Washington and Florida openings do not materially change the near term picture, where the key catalyst remains faster build times and better inventory turns, while the main risk is that weaker consumer confidence and regional pricing pressure keep weighing on orders and margins.

Among the recent announcements, the McCormick Trails community near major employers in Tacoma, Bremerton and Seattle looks most aligned with KB Home’s focus on employment rich markets and faster sales cycles. Its ENERGY STAR certified, personalization driven product in an amenity rich master plan shows how the company is trying to support demand and pricing power even as it faces a softer overall selling environment in places like Florida.

Yet while the new communities look attractive, investors should also be aware of how regional price cuts and softer consumer confidence could still weigh on KB Home’s...

Read the full narrative on KB Home (it's free!)

KB Home's narrative projects $6.8 billion revenue and $496.4 million earnings by 2028. This implies a 0.2% yearly revenue decline and an earnings decrease of about $125 million from $621.5 million today.

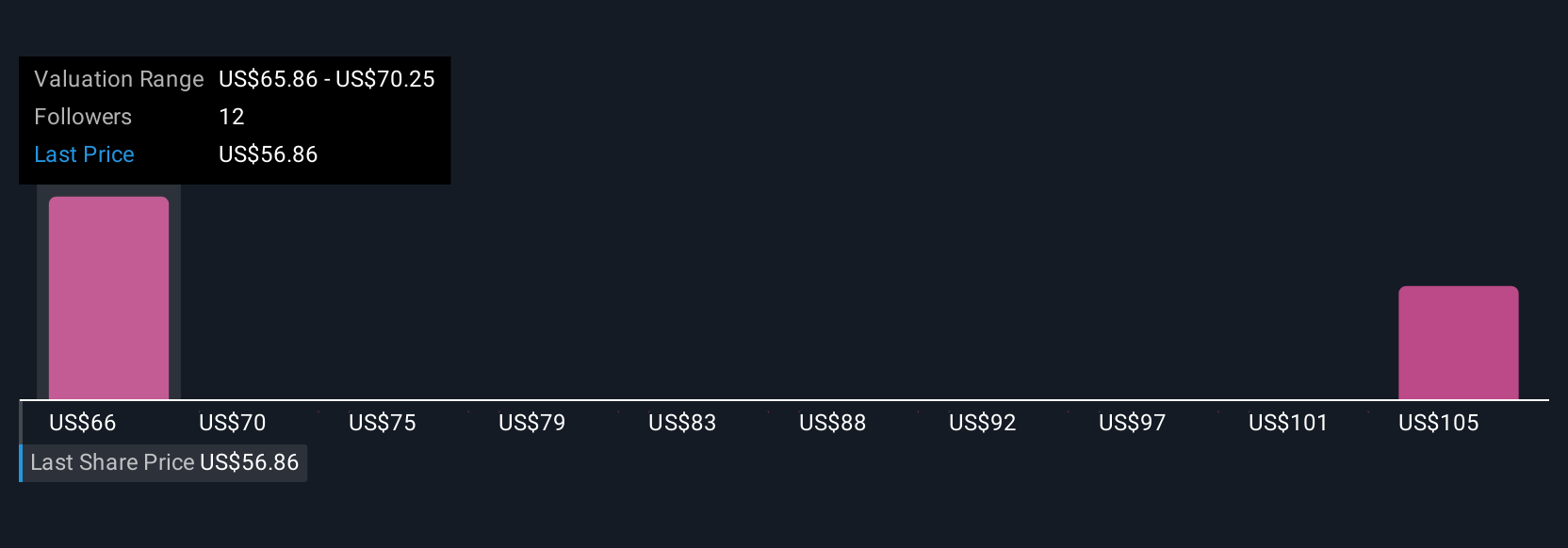

Uncover how KB Home's forecasts yield a $64.67 fair value, in line with its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range from about US$47 to over US$172,000, underlining how far apart individual views can be. When you set those against KB Home’s softer 2025 revenue guidance and pressure from slower homebuying decisions, it becomes clear why you may want to compare several viewpoints before forming your own view on the stock.

Explore 4 other fair value estimates on KB Home - why the stock might be a potential multi-bagger!

Build Your Own KB Home Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KB Home research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free KB Home research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KB Home's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KB Home might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KBH

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026