- United States

- /

- Consumer Durables

- /

- NYSE:GRBK

How Trophy’s Texas Expansion And Cheaper Lots At Green Brick Partners (GRBK) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Green Brick Partners recently reported that its Trophy brand is driving expansion in Texas, including a move into the Houston market, while operational improvements such as faster build cycles, steadier labor, and lower material costs are helping sustain sales despite broader housing headwinds.

- An interesting angle is how a growing pipeline of low-cost lots and a broader mortgage presence may give Green Brick extra pricing flexibility and support buyer affordability as conditions remain challenging.

- We’ll now examine how this Texas and Houston expansion, underpinned by low-cost lot availability, may influence Green Brick Partners’ investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Green Brick Partners Investment Narrative Recap

To own Green Brick Partners, you need to believe the company can keep converting its Texas footprint, especially Trophy’s growth, into steady closings and margins despite housing affordability pressures. The latest update on Houston expansion and build-cycle efficiencies supports the near term sales catalyst, but does not remove the overarching risk that weaker demand or deeper discounting could pressure recent profitability trends.

Among recent announcements, the Q3 2025 results stand out, with revenue of US$499.09 million and diluted EPS of US$1.77, both down year on year. That context makes the Texas expansion and low cost lot pipeline particularly important, as they may help offset margin pressure and softer earnings while the company works through a more challenging housing backdrop.

Yet, while the Trophy-driven expansion may help sustain volumes, investors should also be aware that...

Read the full narrative on Green Brick Partners (it's free!)

Green Brick Partners’ narrative projects $2.0 billion revenue and $252.1 million earnings by 2028. This implies a 2.1% yearly revenue decline and a $95.0 million earnings decrease from $347.1 million today.

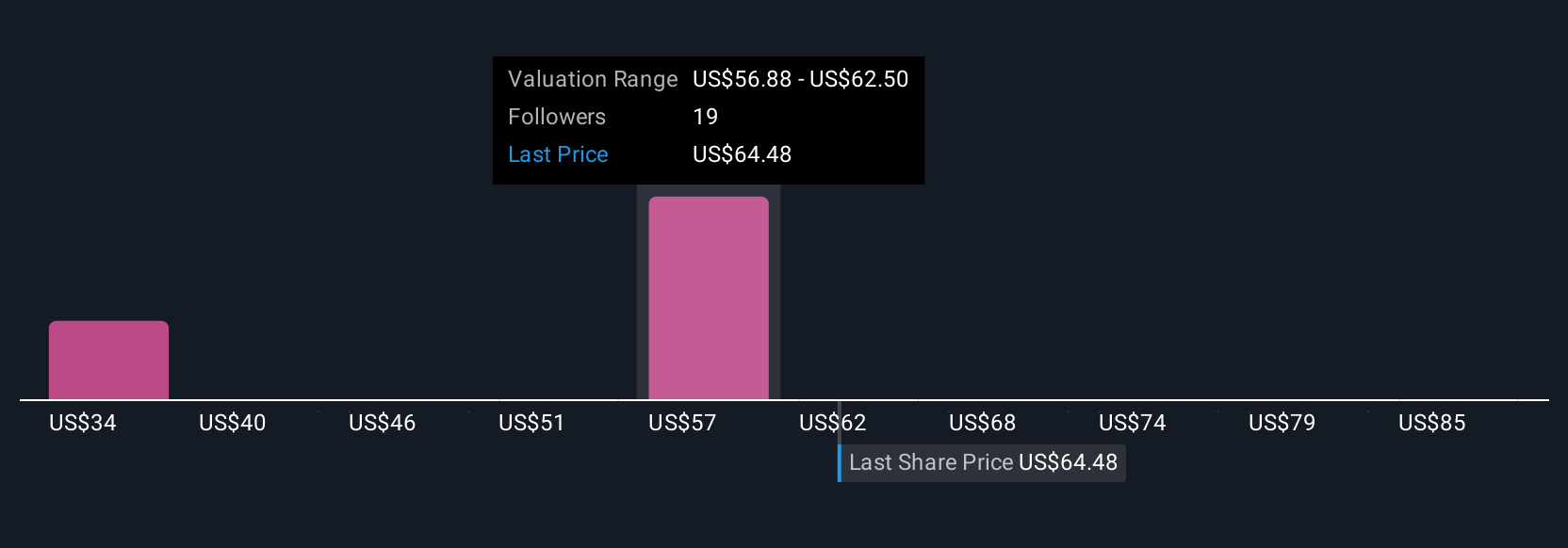

Uncover how Green Brick Partners' forecasts yield a $62.00 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span roughly US$25.61 to US$90.58 per share, showing how far apart individual views can be. Against that backdrop, the tension between Green Brick’s Texas growth ambitions and the risk of weaker housing demand gives you several angles on how its performance could evolve, so it is worth comparing multiple perspectives before forming a view.

Explore 7 other fair value estimates on Green Brick Partners - why the stock might be worth as much as 38% more than the current price!

Build Your Own Green Brick Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Green Brick Partners research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Green Brick Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Green Brick Partners' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRBK

Green Brick Partners

Green Brick Partners, Inc (NYSE: GRBK), the third largest homebuilder in Dallas-Fort Worth, is a diversified homebuilding and land development company that operates in Texas, Georgia, and Florida.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026