- United States

- /

- Leisure

- /

- NYSE:GOLF

Acushnet Holdings (NYSE:GOLF): Evaluating Valuation After Strong Q3 Results and Upbeat 2025 Outlook

Reviewed by Simply Wall St

Acushnet Holdings (NYSE:GOLF) delivered a strong third quarter, surpassing sales and adjusted EBITDA forecasts due to continued momentum in its Titleist Golf Equipment segment. Management subsequently raised their outlook for 2025.

See our latest analysis for Acushnet Holdings.

After a solid third quarter and upbeat guidance lifted investor confidence, Acushnet’s share price has gained 11.3% year to date, with a robust 15.3% total shareholder return over the last twelve months. This highlights long-term momentum that continues to build.

If you're weighing which companies are riding strong momentum and management conviction, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

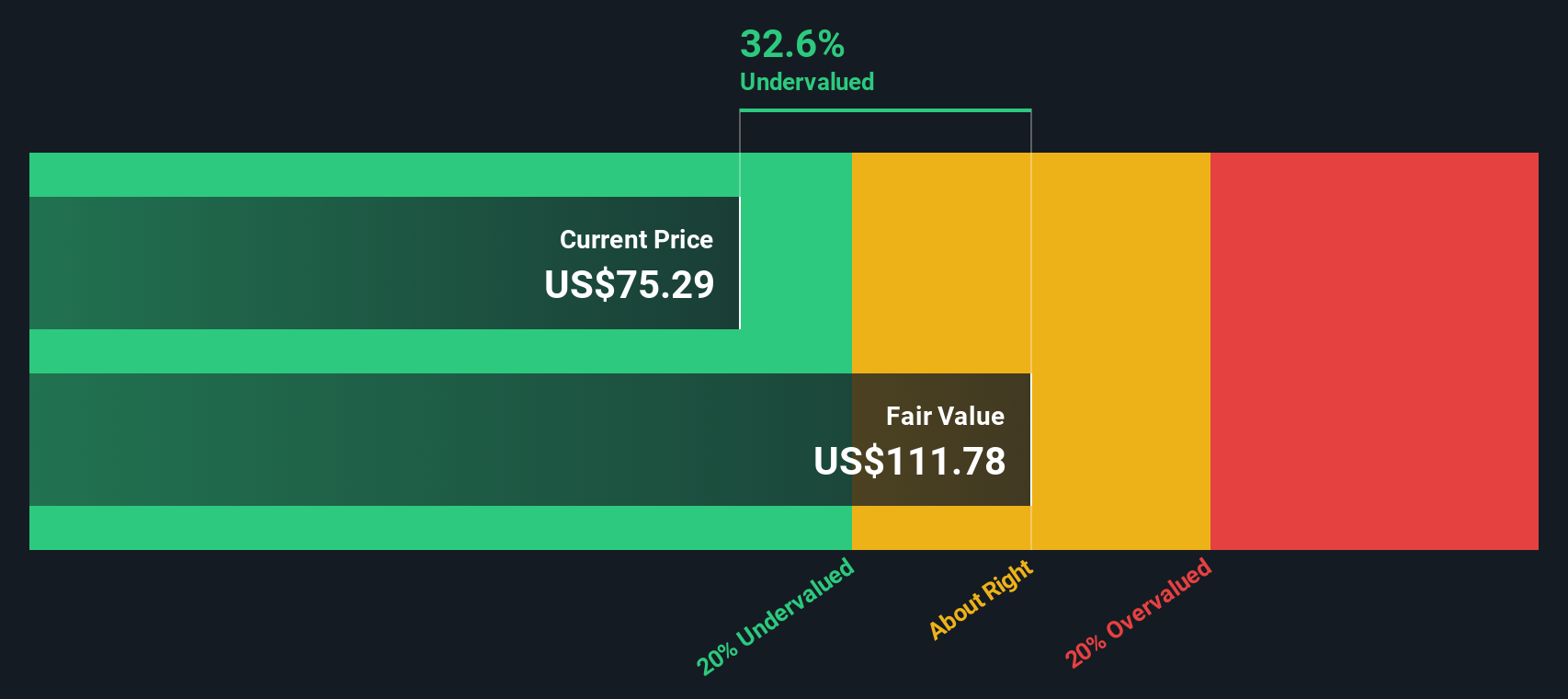

But with these gains and bullish guidance, investors may wonder if Acushnet’s current valuation is an attractive entry point or if the recent momentum has already priced in the company’s growth prospects.

Most Popular Narrative: 2.8% Overvalued

The consensus narrative places Acushnet's fair value slightly below its recent close, suggesting limited upside unless assumptions about future profits and margins prove accurate. This creates an opportunity to examine the catalysts underlying this outlook.

The market appears to be pricing in sustained high revenue growth for Acushnet, driven by the global trend toward greater health and wellness. There are expectations that golf's reputation as a low-impact, lifelong sport will support ongoing increases in participation rates. However, if future participation growth falls short or reverses, top-line growth could disappoint.

Curious how forecasts of growth and profitability combine to justify Acushnet’s valuation? The full narrative unpacks the key profit and revenue assumptions that drive analysts’ price targets. Explore the financial expectations the market is relying on.

Result: Fair Value of $77.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increasing global golf participation or continued success in new product launches could still prove the current narrative overly cautious for Acushnet Holdings.

Find out about the key risks to this Acushnet Holdings narrative.

Another View: SWS DCF Model Suggests Undervaluation

While analysts see limited upside based on consensus price targets, our DCF model points to a much higher fair value of $116.44 per share. This suggests Acushnet could be undervalued by over 30%. Does this deeper look at long-term cash flows challenge the conventional outlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acushnet Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 869 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acushnet Holdings Narrative

If you have your own perspective or want to interpret the numbers differently, it's easy to build your own narrative and see how your view stacks up. Do it your way

A great starting point for your Acushnet Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one winner. Leverage the power of Simply Wall Street’s free Screener to spot high-potential stocks you could be missing.

- Collect stable income streams by targeting market standouts using these 16 dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Capitalize on game-changing breakthroughs by pinpointing companies at the forefront of artificial intelligence. Start with these 24 AI penny stocks and uncover the innovators set to shape tomorrow.

- Catch undervalued opportunities before the crowd by scanning these 869 undervalued stocks based on cash flows and secure bargains based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GOLF

Acushnet Holdings

Designs, develops, manufactures, and distributes golf products in the United States, Europe, the Middle East, Africa, Japan, Korea, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives